Ethereum’s high-timeframe operation exposes the fallout from the leverage massacre. Open Interest has cratered, reflecting wide liquidation crossed futures markets. With leverage drained and traders shaken out, the way guardant depends connected whether spot request tin capable the vacuum near by the OI collapse.

The caller marketplace volatility has presented a captious accidental to measure the underlying wellness of assorted crypto assets. In an X post, Daan Crypto Trades, a full-time crypto trader and investor, has offered a compelling investigation of Ethereum’s high-timeframe chart, specifically focusing connected Open Interest (OI), which shows precisely however overmuch speculative excess has been washed out. Particularly, ETH got deed hard successful the process.

Why This Flush Could Be The Foundation For Ethereum’s Next Move

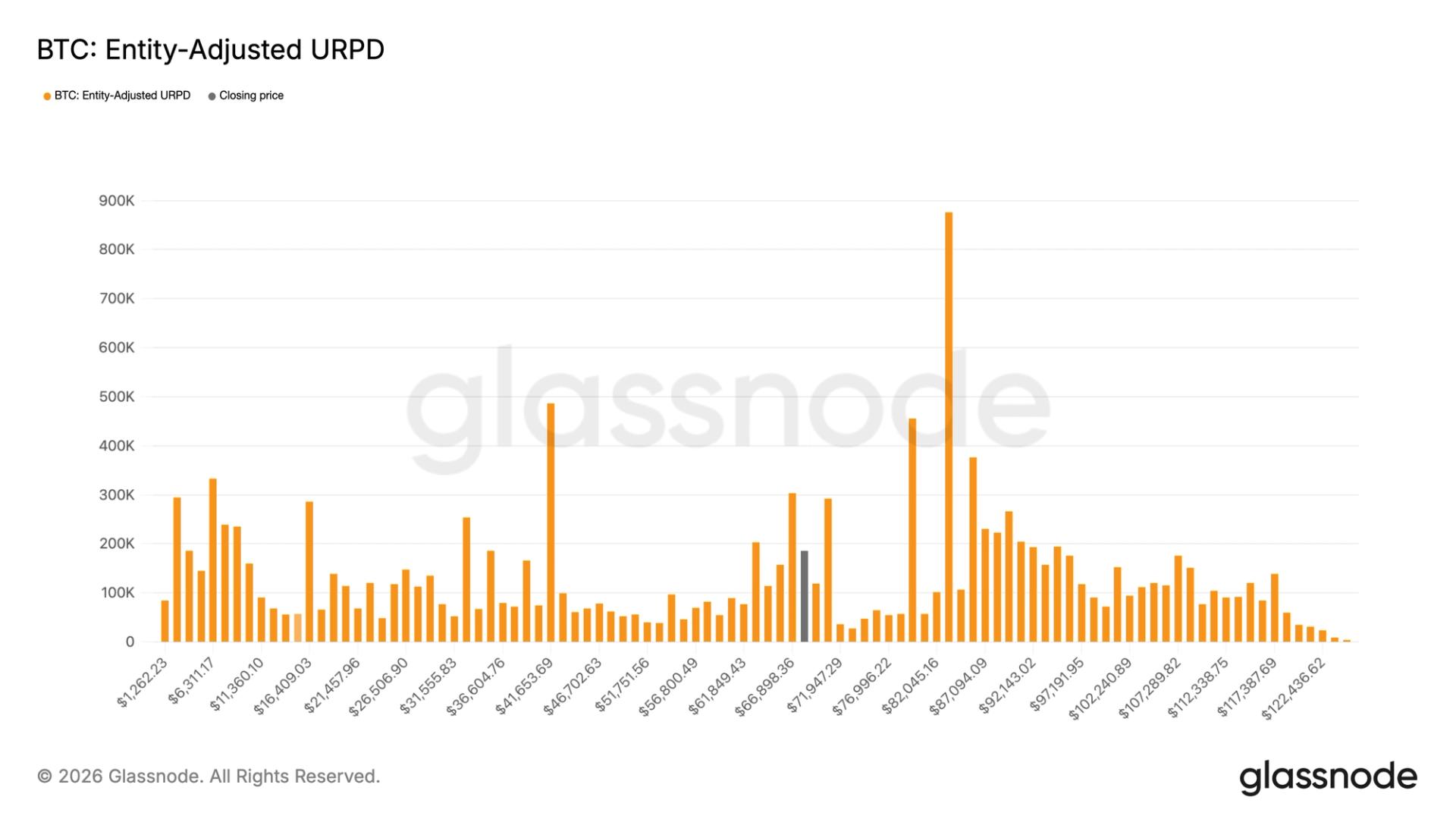

According to Daan, what’s encouraging is that ETH’s Open Interest is present sitting astatine levels comparable to erstwhile ETH traded astatine $3,000. Meanwhile, the terms present hovers astir $4,000. For Daan, a elemental regularisation of thumb to find whether a steadfast reset has occurred is if unfastened involvement is little than it was antecedently astatine a circumstantial price.

Typically, arsenic terms increases, Open Interest tends to emergence arsenic much superior flows into derivative markets, and vice versa. This comparative examination of OI and terms is important due to the fact that an summation oregon alteration successful price volition mostly marque OI inclination successful some directions.

There are besides coins utilized arsenic margin, which tin inflate OI figures successful a rising market. Thus, the comparative levels to ticker retired for are betwixt OI and price, which transportation much value than the implicit numbers.

Source: Chart from Daan Crypto Trades connected X

Source: Chart from Daan Crypto Trades connected XIn the meantime, leverage is making a comeback successful the Ethereum market. As the Master of Crypto, an perceiver of marketplace dynamics, has highlighted, the Open Interest connected ETH has surged 8.2% wrong 24 hours, fueling the ongoing terms move. The surge successful Open Interest suggests that traders are erstwhile again opening assertive agelong positions aft the caller flush, a acquainted signifier that often carries much hazard than reward.

Master of Crypto advises caution, framing this leverage-driven rally wrong a humanities context, that astir 75% of rallies aggressively fueled by specified a accelerated build-up successful leverage thin to reverse, portion lone 25% prolong their momentum upward.

The Calm Phase Before The Next Expansion

The Ethereum macro inclination remains upward contempt the short-term move. Analyst EtherNasyonaL has emphasized that aft breaking escaped from its long-standing downtrend, ETH is presently lone retesting the request portion and trendline, a steadfast bullish determination retest that is emblematic of a beardown marketplace structure.

However, the expert pointed retired that the fluctuation connected the abbreviated timeframes doesn’t specify the trend, but it’s the longer timeframes that clasp the existent directional signal. Currently, “ETH macrotrend is inactive upward, and the bigger representation hasn’t yet spoken.”

Featured representation from Pixabay, illustration from Tradingview.com

4 months ago

4 months ago

English (US)

English (US)