The winds of alteration are swirling astir Ethereum (ETH), the world’s second-largest cryptocurrency. While the Ethereum web itself is buzzing with activity, the price of ETH has taken a tumble successful caller days, leaving investors scratching their heads.

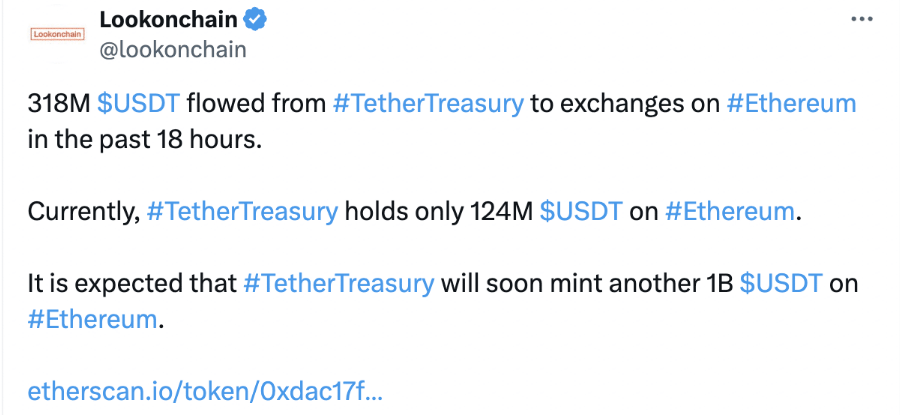

A glimmer of anticipation emerged with Tether’s (USDT) caller movement. Tether, the issuer of the world’s astir fashionable stablecoin pegged to the US dollar, transferred a whopping $318 cardinal worthy of USDT from its treasury wallet straight to exchanges connected the Ethereum network.

This outflow suggests imaginable anticipation of accrued request for USDT, which could, successful turn, awesome rising capitalist involvement successful the broader cryptocurrency market.

Historically, Tether has minted ample amounts of USDT during periods of heightened crypto activity, and the rumor mill present churns with speculation that different cardinal USDT mightiness soon beryllium minted specifically connected Ethereum.

However, analysts caution against unsighted optimism. While an summation successful USDT enactment could bode good for Ethereum, it’s not a guaranteed way to prosperity.

Other blockchains, similar Tron, are besides susceptible of handling USDT transactions, offering investors alternate avenues.

Price Woes And Investor Sentiment

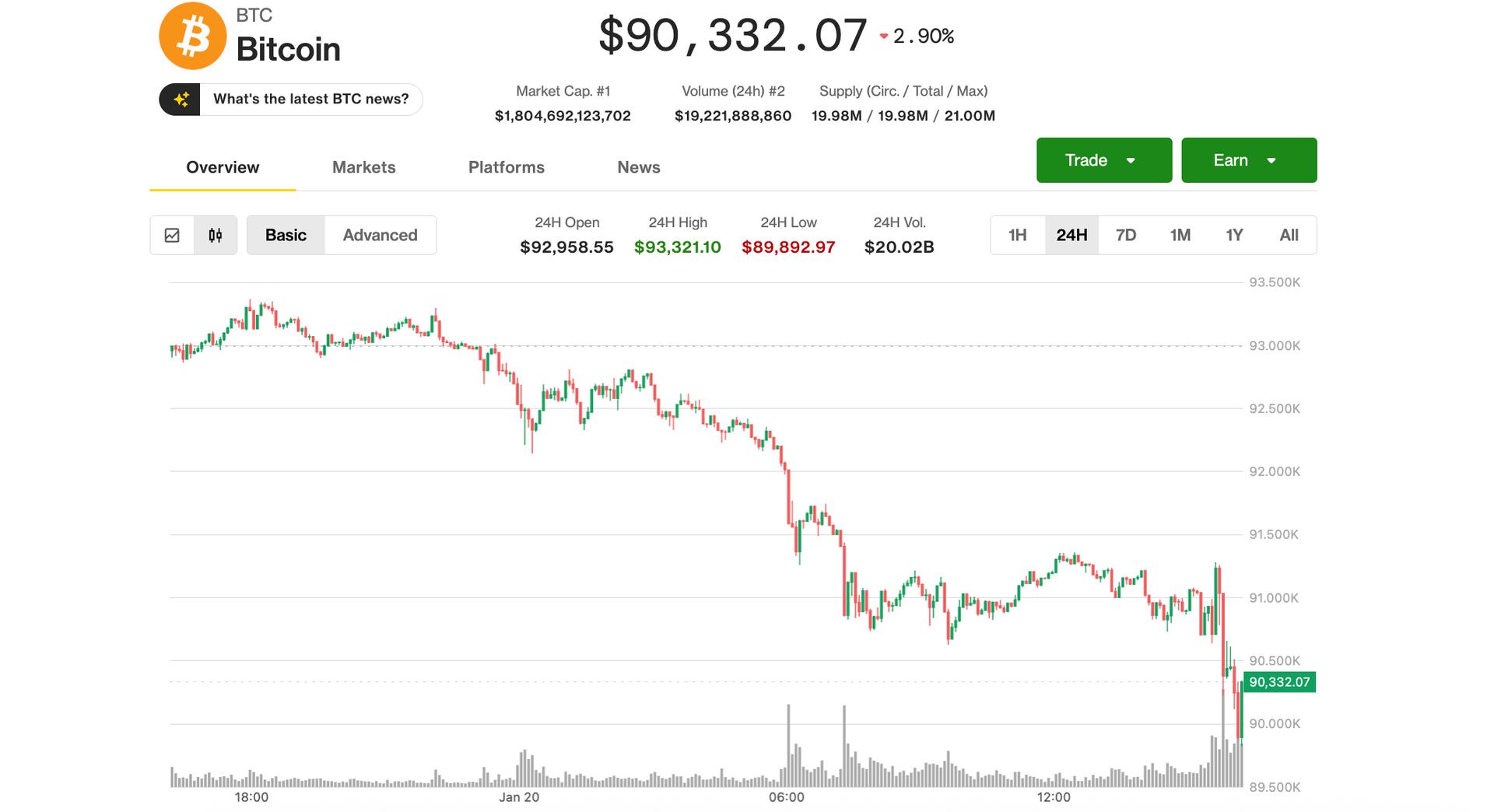

Meanwhile, the terms of ETH has stubbornly refused to cooperate. As of today, ETH is trading beneath the important $3,000 mark, having dropped by astir 3% successful the past 24 hours.

Ethereum has lost 11% of its value successful the past 7 days, information from Coingecko shows.

Related Reading: Toncoin Unleashes DeFi Monster Growth: TVL Soars 300% In A Month

A further terms driblet beneath $3,000 could trigger panic selling, exacerbating the downward spiral.

The existent concern presents a analyzable representation for Ethereum. While Tether’s caller determination and dependable web enactment connection slivers of optimism, the declining terms and NFT marketplace correction overgarment a contrasting picture.

A Hive Of Activity Despite Stress On Price

While the terms of ETH mightiness beryllium feeling the heat, the Ethereum web itself is humming with activity. Unlike the caller slump successful the NFT (Non-Fungible Token) market, wide web usage has remained remarkably consistent.

This suggests a displacement successful absorption wrong the Ethereum ecosystem. While the flamboyant satellite of NFTs mightiness beryllium experiencing a impermanent correction, different sectors wrong Ethereum are picking up the slack.

The emergence successful DeFi (Decentralized Finance) transactions, stablecoin swaps, and wide token enactment could beryllium the hidden forces keeping the web busy.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)