Ethereum (ETH), the world’s second-largest cryptocurrency by marketplace cap, has seen a important exodus from centralized exchanges successful caller weeks, with information suggesting a increasing penchant for holding the plus extracurricular of trading platforms.

At the clip of writing, ETH was trading astatine $2,289, down 0.7% successful the past 24 hours, but managed to summation 1.6% successful the past week, information from Coingecko shows.

Ethereum Outflow Hits $1.2 Billion

According to blockchain analytics steadfast IntoTheBlock, a staggering $500 cardinal worthy of ETH exited exchanges past week, contributing to a full outflow of $1.2 cardinal for the full period of January. This represents a large displacement compared to erstwhile months, raising questions astir the motivations down this trend.

$500M successful $ETH was withdrawn from CEXs this week, adding to a full of implicit $1.2B successful outflows successful the past period pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

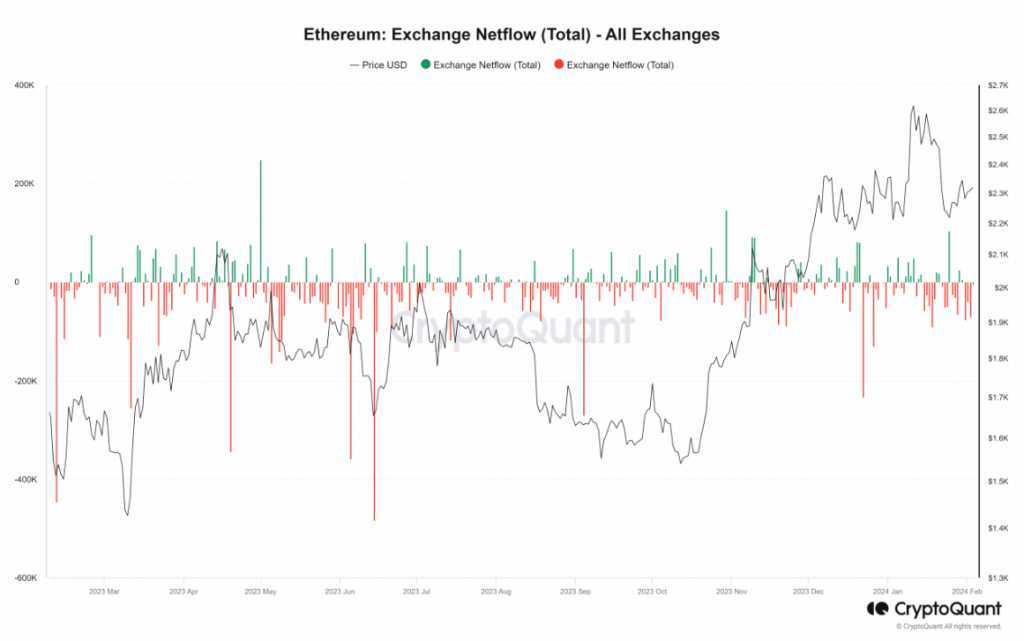

CryptoQuant information paints an adjacent starker picture, showcasing a ascendant signifier of outflows since the opening of January. The illustration reveals a persistent diminution successful speech holdings, with the past inflow recorded connected January 30th. At the clip of writing, the outflow continues unabated, with implicit 3,000 ETH leaving exchanges each hour.

However, the interaction connected wide speech proviso is not wholly uniform. While the full magnitude of ETH held connected exchanges initially accrued successful January, reaching astir 10.7 cardinal by mid-month, it subsequently dipped to 10.3 cardinal by January 28th. Currently, the proviso has resumed an upward trend, sitting astatine astir 10.6 million.

Binance ETH Exodus: Investors’ Strategic Moves

Interestingly, the humanities equilibrium of ETH connected Binance, the world’s largest cryptocurrency exchange, tells a antithetic story. Despite the wide uptick successful speech holdings, Binance has witnessed a accordant diminution successful its ETH equilibrium passim January. From a highest of implicit 3.9 cardinal ETH connected January 23rd, the equilibrium has shrunk to astir 3.7 million, indicating that users are actively withdrawing their Ethereum from the platform.

While the nonstop reasons down this inclination stay unclear, respective imaginable interpretations emerge:

- Increased Investor Confidence: Moving ETH disconnected exchanges could awesome a increasing sentiment among investors to clasp the plus for the agelong term, perchance driven by assurance successful its aboriginal potential. Additionally, immoderate investors mightiness beryllium transferring their ETH to DeFi platforms for staking oregon output farming opportunities.

- Market Uncertainty: The caller outflows could besides bespeak broader concerns astir marketplace volatility oregon imaginable regulatory changes, prompting investors to question safer retention for their holdings.

- Binance-Specific Dynamics: The diminution connected Binance mightiness beryllium owed to factors circumstantial to the exchange, specified arsenic idiosyncratic preferences for alternate platforms oregon changes successful its trading fees oregon policies.

Featured representation from Adobe Stock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)