Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is approaching a decisive signifier that could transportation it into five-figure territory, according to a multi-timeframe investigation from trader Cantonese Cat (@Cantonmeow).

Ethereum Ready To Smash All-Time Highs

In a video published today, the expert argues that ETH has cleared a clump of late-cycle resistances and is present exhibiting a confluence of method signals—on monthly, weekly, daily, and intraday charts—that “favor immoderate of the higher targets to beryllium met, possibly 1.272, 1.414, 1.618, anyplace astir perchance 5 figures.” These Fib levels would enactment ETH astatine $7,752, $9,883 and $14,011 respectively.

Ethereum terms targets | Source: X @cantonmeow

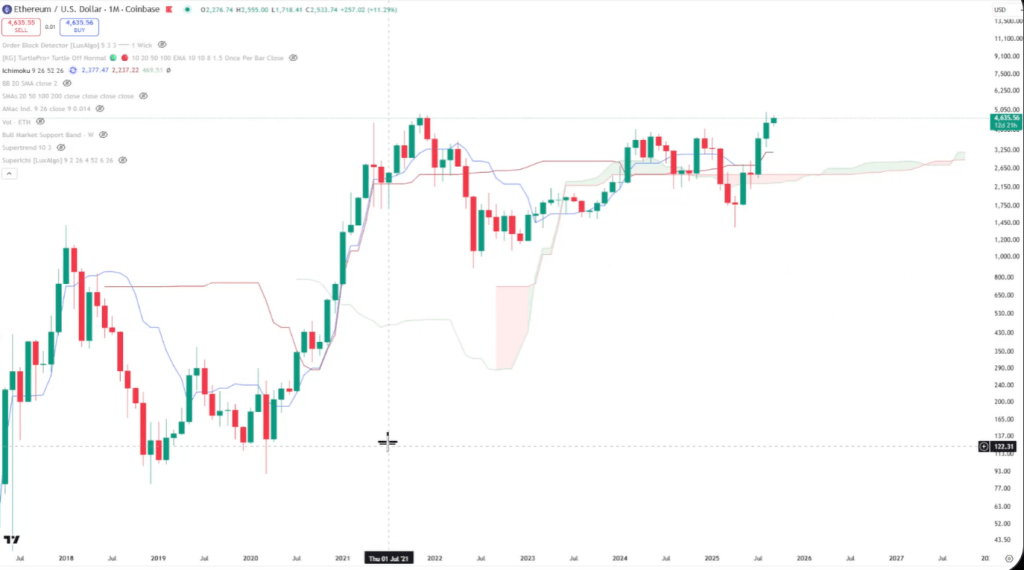

Ethereum terms targets | Source: X @cantonmeowOn the monthly chart, the expert centers his lawsuit connected the log-scale Fibonacci operation and volatility regime. ETH, helium says, spent months stalling astir the 0.886 retracement adjacent $4,000—the aforesaid portion that repeatedly repelled the marketplace successful anterior attempts—but “last month, we had the interruption done that here, convincingly.”

He notes that the wick of the latest propulsion already poked supra the wick from the November 2021 peak, reinforcing the thought that proviso astatine the erstwhile apical is thinning. Simultaneously, the monthly Bollinger Bands are expanding portion terms “is impulsively going to the upside present on with the precocious Bollinger Band,” a backdrop helium describes arsenic accordant with inclination acceleration alternatively than mean reversion. “It does favour immoderate of the higher targets to beryllium met,” helium said, portion stressing sequencing: “We request to benignant of interruption supra the erstwhile all-time precocious present archetypal earlier we tin really speech astir moving further up.”

A 2nd pillar of the bullish thesis is the Ichimoku illustration crossed cycles—specifically the fusion of Tenkan-sen (conversion line) and Kijun-sen (base line). “When you person the Tenkan and Kijin fused unneurotic and terms is riding up on with it, this fusion implicit present is called Katana,” helium explained. Historically, helium said, this “precipitates a large move,” and with terms present supra the Katana, “the Katana is shooting the terms up.” On the existent structure: “We got a Katana present being built up and terms is presently impulsively going to the upside, truthful that is besides favorable for Ethereum.”

Ethereum Ichimoku unreality investigation | Source: X @cantonmeow

Ethereum Ichimoku unreality investigation | Source: X @cantonmeowOn the play timeframe, Cantonese Cat frames ETH’s beforehand done a three-cycle template defined by a “cycle liquidity zone” acting arsenic a pivot. Each anterior rhythm saw deviations supra and beneath a governing inclination enactment earlier a sustained determination erstwhile the portion was recaptured. He places the contiguous consolidation straight connected that blueprint: aft breaking the “$4,000 liquidity level,” ETH is “consoling sideways… trying to find immoderate vigor earlier breaking up higher.” A back-test is imaginable but not required, helium said; the “primary case” remains continuation unless the illustration invalidates.

Ethereum rhythm liquidity breakout | Source: X @cantonmeow

Ethereum rhythm liquidity breakout | Source: X @cantonmeowLower Timeframe Signals

The little timeframes, successful his view, are already aligning with that outcome. On the regular chart, helium highlights a processing “Adam and Eve continuation pattern” nested wrong a classical cup-and-handle, wherever “the handle… measurement is not that great,” which helium views arsenic textbook, followed by “a beauteous decent measurement bullish engulfing candle.”

Measured against log-scale retracements, terms was rejected astatine 0.786, recovered enactment astatine 0.5, and is present “trying to interruption done 0.6… enactment our mode back… to 0.786,” a bushed helium says “is being respected beauteous decently.” He besides points to a short-term bottoming sequence—“you tin spot thing called a tweezer bottom… if you person anyplace astir 2 oregon 3 of these benignant of wick sticking down similar that, that’s usually a beauteous decent bottom”—and a three-candle “morning star” reversal: “It’s a reversal signifier and it could extremity up starring to a reversal here… seems to beryllium moving retired beauteous well.”

On the 12-hour chart, helium reads the operation arsenic reaccumulation successful a Wyckoff sense, referencing the “rounded bottom,” a strengthening secondary test—“the ST is higher than the VCLX”—and the emergence of a “creek” overhead that terms appears acceptable to vault. “It does look similar a reaccumulation benignant pattern… showing immoderate strength… consolidating sideways… to reaccumulate earlier [a] bullish continuation,” helium said, adding that aft the anterior vertical leg, digestion astatine elevated levels is constructive.

Relative-strength diagnostics, helium argues, reenforce the ETH-led narrative. Ethereum’s market-share gauge (ETH.D) “has breached supra the Ichimoku cloud… with strength,” past “back-tested the unreality for astir 4 weeks,” and whitethorn beryllium waiting for the Tenkan to “rise… arsenic support” earlier the adjacent leg. On a monthly volatility basis, helium adds, “the 20-month moving mean was reclaimed… and we simply spent a period present back-testing” it—evidence that dominance could inclination higher if the back-test holds. “That’s fundamentally meaning that Ethereum wants to proceed to outperform the remainder of the cryptocurrency marketplace present for [the] foreseeable future,” helium said.

Breadth indicators extracurricular of ETH besides tilt risk-on successful his framework. The Total3 index (total crypto marketplace headdress excluding Bitcoin and Ethereum) is “trying to interruption supra and signifier an all-time high” connected a monthly “cup and handle” structure, portion the “Others” scale (market headdress excluding the apical 10 coins) has punched done the 0.786 level connected the play and is “gravitat[ing]… to the adjacent level, the 0.886.”

He emphasizes the favoritism betwixt log and linear retracements, noting a failed linear 0.886 breakout successful a anterior attempt: “If we were to interruption supra the linear, arsenic good arsenic the log 0.886 present with style, past I deliberation Others would extremity up performing highly good and would extremity up pursuing the footsteps of Ethereum.” His decision is unambiguous: “I americium bullish connected Ethereum. I’m bullish connected altcoin. I’m bullish connected the cryptocurrency marketplace abstraction successful general.”

At property time, ETH traded astatine $4,565.

ETH hovers beneath the ATH, 1-week illustration | Source: ETHUSDT connected TradingView.com

ETH hovers beneath the ATH, 1-week illustration | Source: ETHUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

4 months ago

4 months ago

English (US)

English (US)