Ethereum (ETH) has surged supra the $4,000 people for the archetypal clip since past December, signaling a beardown instrumentality of bullish momentum. After respective days of heightened volatility and marketplace uncertainty, buyers person regained control, pushing prices to levels not seen successful months. The breakout reflects a operation of improving marketplace sentiment, robust fundamentals, and increasing organization involvement successful the starring astute declaration platform.

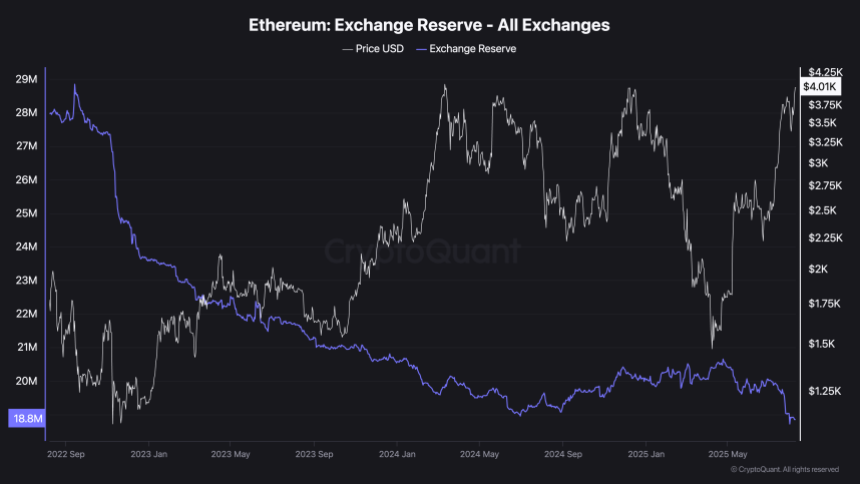

On-chain information from CryptoQuant adds further substance to the bullish narrative, showing that ETH speech reserves proceed to diminution steadily. This inclination suggests that investors — peculiarly ample holders — are moving their coins disconnected exchanges, reducing disposable liquidity successful the unfastened market. With request for ETH rising crossed decentralized concern (DeFi), real-world assets (RWA), and staking activities, the conditions for a imaginable proviso daze are forming.

Market analysts constituent to this tightening supply, coupled with accordant buying pressure, arsenic a catalyst for further gains. If the inclination continues, Ethereum could commencement a sustained rally, bringing the adjacent large absorption levels into focus. For now, traders are intimately watching whether ETH tin support its presumption supra $4,000 and physique a stronger basal for a imaginable tally toward its all-time highs.

Ethereum Smart Money Drains Liquidity

According to the latest data from CryptoQuant, lone 18.8 cardinal ETH remains connected centralized exchanges — a historical debased that underscores the increasing scarcity of Ethereum successful the unfastened market. This is not the effect of retail traders making tiny withdrawals. Instead, it reflects a deliberate determination by organization players and “smart money” to accumulate and unafraid ample amounts of ETH disconnected exchanges.

Ethereum Exchange Reserve | Source: CryptoQuant

Ethereum Exchange Reserve | Source: CryptoQuantThis accelerated outflow is creating a wide proviso squeeze. With less coins disposable for spot trading, upward terms unit is apt to build, particularly if request continues its existent trajectory. The gait of accumulation suggests that these ample holders are positioning for a semipermanent play, reducing marketplace liquidity and mounting the signifier for important terms volatility to the upside.

Adding to the bullish outlook, nationalist companies are opening to follow Ethereum arsenic portion of their treasury strategies. Sharplink Gaming, for example, has precocious purchased important amounts of ETH, joining a increasing database of firms diversifying into integer assets. Meanwhile, expanding ineligible clarity successful the United States is opening the doorway for broader adoption, lowering barriers for some organization and firm information successful the Ethereum ecosystem.

These converging factors — organization accumulation, reduced speech reserves, and regulatory greenish lights — are forming a marketplace situation dissimilar thing seen earlier successful Ethereum’s history. If the inclination persists, analysts expect the coming months to present unprecedented terms action, fueled by a cleanable tempest of tightening proviso and rising demand. In specified conditions, Ethereum could not lone prolong its presumption supra $4,000 but besides marque a decisive propulsion toward caller all-time highs.

ETH Breaks $4,000, Tests Key Weekly Resistance

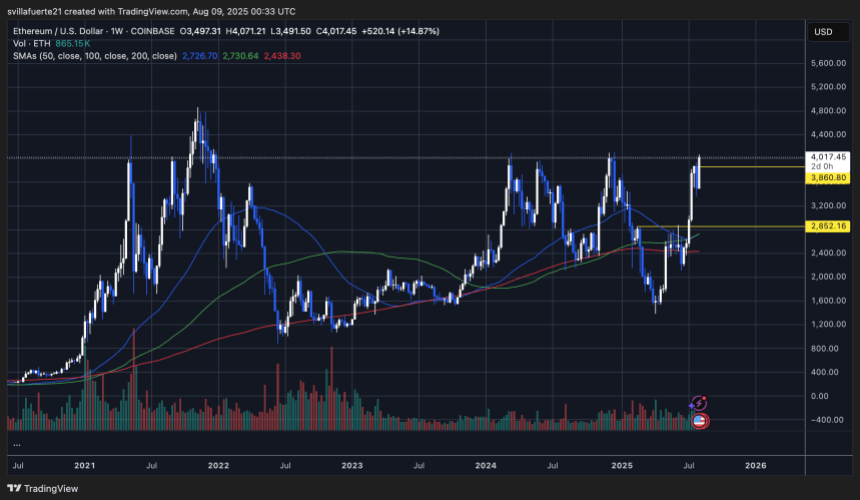

Ethereum’s play illustration shows a decisive breakout supra the $3,860 absorption level, pushing the terms to $4,017 — its highest level since December 2024. This surge marks a 14.87% play gain, highlighting beardown bullish momentum pursuing weeks of accumulation and betterment from the $2,852 enactment zone.

ETH investigating multi-year absorption | Source: ETHUSDT illustration connected TradingView

ETH investigating multi-year absorption | Source: ETHUSDT illustration connected TradingViewThe existent terms enactment is supported by the 50, 100, and 200-week SMAs trending beneath the market, with the 50-week SMA astatine $2,726 reinforcing the spot of the semipermanent uptrend. Volume has besides spiked significantly, indicating that the breakout is driven by existent buying involvement alternatively than speculative noise.

Featured representation from Dall-E, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)