On-chain information shows the Ethereum speech netflow has witnessed a antagonistic spike during the past week, a imaginable motion that investors person been accumulating.

Ethereum Exchange Netflow Has Been Red For The Past Week

As pointed retired by organization DeFi solutions supplier Sentora successful a caller post connected X, Ethereum has seen nett outflows from exchanges successful the past week. The indicator of relevance present is the “Exchange Netflow,” which measures the nett magnitude of ETH that’s moving into oregon retired of wallets connected with centralized exchanges.

When the worth of this metric is positive, it means the investors are depositing a nett fig of tokens to these platforms. As 1 of the main reasons wherefore holders deposit their coins to exchanges is for selling-related purposes, this benignant of inclination tin beryllium bearish for the asset’s price.

On the different hand, the indicator being beneath zero suggests outflows are dominating the inflows connected exchanges. Such a inclination tin beryllium a motion that investors are successful a signifier of accumulation, which tin people beryllium bullish for the cryptocurrency.

As the information shared by Sentora shows, Ethereum has seen a play Exchange Netflow worth of -$978.45 million, indicating that traders person made a monolithic magnitude of nett withdrawals.

The play alteration successful the ETH web fees and Exchange Netflow | Source: Sentora connected X

The play alteration successful the ETH web fees and Exchange Netflow | Source: Sentora connected XThe important outflows person travel arsenic Ethereum has witnessed a diminution during the past week. As Sentora explains:

This signals assertive accumulation wherever investors are apt “buying the dip” and withdrawing assets to acold retention oregon on-chain environments, tightening the liquid proviso contempt the antagonistic terms momentum.

The terms drawdown successful the past week has besides accompanied a driblet successful the full transaction fees connected the network, meaning that transportation enactment has gone down. The blockchain saw astir $2.64 cardinal successful fees implicit the past week, which is much than 15% down week-over-week.

ETH Saw A Brief Visit Under $2,800 Before Rebounding

Ethereum observed a diminution to $2,780 connected Thursday, but the plus was capable to bounce backmost arsenic it’s present floating conscionable nether $3,000.

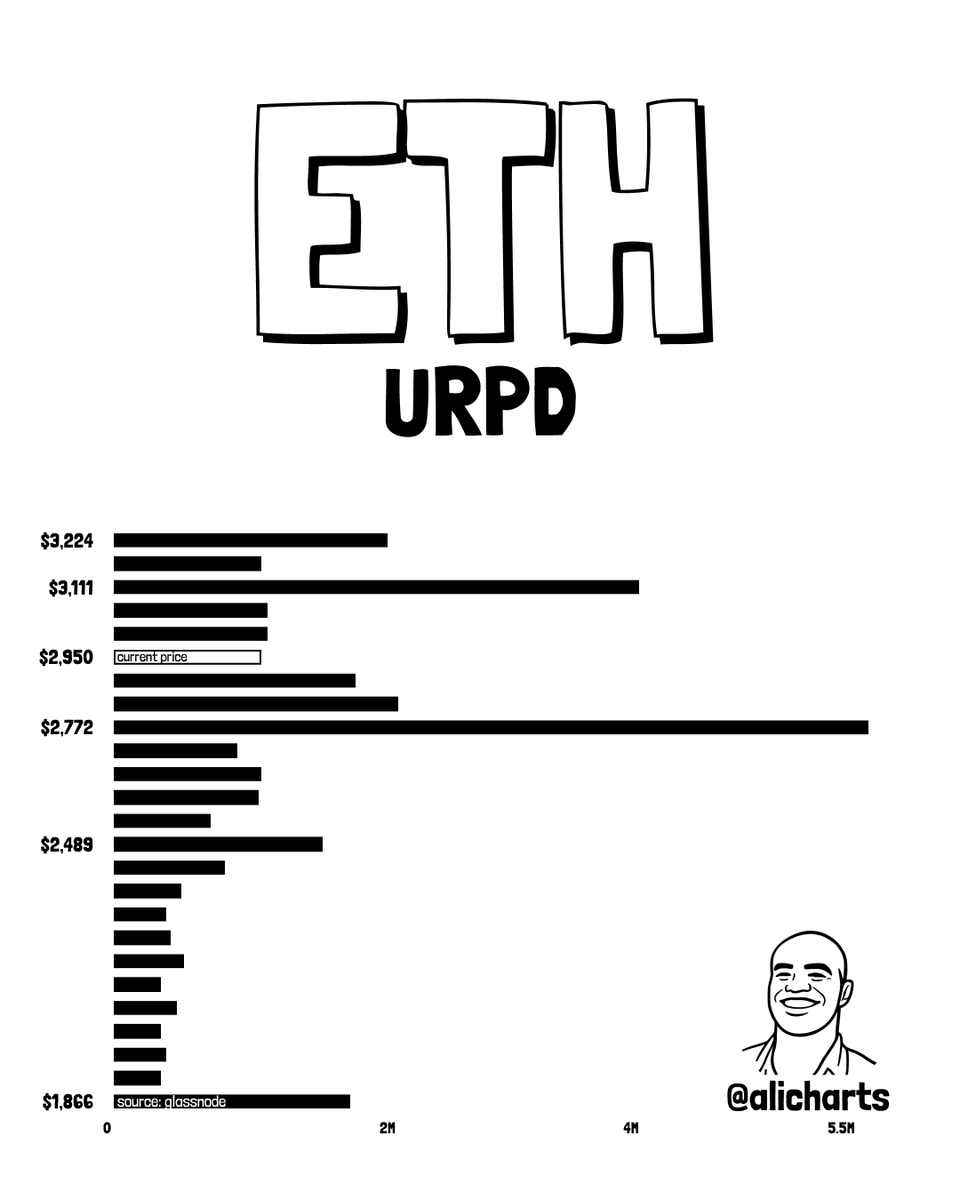

Interestingly, ETH’s bottommost was astir the aforesaid level arsenic a large on-chain proviso cluster, arsenic a illustration shared by expert Ali Martinez successful an X post shows.

How the existent URPD of ETH looks | Source: @ali_charts connected X

How the existent URPD of ETH looks | Source: @ali_charts connected XIn the graph, Martinez has attached the information of the Ethereum UTXO Realized Price Distribution (URPD) from on-chain analytics steadfast Glassnode. This metric fundamentally tells america however overmuch ETH proviso was past transacted astatine the assorted terms levels that the coin has visited successful its history.

There is simply a immense proviso portion located astatine $2,772 connected the URPD, suggesting a ample magnitude of investors person their outgo ground astatine it. Generally, specified levels enactment arsenic a enactment bound during downtrends, arsenic traders who purchased determination bargain the dip to support it.

Featured representation from Dall-E, Sentora.com, illustration from TradingView.com

2 hours ago

2 hours ago

English (US)

English (US)