While the approval of spot Ethereum ETFs successful the US failed to trigger a monolithic rally for ETH, it sparked a important surge successful the derivatives market. The support of spot ETFs was hailed arsenic a large regulatory breakthrough for the crypto market, providing a caller level of legitimacy and accessibility for Ethereum.

The interaction of this support is intelligibly reflected successful the derivatives market, particularly futures, which had a comparatively uneventful twelvemonth until the support of the ETFs.

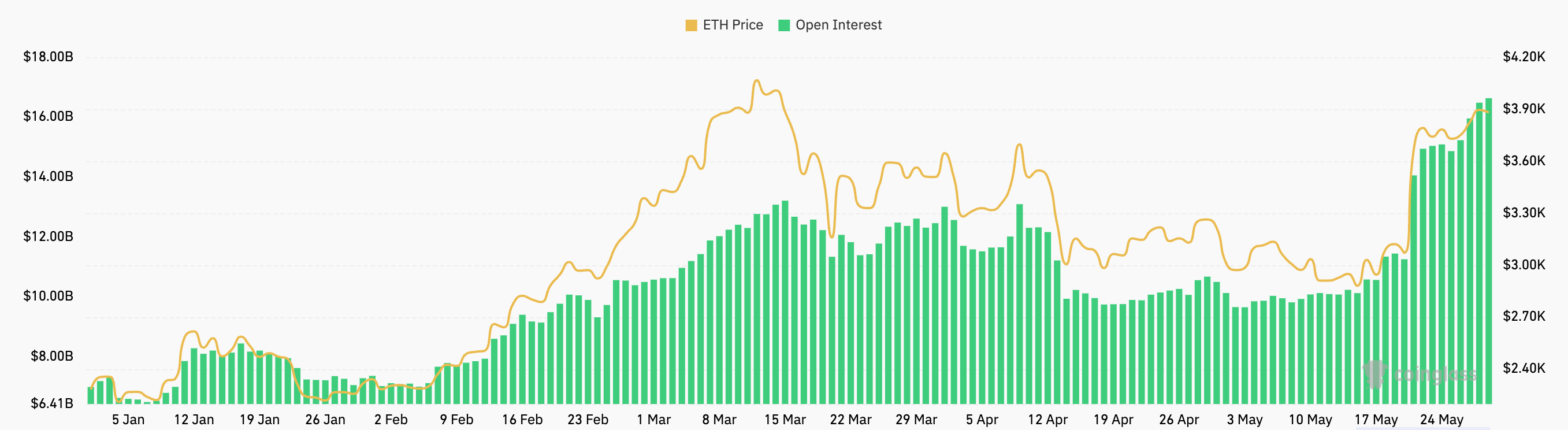

At the opening of the year, unfastened involvement for ETH futures stood astatine conscionable nether $7 billion, with options OI astatine $6.45 billion. These figures were comparatively unchangeable until aboriginal March, erstwhile ETH saw its terms emergence significantly, reaching $3,343 connected March 29.

This terms surge was accompanied by an summation successful futures OI to $10.57 cardinal and options OI to $10.72 billion. However, the existent momentum started gathering successful precocious April erstwhile the marketplace began anticipating ETF approvals.

By April 29, ETH crossed the $3,500 market, and futures OI surged to $13.01 billion. Options unfastened involvement reached an all-time precocious of $15.34 cardinal — a culmination of speculative enactment arsenic traders positioned themselves to capitalize connected the anticipated support of the ETFs.

Graph showing the unfastened involvement for Ethereum futures from Jan. 1 to May 28, 2024 (Source: CoinGlass)

Graph showing the unfastened involvement for Ethereum futures from Jan. 1 to May 28, 2024 (Source: CoinGlass)The support of spot ETH ETFs had a profound interaction connected the futures market, arsenic futures OI reached an all-time precocious of $17.12 cardinal connected May 28. On the different hand, the options marketplace has not seen specified a notable summation successful OI pursuing the ETF approval.

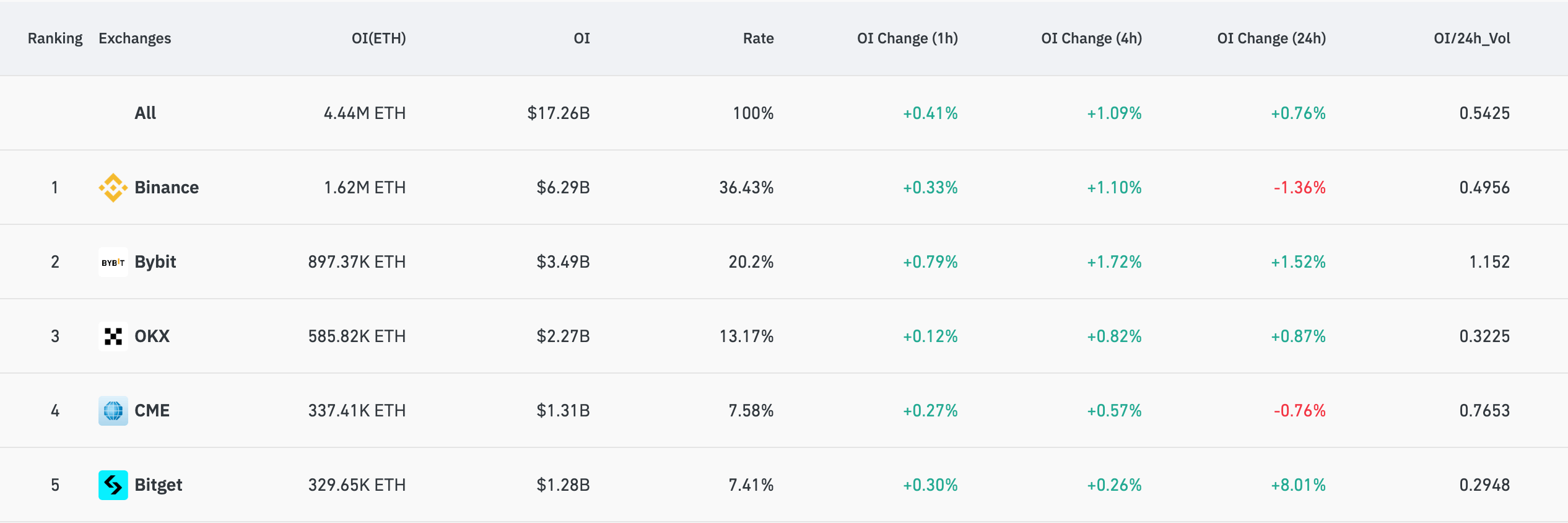

The organisation of futures unfastened involvement crossed exchanges shows Binance’s dominance successful the market, with $6.24 cardinal successful unfastened involvement sitting connected the exchange. Meanwhile, Bybit and OKX travel with $3.45 cardinal and $2.25 cardinal successful unfastened interest, respectively.

The important magnitude of OI connected CME — $1.30 cardinal — shows a coagulated magnitude of organization information successful the Ethereum derivatives market, astir apt attracted by the regulated situation CME offers.

Table showing the organisation of Ethereum futures unfastened involvement crossed exchanges connected May 28, 2024 (Source: CoinGlass)

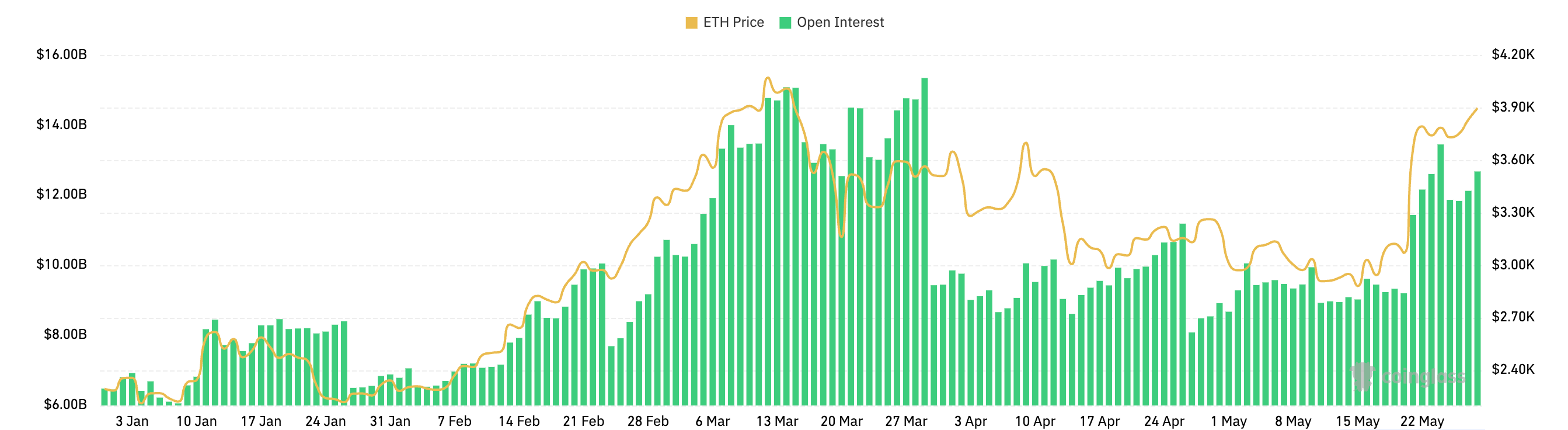

Table showing the organisation of Ethereum futures unfastened involvement crossed exchanges connected May 28, 2024 (Source: CoinGlass)While options OI remains little than futures, options trading mostly mirrored the inclination we’ve seen with Ethereum futures. Options OI peaked astatine $13.44 cardinal connected May 24, and contempt the flimsy pullback to $12.67 cardinal by May 28, the wide inclination remains upward.

Graph showing the unfastened involvement for Ethereum options from Jan. 1 to May 28, 2024 (Source: CoinGlass)

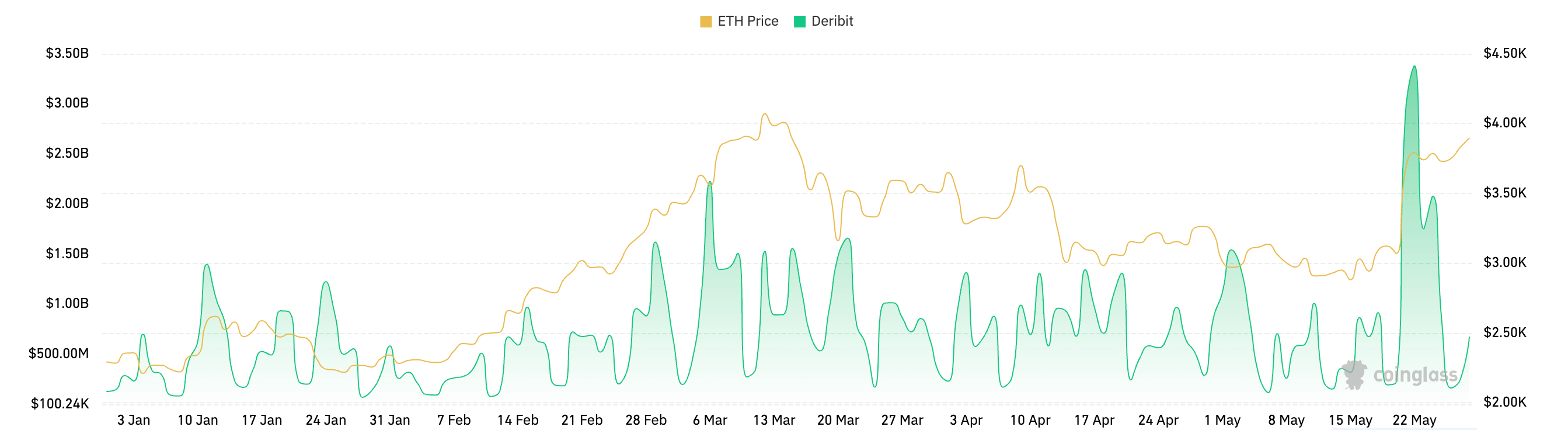

Graph showing the unfastened involvement for Ethereum options from Jan. 1 to May 28, 2024 (Source: CoinGlass)The measurement of ETH options connected Deribit shows conscionable however precocious the involvement successful derivatives is. Options measurement reached an all-time precocious of $3.38 cardinal connected May 22 — a important summation to the $144 cardinal successful measurement options saw astatine the opening of the year.

As specified a precocious measurement had a minimal interaction connected ETH’s terms astatine the time, it shows that Ethereum’s derivatives marketplace has go rather robust with important liquidity.

Graph showing the trading measurement for Ethereum options connected Deribit from Jan. 1 to May 28, 2024 (Source: CoinGlass)

Graph showing the trading measurement for Ethereum options connected Deribit from Jan. 1 to May 28, 2024 (Source: CoinGlass)The important summation successful futures and options OI, coupled with rising trading volumes connected Deribit, shows a important influx of superior and involvement into Ethereum derivatives. Last week’s support of spot ETFs decidedly acted arsenic a catalyst for this growth, enhancing marketplace liquidity.

While the options marketplace remains tied to Deribit, the organisation of futures unfastened involvement crossed exchanges shows conscionable however competitory the marketplace has become. It highlights the relation antithetic exchanges person successful accommodating accrued enactment successful futures trading — Binance’s dominance shows its entreaty to retail traders, portion CME’s important OI points to a increasing appetite among organization and blase investors.

The station Ethereum futures deed grounds highs pursuing spot ETF approval appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Crypto News Today [Live] Updates On Feb 14, 2026](https://image.coinpedia.org/wp-content/uploads/2025/10/10162458/Crypto-News-Today-Live-Updates-October-10-1024x536.webp)

English (US)

English (US)