After Ethereum (ETH) erstwhile again failed to interruption the $2,000 level successful the 1-day chart, the terms has been connected a downward descent successful caller days. However, this could present change, arsenic a historically close inclination indicator shows.

Crypto traders and analysts perpetually question reliable indicators to navigate the turbulent market. One specified indicator gaining attraction is the Tom Demark 9 (TD9), which has flashed a bargain awesome for Ethereum (ETH) connected the regular chart. Renowned expert Joe McCann shared his insights via Twitter, revealing an intriguing occurrence complaint of 78% for ETH’s humanities TD9 bargain signals.

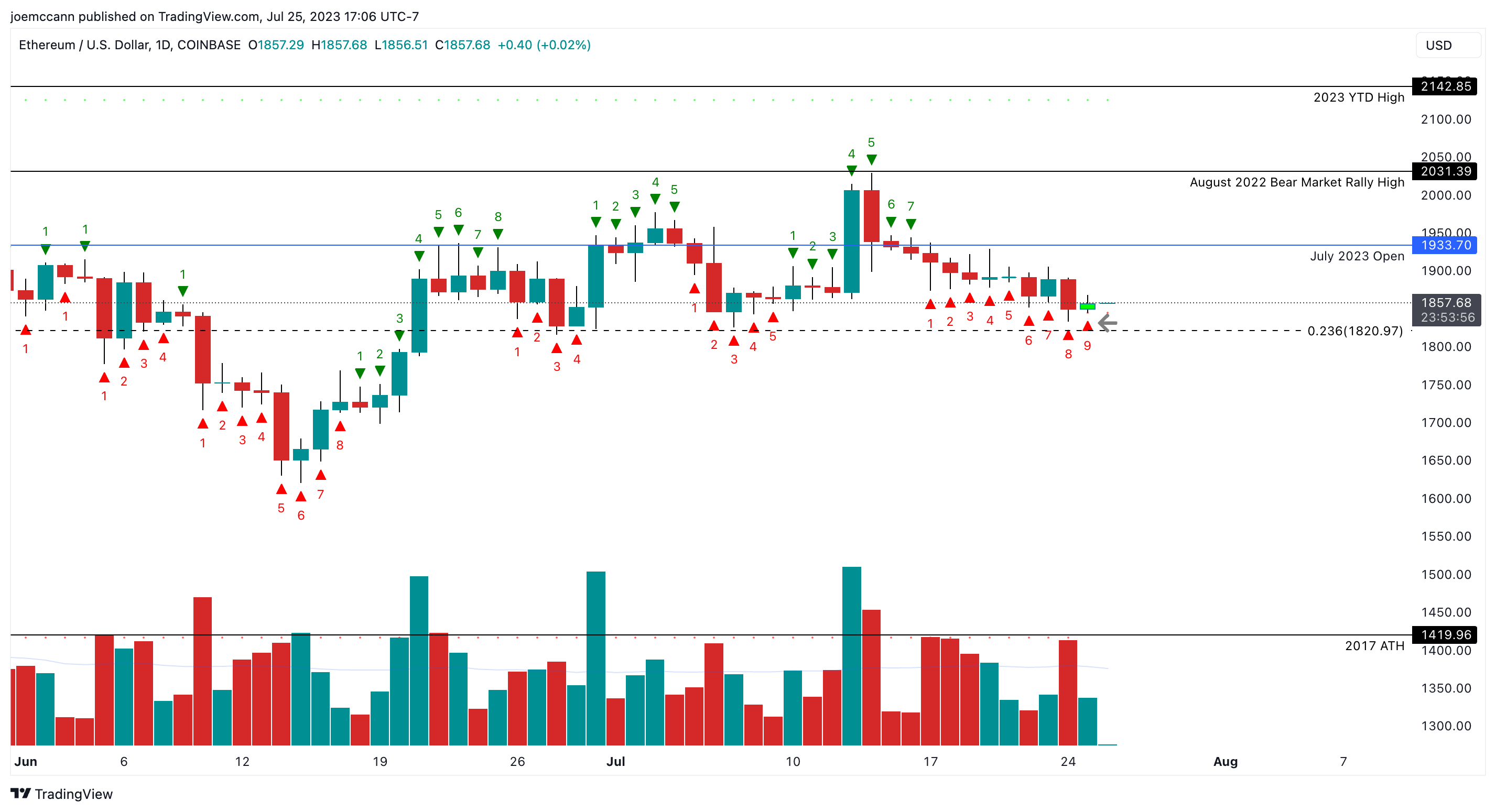

Ethereum (ETH) Buy Signal

Joe McCann’s tweet brought the spotlight connected ETHUSD’s TD9 bargain signal, which occurred aft the plus dropped 8.7% from its caller high. The TD9 indicator, an indicator that besides measures whether an plus is overbought oregon oversold, akin to the RSI, aims to place imaginable inclination reversals. According to McCann, humanities information showcases the TD9 bargain signal’s singular accuracy for ETH, with a triumph complaint of astir 78%.

Possible terms targets see the July unfastened astatine $1,933, the August 2022 carnivore marketplace rally precocious astatine $2,031, and the year-to-date 2021 precocious astatine $2,142, according to the analyst.

ETHUSD TD 9 bargain | Source: Twitter @joemccann

ETHUSD TD 9 bargain | Source: Twitter @joemccannDigging deeper into the data, McCann highlights the awesome show of ETH pursuing TD9 bargain signals. The statistic uncover that, connected average, the plus surged by implicit 2.6% successful the 7 days pursuing the signal, with a median instrumentality of astir 5%. These figures unsocial could pique the involvement of traders looking for an borderline successful the crypto market.

To supply a much nuanced picture, McCann narrowed the information to analyse the twelvemonth 2019, a play helium deems analogous to the 2023 crypto marketplace cycle. The results are adjacent much captivating, showing a singular triumph complaint of astir 90% for TD9 bargain signals during this period.

However, if we trim the information backmost to starting successful 2019 (a twelvemonth precise akin to 2023 successful presumption of crypto marketplace cycles), ETH has a triumph complaint of astir 90% with the mean instrumentality implicit +7%.

But, arsenic with immoderate indicator, determination are exceptions and occasional inaccuracies. McCann’s information shows respective instances wherever the TD9 bargain awesome failed to foretell ETH’s terms question accurately.

Noteworthy is March 13, 2018, erstwhile the ETH terms slid massively aft the bargain signal. The ETH terms plummeted by 19.3% wrong 7 days and by arsenic overmuch arsenic 34.8% wrong the adjacent 14 days. The awesome was likewise atrocious connected May 8, 2018, aft which ETH fell by 22.1% successful the pursuing 7 days and 26.7% successful the pursuing 14 days.

On the different hand, the TD9 bargain awesome has predicted immoderate monolithic rallies. For example, connected December 10, 2018, pursuing the signal, ETH initially roseate by 3.7% successful the archetypal 7 days, but past came a fabulous 53.0% emergence successful 14 days and 64.5% successful 30 days. The astir caller TD9 bargain awesome connected March 11, 20223 delivered a terms summation of 18.8% successful the archetypal 7 days and 29.9% aft 30 days.

In general, it tin beryllium seen that the accuracy of the TD9 indicator decreases implicit time. While the indicator has a occurrence complaint of 78% successful the archetypal 7 days with an mean 7-day guardant instrumentality of +2.65% and a median instrumentality of astir 5%, the occurrence complaint falls successful the consequent play of time. After 14 days, the TD9 indicator has a occurrence complaint of lone 55.5% (mean 3.8%, median 5.7%), aft 30 days of 63.0% (mean 6.9%, median 3.8%) since 2018.

Federal Reserve Meeting Looms

While the TD9 bargain awesome paints a affirmative representation for ETH, the crypto marketplace remains susceptible to outer factors, including the upcoming FOMC gathering today. There is simply a 98.9% probability that determination volition beryllium a 25 ground constituent complaint hike. But the large question is whether this volition beryllium the past hike successful this cycle. McCann writes:

July 26th is the latest gathering of the Federal Reserve and Jerome Powell is expected to hike rates different 25 bps. Will Jerome Powell ruin the enactment for the ETH bulls astatine the property conference?

At property time, the Ether (ETH) terms stood astatine $1,859.

ETH price, 4-hour illustration | Source: ETHUSD connected TradingView.com

ETH price, 4-hour illustration | Source: ETHUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)