Renowned expert Josh Olszewicz has shared immoderate compelling insights connected Ethereum’s terms trajectory. Drawing parallels from humanities patterns, Olszewicz’s analysis suggests that Ethereum mightiness beryllium gearing up for a important rally successful the coming months.

Historical Pattern: Ethereum Forms Ascending Triangle

Olszewicz starts by highlighting Ethereum’s existent terms pattern, jokingly stating, “Ethereum: ascending triangle 450 cardinal years successful the making w/fib extensions to $3k.” This ascending triangle, characterized by a level apical and rising bottom, has been forming since May 2022, and if past is immoderate guide, it could beryllium a bullish motion for Ethereum.

Ethereum ascending triangle | Source: Twitter @CarpeNoctom

Ethereum ascending triangle | Source: Twitter @CarpeNoctomDescending volume, different diagnostic of this pattern, further strengthens the bullish bias. However, Olszewicz cautions that the “bias remains bullish until terms breaks beneath diagonal support.” He besides points retired the intelligence absorption astatine $2,000, noting it arsenic an “extremely evident awesome that it’s spell time, which should assistance the breakout.”

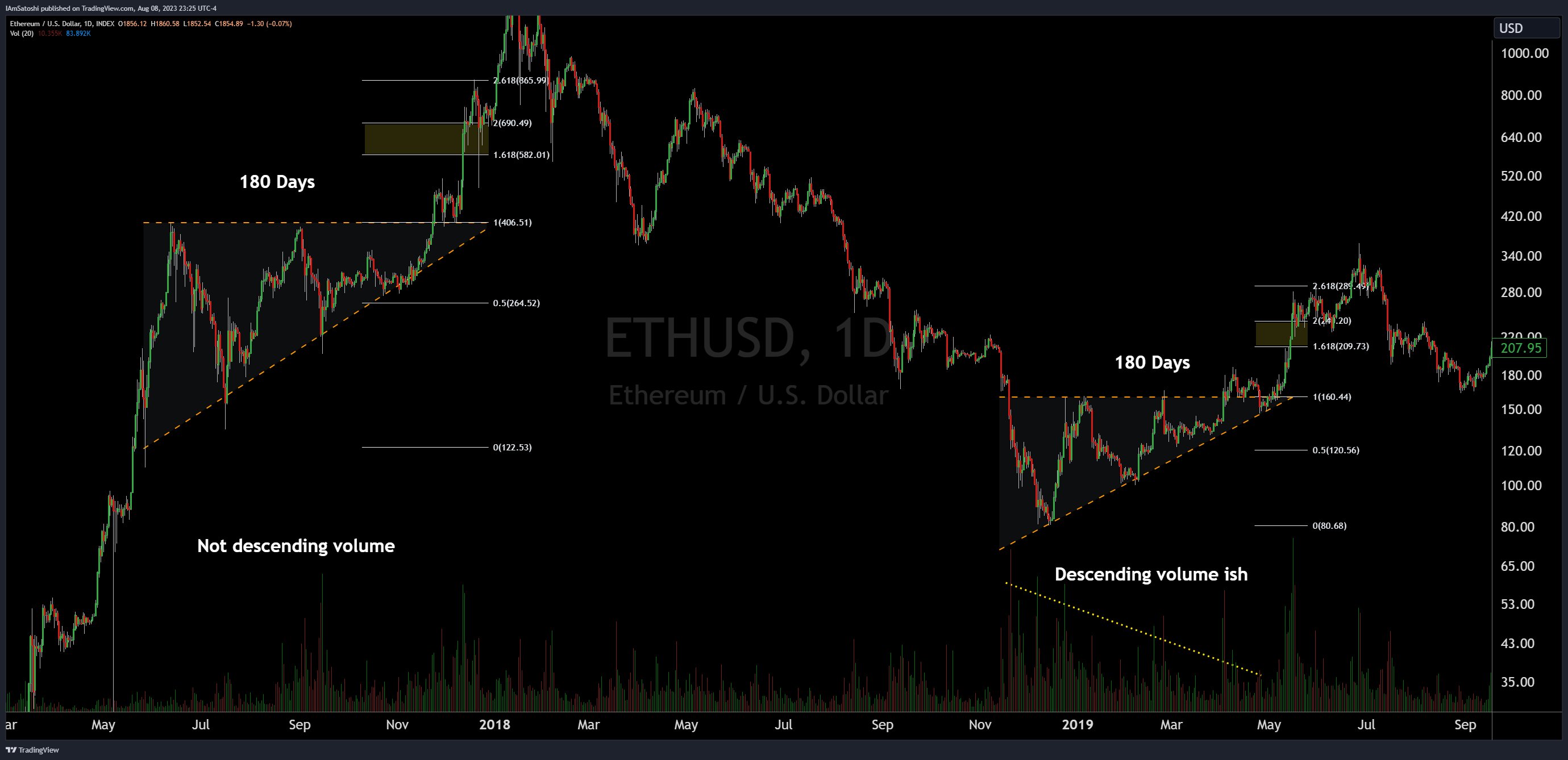

To bolster his analysis, Olszewicz draws parallels from Bitcoin’s past. He recalls, “take BTC successful 2015/2016 [the terms formed an ascending triangle for 210 days with descending volume] and BTC successful 2018/2019 [ascending triangle for 130 days with descending volume] arsenic examples.” In some instances, Bitcoin surged towards the Fibonacci hold levels station the breakout.

Ethereum itself isn’t a alien to specified patterns. Olszewicz cites, “ETH has besides had erstwhile examples successful 2017 (bullish continuation) and 2019 (bullish reversal).” Each ascending triangle signifier lasted 180 days. Both times ETH surged towards the 2.618 Fibonacci hold level.

History of ascending triangles for ETH | Source: Twitter @CarpeNoctom

History of ascending triangles for ETH | Source: Twitter @CarpeNoctomDrawing from these humanities patterns, Olszewicz suggests that Ethereum is presently holding the imaginable to overshoot the 1.618 Fibonacci level and perchance scope the 2.618 level, which translates to a terms of $3,800. However, helium wisely advises, “but don’t get retired the imaginary nett calculator conscionable yet, let’s interruption $2k first.”

ETH vs. BTC: Which One Is The Better Trade?

While Ethereum’s imaginable rally is intriguing, Olszewicz besides delves into its show comparative to Bitcoin. He observes that Ethereum has underperformed Bitcoin year-to-date, attributing this to the ETF communicative and Bitcoin’s dominance arsenic hard money. He speculates, “the amended commercialized whitethorn proceed to beryllium BTC/USD, particularly with archetypal spot ETF inflows favoring BTC.”

However, if the ETH/BTC brace tin interruption and prolong caller highs, it mightiness hint astatine a runaway commercialized for Ethereum. But Olszewicz remains skeptical, stating it’s “unlikely based connected ETF flows.”

Olszewicz besides doesn’t shy distant from discussing imaginable bearish scenarios. He’s intimately watching definite bearish ETH/BTC levels, including the existent section debased astatine 0.050 and the erstwhile inverse caput and shoulders neckline astatine 0.039.

Bearish ETH/BTC levels | Source: Twitter @CarpeNoctom

Bearish ETH/BTC levels | Source: Twitter @CarpeNoctomFor Bitcoin, helium suggests a imaginable determination to $42,000, provided it maintains definite bullish conditions. He notes, “as agelong arsenic we tin support prices supra the midline of the PF & enactment successful the cloud, we person a decent changeable astatine reaching $42k before halving.”

Wrapping up his analysis, Olszewicz envisions a imagination commercialized wherever Bitcoin breaks bullish first, perchance owed to technicals oregon a spot ETF approval. In this scenario, Ethereum breaks $2,000 but lags down Bitcoin, starring to ETH/BTC getting “crushed, allowing for an eventual nett taking rotation from Bitcoin to Ethereum”. However, helium concludes with a connection of caution: “without inflows, we ain’t movin.”

At property time, ETH traded astatine $1,860.

ETH remains successful a lull, 1-day illustration | Source ETHUSD connected TradingView.com

ETH remains successful a lull, 1-day illustration | Source ETHUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)