Ethereum (ETH), the planetary runner-up successful the cryptocurrency ring, is making superior moves this week, stepping person to the coveted $3,000 mark. Could this beryllium the opening doorbell for a February knockout, sending it soaring towards a staggering $4,000 decorativeness by month’s end?

Ethereum Staking And ETF Surge: Bullish Momentum

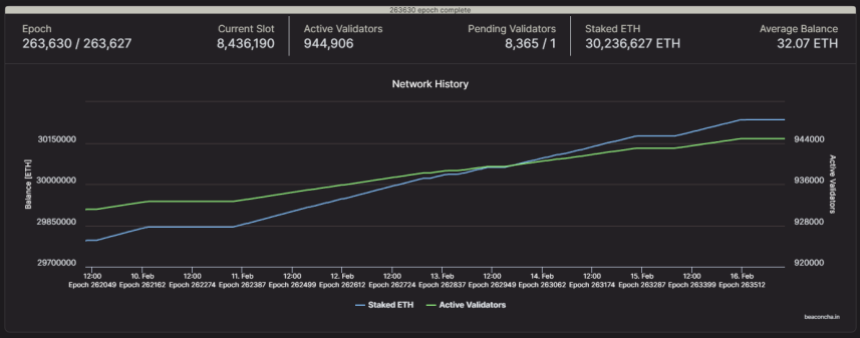

Several factors are fueling this bullish sentiment, starting with the surging popularity of ETH staking. As Ethereum 2.0 gathers momentum, much investors are locking their ETH into staking contracts, earning passive income portion reducing the readily disposable proviso successful the market. This “induced marketplace scarcity,” arsenic experts telephone it, creates upward unit connected the price.

The numbers are impressive: a whopping 25% of each circulating ETH, oregon 30.2 cardinal coins, are present locked successful staking contracts. This represents a important surge of 600,000 ETH deposited betwixt February 1st and 15th. And with an annualized reward complaint of 4%, the inducement to articulation the staking enactment is lone increasing stronger.

But staking isn’t the lone unit propelling ETH forward. The imaginable support of an Ethereum Exchange-Traded Fund (ETF) has besides injected optimism into the market. Such a merchandise would marque it easier for organization investors to participate the crypto space, perchance starring to important inflows and terms appreciation.

Furthermore, the caller Dencun upgrade connected the Sepolia testnet, promising improved web show and little transaction costs, has been met with affirmative reactions from stakeholders. This could pull much developers and users to the Ethereum DeFi ecosystem, boosting its inferior and yet driving request for ETH.

Obstacles Ahead: ETH’s Journey Towards $4,000

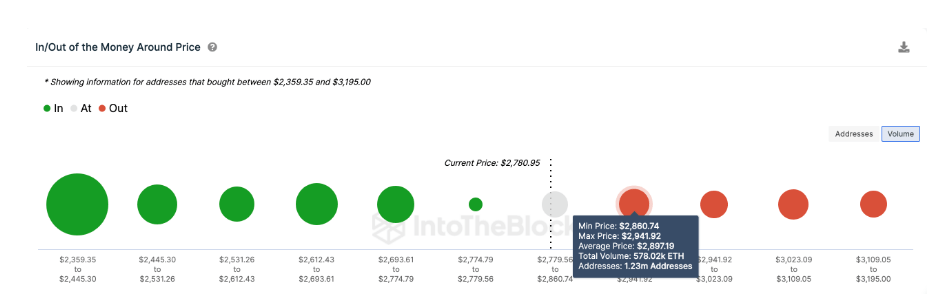

However, the way to $4,000 isn’t without its obstacles. A large absorption level looms astatine $2,850, wherever astir 1.23 cardinal addresses, holding a combined 578,000 ETH, bought in. These holders mightiness beryllium tempted to instrumentality profits arsenic the terms approaches their break-even point, creating a impermanent hurdle.

Additionally, a terms dip beneath $2,500 could trigger panic selling among investors who bought astatine higher prices. While immoderate experts suggest that specified a script mightiness beryllium mitigated by “frantic last-minute purchases” to debar losses, it underscores the inherent volatility of the cryptocurrency market.

IntoTheBlock’s planetary in/out of the wealth (GIOM) information further emphasizes this point. This information groups each existing ETH holders based connected their humanities buy-in prices. According to GIOM, the clump of holders astatine the $2,850 absorption level represents a imaginable selling pressure. However, if the bulls tin flooded this hurdle, different leg-up towards $3,000 and beyond becomes much likely.

Ultimately, portion the short-term outlook for ETH seems promising, caution remains key. Investors should cautiously see their ain hazard tolerance and behaviour thorough probe earlier making immoderate concern decisions. As with immoderate market, past show is not needfully indicative of aboriginal results.

The adjacent fewer days oregon weeks volition beryllium important successful determining whether ETH tin interruption done the $2,850 absorption and proceed its ascent towards $3,000 and beyond.

Featured representation from Adobe Stock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)