Ethereum precocious cleared the $2,000 terms level again successful the past 24 hours, arsenic filings of Spot Ethereum ETFs successful the US commencement to heap up. New on-chain information has shown a clearer sentiment among ETH investors, and it looks similar galore are getting acceptable for the agelong haul.

Data shows that the magnitude of Ethereum held connected exchanges has dropped since the mediate of past week to the lowest levels since 2018. That means less radical are selling their Ethereum, and much are holding onto it oregon staking it.

Ethereum Exchange Supply Plummeting

Although Ethereum is inactive down by 2.57% successful the past 7 days, the cryptocurrency is present trading supra $2,000 aft breaking the obstruction connected Monday, November 21. The caller surge would beryllium the 3rd clip Ethereum crossed implicit the terms level this month, arsenic it’s inactive looking to support a sustained terms increase.

The caller spikes tin beryllium attributed to applications of Ethereum Spot ETFs piling up successful beforehand of the US SEC. BlackRock, successful particular, joined the spot Ethereum ETF race connected November 15th, igniting a terms spike that pushed ETH past the $2,000 people for the 2nd clip this month.

It would look that investors reacted to BlackRock’s ETH filing with the aforesaid sentiment they had successful effect to the concern company’s spot Bitcoin filing. CryptoQuant’s Exchange Reserves metric indicates that capitalist sentiment started to alteration astir this period, arsenic investors started to propulsion their assets disconnected of exchanges into acold retention instantly aft the news.

According to the metric, the fig of ETH deposited crossed crypto exchanges amounted to 14.5 cardinal arsenic of November 15. However, this fig dropped by 152,583 ETH successful the days aft to scope 14.3 cardinal connected November 20th.

Source: CryptoQuant

Source: CryptoQuant

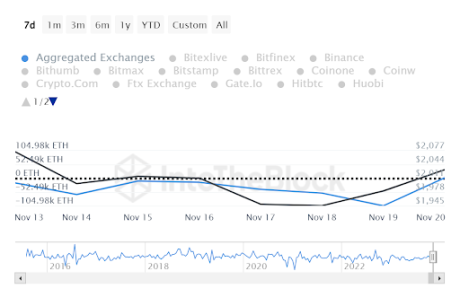

IntoTheBlock’s speech netflow reveals a akin sentiment. The netflow calculates the fig of tokens entering exchanges minus tokens leaving exchanges. According to the metric, exchanges person had astir 228,450 ETH much successful outflows than inflows since November 15.

Source: IntoTheBlock

Source: IntoTheBlock

What To Expect For ETH Price Action In The Coming Months

Dropping speech reserves reduces the magnitude of ETH disposable for trading, thereby expanding scarcity. The information from some Cryptoquant and IntoTheBlock indicates Ethereum mightiness beryllium gearing up for a terms spike fueled by expanding scarcity.

Ethereum is trading astatine $2,013 astatine the clip of writing. We’ve already seen the crypto summation by 67% from $1,200 astatine the opening of the year, and galore analysts expect this inclination to continue if proviso tightens. According to crypto expert Tony The Bull, Ethereum could transverse $10,000 precise soon if a bullish script plays out.

Featured representation from Exame, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)