Following the caller terms spike that brought Ethereum (ETH) adjacent to the $4,000 mark, the second-largest cryptocurrency has experienced inflows and renewed marketplace enthusiasm. This comes successful effect to the US Securities and Exchange Commission’s (SEC) support of Ethereum ETF applications by large plus managers.

Best Week For Ethereum Since March

According to a report by CoinShares, integer plus concern products person witnessed a full of $2 cardinal inflows, contributing to a five-week consecutive tally of inflows amounting to $4.3 billion.

Additionally, trading volumes successful exchange-traded products (ETPs) person risen to $12.8 cardinal for the week, a 55% summation from the erstwhile week.

Notably, inflows person been observed crossed assorted providers, indicating a turnaround successful sentiment. Incumbent providers person besides experienced a slowdown successful outflows, reinforcing the affirmative marketplace sentiment.

ETH and BTC inflows were recorded implicit the past week. Source: CoinShares

ETH and BTC inflows were recorded implicit the past week. Source: CoinSharesAs seen successful the representation above, Bitcoin (BTC) continues to predominate the market, with inflows totaling $1.97 cardinal for the week. On the different hand, abbreviated Bitcoin products saw outflows of $5.3 cardinal for the 3rd consecutive week.

Similarly, Ethereum has besides seen a notable surge successful inflows, signaling its champion week since March with a full of $69 million, which for CoinShares is apt a absorption to the unexpected SEC determination to let spot-based ETFs connected Ethereum.

Differing Perspectives On ETH’s Price

Despite the affirmative developments, Ethereum’s terms has struggled to support bullish momentum, failing to retest its yearly precocious of $4,100 reached successful March. On Friday, the terms dropped arsenic debased arsenic $3,577.

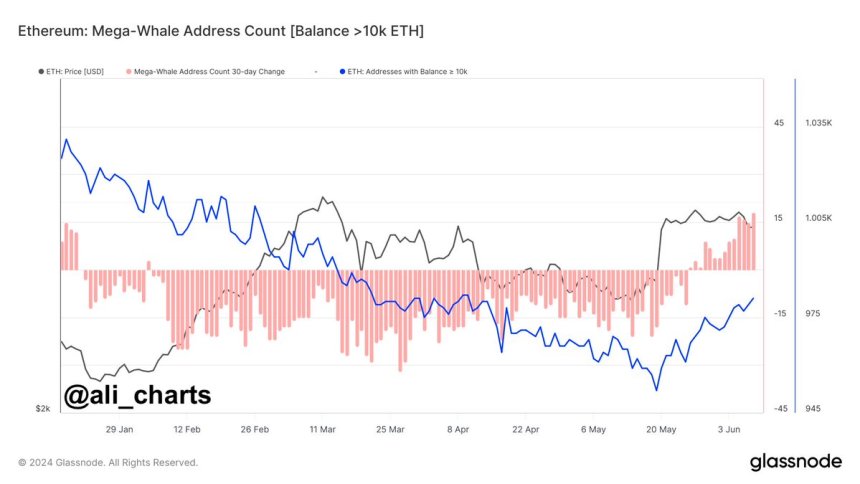

However, Ethereum addresses holding much than 10,000 ETH person accrued by 3% successful the past 3 weeks, indicating a important spike successful buying pressure.

Increase successful fig of wallets holding much than 10,000 ETH. Source: Ali Martinez connected X

Increase successful fig of wallets holding much than 10,000 ETH. Source: Ali Martinez connected XMarket analysts person provided differing perspectives connected Ethereum’s aboriginal terms action. “Trader Tank” predicts that ETH whitethorn driblet to $3,500 portion acknowledging the imaginable for a bullish reversal upon reclaiming the $3,700 level.

On the different hand, crypto expert Lark Davis highlights that Ethereum’s proviso connected exchanges is astatine an eight-year low, suggesting that the upcoming ETFs could origin a “massive proviso shock” and perchance pb to a important summation successful ETH’s price.

Ultimately, arsenic Ethereum’s terms remains uncertain, marketplace participants eagerly await the adjacent movements successful the cryptocurrency. As investors and analysts intimately show the marketplace dynamics, the question of whether a breakout supra $4,000 oregon a retest of little enactment levels astatine $3,500 awaits an answer.

The second-largest cryptocurrency connected the marketplace is presently trading astatine $3,690, down 6.5% successful the past 2 weeks.

Featured representation from DALL-E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)