According to data from Lookonchain, an on-chain analytics platform, Ethereum (ETH), whales person withdrawn astir $64.2 cardinal worthy of ETH from large exchanges.

This important question of funds coincides with a notable uptick successful the terms of ETH, indicating an expanding involvement successful the asset.

Ethereum Whales Movement Signals Confidence

According to Lookonchain’s findings, overmuch of the ETH proviso has been shifted from speech wallets to custodial wallets. The on-chain analytics level reported that an Ethereum code labeled 0x8B94 had withdrawn an magnitude of 14,632 ETH, valued astatine astir $45.5 million, from Binance.

Lookonchain states these funds person been actively staked wrong six days, indicating a deliberate determination towards adopting semipermanent concern strategies.

The investigation from the level besides points retired that different 2 caller whale wallets person transferred 6,000 ETH, amounting to $18.7 million, from Kraken to undisclosed wallet addresses implicit the past 2 days.

Whales are accumulating $ETH!

0x8B94 withdrew 14,632 $ETH($45.5M) from #Binance and staked it successful the past 6 days.https://t.co/bywnrZ2glt

2 caller whale wallets withdrew 6K $ETH($18.7M) from #Kraken successful the past 2 days.https://t.co/0kEvOmiv3hhttps://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This inclination suggests an summation successful large investors to unafraid important amounts of Ethereum distant from speech platforms, perchance arsenic a means of positioning for semipermanent plus appreciation.

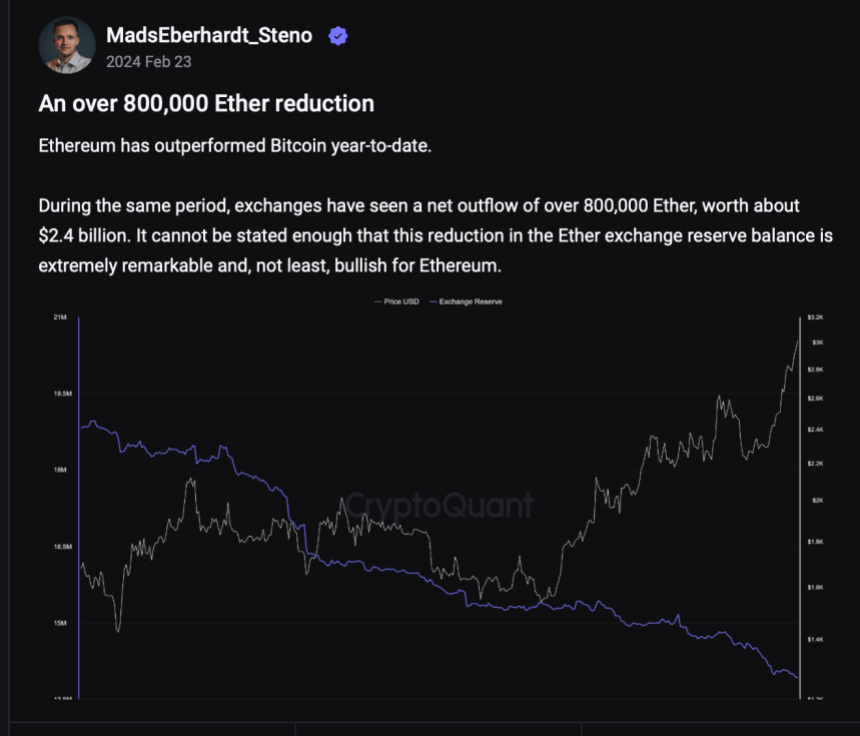

Further echoing this is simply a caller investigation from CryptoQuant’s Quicktake, which underscores a notable inclination regarding Ethereum withdrawals from exchanges implicit the past fewer weeks. This reflection relies connected the “Exchange Reserve” metric, which monitors the quantity of ETH tokens held successful the wallets of each centralized exchanges.

When the worth of this metric increases, it signifies that investors are depositing much assets than withdrawing them from centralized exchanges, indicating a buildup of Ethereum reserves. Conversely, a diminution successful the metric suggests a nett outflow of assets from these platforms.

According to information from CryptoQuant, over 800,000 ETH, equivalent to astir $2.4 billion, has exited cryptocurrency exchanges since the opening of the year. Such important outflows from these platforms typically bespeak a surge successful capitalist assurance successful the Ethereum web and its autochthonal token.

Ethereum’s Price Momentum And Potential For A Significant Breakout

Meanwhile, Ethereum’s terms has displayed bullish momentum, witnessing a 5.5% summation successful the past week and reclaiming the important $3,000 mark.

Financial guru Raoul Pal has drawn attraction to Ethereum’s imaginable for a large breakout, pointing to a “dual-chart pattern” observed connected the ETH/BTC chart.

The ETH/BTC illustration is an implicit stunner…and acceptable for the adjacent large determination the interruption of the mega wedge…lets spot however is pans out… pic.twitter.com/5x4tJLjtJy

— Raoul Pal (@RaoulGMI) February 25, 2024

Pal highlights a “mega wedge” pattern alongside an interior descending channel, indicating a consolidation signifier with bullish potential.

Featured representation from Unsplash, Chart from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)