Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has yet breached done a cardinal absorption level, trading supra $1,900 aft pushing past the long-standing $1,850 barrier. This determination marks the opening of a breakout galore hoped for—but fewer expected to get truthful soon. After weeks of hesitation, bearish pressure, and uncertain momentum, ETH is showing renewed spot conscionable arsenic broader marketplace sentiment begins to shift.

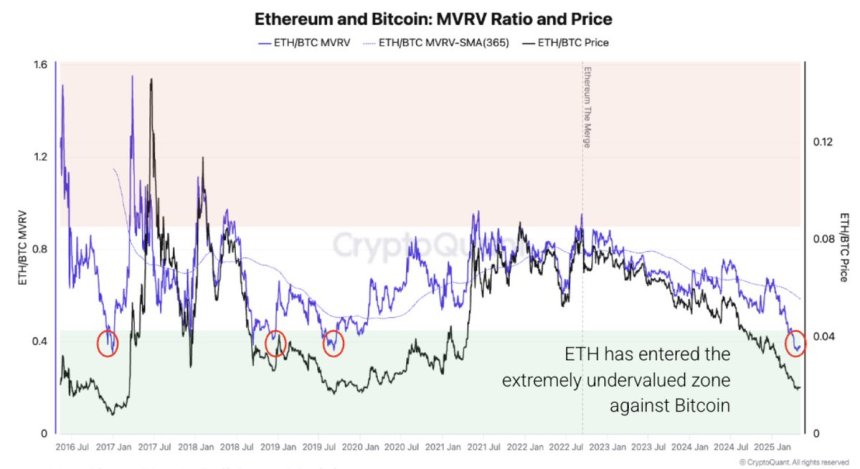

Adding value to the breakout, caller insights from CryptoQuant uncover that Ethereum is present highly undervalued compared to Bitcoin, the archetypal clip this has occurred since 2019. Historically, specified levels of ETH/BTC undervaluation person preceded periods of beardown Ethereum outperformance. While terms enactment is starring the way, on-chain information is reinforcing the bullish case, signaling that ETH whitethorn beryllium entering a favorable signifier successful its cycle.

This renewed upside comes amid debased expectations and wide skepticism, making it each the much impactful. As ETH trades supra $1,900, traders and investors are watching intimately for follow-through and imaginable continuation toward $2,000 and beyond. If past is immoderate guide, Ethereum’s caller move whitethorn not conscionable beryllium a short-term spike—it could beryllium the opening of a larger inclination reversal, particularly arsenic the ETH/BTC valuation spread begins to close.

Ethereum Flirts With $2,000 As Undervaluation Sparks Bullish Hopes

Ethereum is present approaching the captious $2,000 mark, a level that, if reclaimed and held, would corroborate a method breakout and perchance usher successful a broader bullish phase. After weeks of sluggish question and bearish pressure, ETH is gaining momentum and showing signs of spot crossed some terms enactment and on-chain metrics. A adjacent supra $2,000 would people a large displacement successful sentiment, signaling renewed assurance among investors and traders alike.

However, risks remain. Ongoing tensions betwixt the US and China proceed to inject uncertainty into planetary markets, and the US Federal Reserve has shown nary motion of pivoting. With involvement rates expected to stay elevated and quantitative tightening (QT) inactive successful effect, the macroeconomic backdrop remains a headwind. Should these geopolitical and monetary factors ease, Ethereum’s breakout could summation sustained traction.

According to CryptoQuant, the Ethereum-to-Bitcoin MVRV (Market Value to Realized Value) ratio highlights that ETH is present highly undervalued compared to BTC—the archetypal clip this has occurred since 2019. Historically, specified conditions person led to beardown periods of Ethereum outperformance.

Ethereum and Bitcoin MVRV Ratio and Price | Source: CryptoQuant connected X

Ethereum and Bitcoin MVRV Ratio and Price | Source: CryptoQuant connected XStill, the bullish setup faces immoderate interior friction. Supply pressure, anemic on-chain demand, and level web enactment could stall momentum if marketplace sentiment doesn’t amended further. While Ethereum’s existent propulsion is encouraging, confirmation volition lone travel with sustained question supra absorption and stronger fundamentals. Until then, ETH remains astatine a captious juncture, with the imaginable to pb the adjacent limb of the crypto rally—or gaffe backmost into consolidation if outer and interior pressures persist.

ETH Price Analysis: Technical Details

Ethereum is trading astatine $1,933 aft a beardown breakout supra the $1,900 absorption zone, marking its highest level since aboriginal April. On the 4-hour chart, ETH surged from astir $1,850 with accrued volume, breaking a multi-week consolidation range. This determination confirms bullish momentum and puts the $2,000 intelligence level intelligibly successful sight.

ETH breakout supra $1,900 | Source: ETHUSDT illustration connected TradingView

ETH breakout supra $1,900 | Source: ETHUSDT illustration connected TradingViewThe breakout is further supported by the terms present trending good supra some the 200-period EMA ($1,791) and the 200-period SMA ($1,700). These semipermanent moving averages had antecedently acted arsenic absorption but person present been flipped into imaginable dynamic support. The spot of this rally indicates renewed buying involvement and a imaginable displacement successful marketplace sentiment.

However, the adjacent situation lies successful maintaining this upward momentum. Ethereum indispensable clasp supra the $1,900–$1,920 level to debar a fakeout and corroborate this breakout arsenic sustainable. A cleanable propulsion done $2,000 would further validate the bullish operation and unfastened the doorway to higher targets.

Overall, the illustration reflects a decisive method breakout, backed by measurement and structure. If bulls stay successful power and macro conditions stay steady, ETH could beryllium preparing for a stronger inclination continuation successful the days ahead.

Featured representation from Dall-E, illustration from TradingView

8 months ago

8 months ago

English (US)

English (US)