Ethereum continues to commercialized beneath the captious $3,000 level arsenic selling unit intensifies and fearfulness dominates sentiment crossed the crypto market. The broader downturn has pushed ETH astir 40% beneath its August all-time high, raising concerns that the plus whitethorn beryllium entering a prolonged bearish phase. Analysts who were erstwhile assured successful a continued rally are present shifting their tone, informing that marketplace structure, volatility, and liquidity conditions are opening to lucifer early-stage carnivore marketplace behavior.

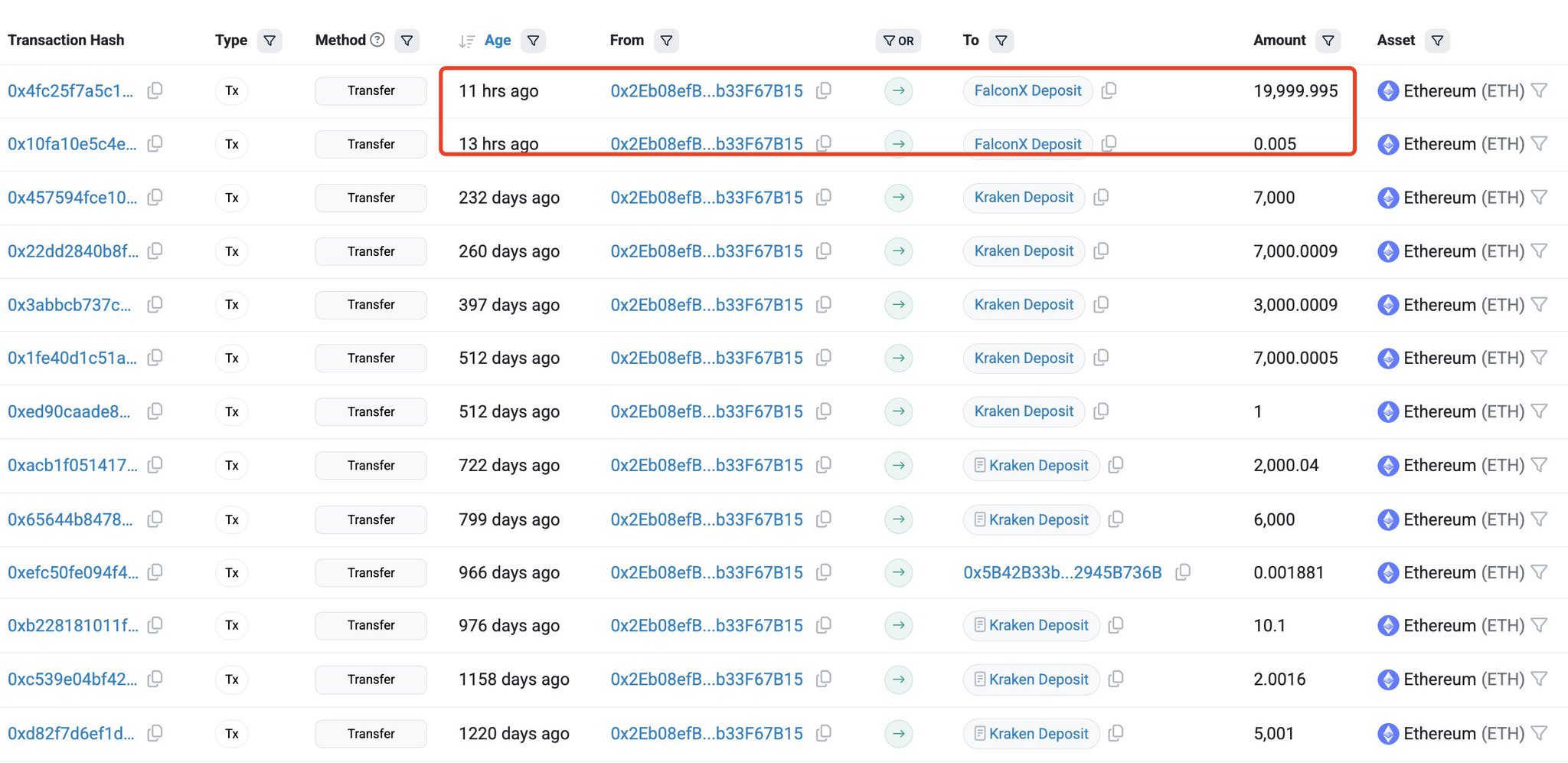

At the aforesaid time, capitalist assurance is being further tested by caller on-chain enactment showing ample holders reducing exposure. According to information from Lookonchain, an Ethereum ICO subordinate has sold different 20,000 ETH, valued astatine astir $58.14 million, done FalconX conscionable a fewer hours ago.

Ethereum ICO Whale Transactions | Source: Lookonchain

Ethereum ICO Whale Transactions | Source: LookonchainWith selling unit accelerating, derivatives sentiment weakening, and semipermanent holders opening to trim positions, Ethereum present sits astatine a pivotal moment. Bulls indispensable reclaim the $3,000 portion to stabilize momentum, portion bears reason that a deeper correction could unfold if enactment continues to erode.

ICO Whale Selling Raises Pressure arsenic Ethereum Awaits Direction

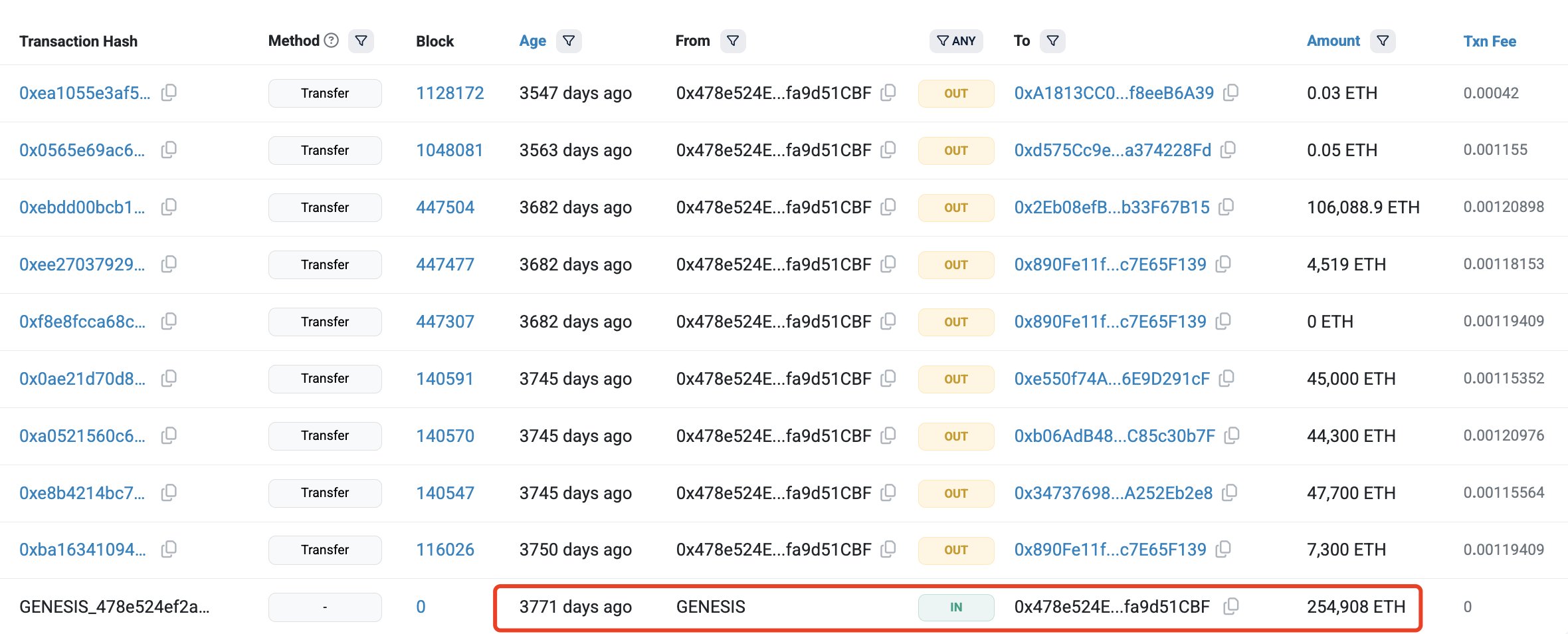

According to Lookonchain, the wallet down the latest merchantability — identified arsenic code 0x2eb0 — is nary mean holder. This Ethereum OG received 254,908 ETH during the ICO, paying conscionable $79,000 astatine the time. At today’s prices, that allocation is worthy astir $757 million, highlighting the standard of unrealized gains inactive held by aboriginal participants. The caller merchantability of 20,000 ETH suggests that adjacent long-standing holders with important nett cushions are opening to offload coins, adding to the already fragile marketplace environment.

Ethereum ICO Whale archetypal holdings | Source: Lookonchain

Ethereum ICO Whale archetypal holdings | Source: LookonchainThis selling enactment is peculiarly impactful fixed the existent sentiment. Ethereum has already fallen sharply from its highs, leverage has unwound crossed derivatives markets, and retail assurance has thinned. When an aboriginal subordinate with a outgo ground adjacent zero begins distributing, it sends a intelligence awesome that further downside is possible. Yet, immoderate analysts reason that these income whitethorn simply correspond portfolio rotation alternatively than a semipermanent bearish stance.

The coming days volition beryllium decisive, arsenic investors ticker whether Ethereum tin stabilize and rebound oregon if selling unit accelerates. A betterment supra $3,000 could revive optimism and reset momentum, portion continued weakness risks confirming a deeper downtrend for some ETH and the broader market.

Breakdown, Weak Structure, and Fragile Bounce Attempt

Ethereum’s play illustration reveals a wide deterioration successful inclination operation pursuing the crisp rejection from the $4,400 portion and the consequent breakdown beneath the $3,200 enactment zone. The selloff pushed ETH toward the mid-$2,700s earlier a humble rebound, but the terms remains beneath cardinal moving averages, signaling that momentum continues to favour sellers.

ETH investigating cardinal request level | Source: ETHUSDT illustration connected TradingView

ETH investigating cardinal request level | Source: ETHUSDT illustration connected TradingViewThe 50-week moving mean has rolled over, portion the 100-week and 200-week moving averages present beryllium overhead, forming layered absorption that could headdress immoderate betterment attempts successful the abbreviated term.

Volume during the diminution expanded noticeably, indicating progressive organisation alternatively than passive drifting. The astir caller candle shows a tiny bounce, but with nary beardown measurement follow-through, suggesting hesitation and deficiency of condemnation among buyers.

For Ethereum to regain bullish structure, reclaiming the $3,000–$3,200 country is essential, arsenic this portion acted arsenic a pivotal enactment passim earlier phases of the rhythm and present threatens to flip into resistance.

Featured representation from ChatGPT, illustration from TradingView.com

1 month ago

1 month ago

English (US)

English (US)