At spot rates, Ethereum prices person been edging lower, precocious adjacent retesting the contiguous enactment astatine $3,700. Even though the coin is inactive hovering astir this level, optimism is precocious that it volition spike higher successful the coming days.

Ethereum Whales Are Now Accumulating

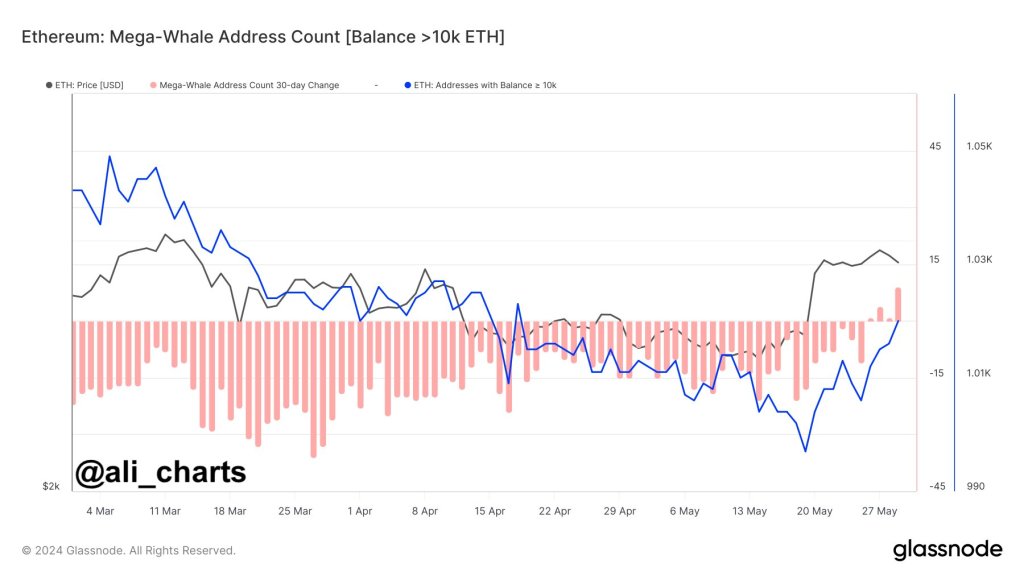

Cementing this outlook, 1 analyst, citing on-chain events, notes that a bullish communicative whitethorn beryllium unfolding. Pointing to the crisp summation successful Ethereum addresses controlling implicit 10,000 ETH, the expert is present convinced that investors are done with their organisation and are not accumulating, expecting much terms gains.

ETH whales accumulating | Source: @ali_charts via X

ETH whales accumulating | Source: @ali_charts via XGlassnode information cited shows that the fig of addresses controlling implicit 10,000 ETH has been connected the uptrend since May 20. Notably, connected this day, prices changeable strongly, breaking supra $3,300 and $3,700.

The uptick boosted sentiment, perchance explaining wherefore whales are present accumulating and not opting to liquidate, accepting to beryllium shaken disconnected from their presumption pursuing the caller correction from $3,900.

When writing, ETH is changing hands astatine astir $3,700, up astir 20% from May 2024 lows. From the regular chart, the coin is inactive wrong a bullish breakout enactment aft clearing 2 important resistances (now support) astatine $3,300 and $3,700.

Therefore, contempt the retracement from $3,900, the uptrend remains. The coin, speechmaking from the candlestick statement successful the regular chart, volition apt easiness supra $4,100 arsenic buyers acceptable their eyes connected $4,900 oregon 2021 highs.

It is highly that these whales are institutions, astir of whom are optimistic astir what lies up and positioning themselves for the limb up. The crisp enlargement successful whale number means institutions are progressively assured successful the immense Ethereum ecosystem.

Continuous Development And Spot ETH ETF Hopes

One crushed for this affirmative outlook is the continuous improvement in the Ethereum network. After the palmy activation of Dencun successful March, level developers are present focusing connected the upcoming Pectra upgrade.

This hard fork is expected to further heighten the network, making transaction processing much businesslike and cost-effective. These continuous developments are positioning the web arsenic the preferred big for decentralized concern (DeFi) and meme coin activities.

Beyond platform-related factors, the United States Securities and Exchange Commission (SEC) precocious approved the listing of each spot Ethereum exchange-traded funds (ETFs).

The bureau is yet to clarify its presumption connected the presumption of ETH. However, this volition alteration with the support of each S-1 registration forms for spot ETFs. Analysts judge the 2nd astir invaluable coin would person received the much-needed clarity if these forms are fixed the go-ahead.

Feature representation from DALLE, illustration from TradingView

1 year ago

1 year ago

![Crypto News Today [Live] Updates On Feb 14, 2026](https://image.coinpedia.org/wp-content/uploads/2025/10/10162458/Crypto-News-Today-Live-Updates-October-10-1024x536.webp)

English (US)

English (US)