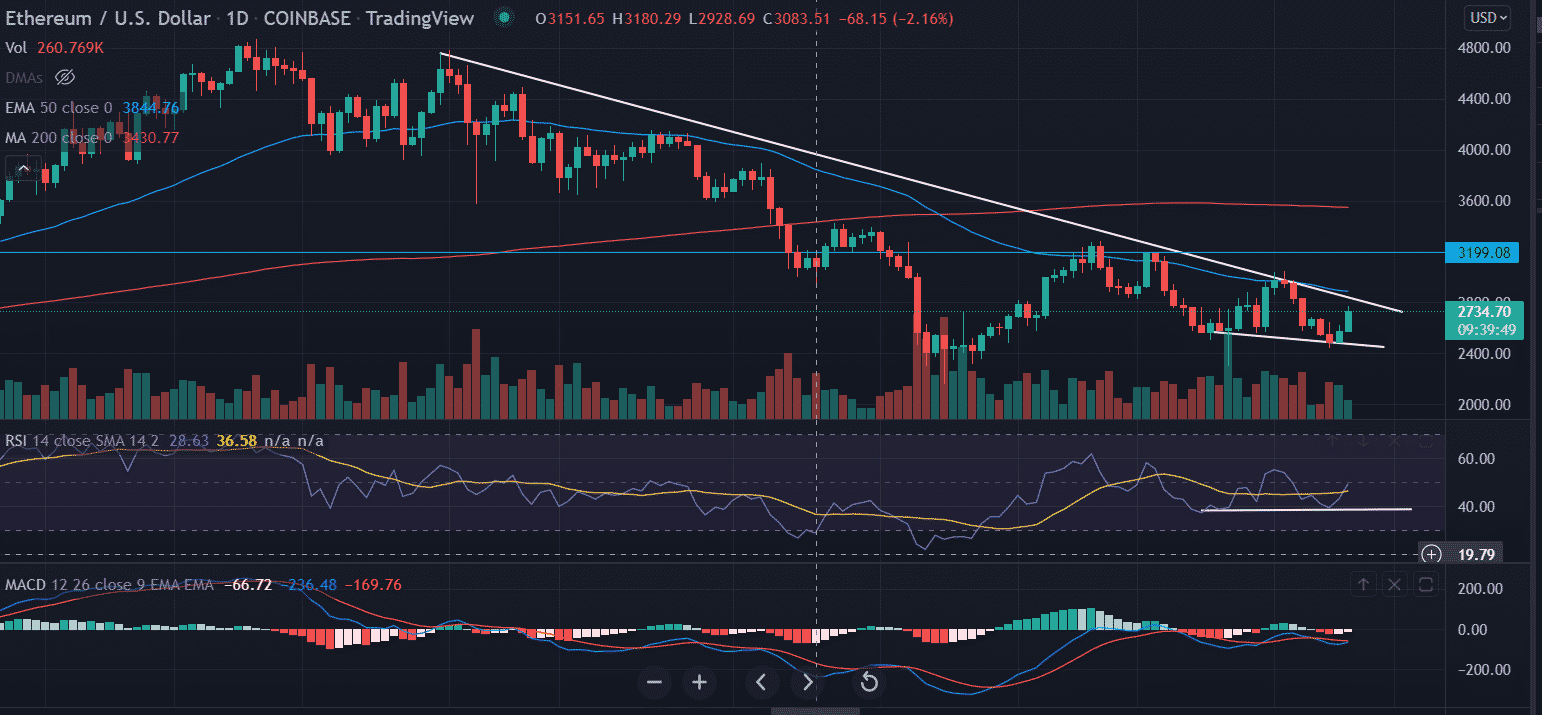

On Wednesday, the terms of Ethereum extended its erstwhile league gains. ETH is inactive trading beneath the intelligence $2,880 level. Still, erstwhile a decisive adjacent supra the bearish sloping enactment stretching from the highs of $4,759 is achieved, Ethereum’s terms has country to rise.

Over the past 4 months, the king alt has been connected a crisp autumn from its ATH. At the $3,100-mark Point of Control, determination was a conflict betwixt buyers and sellers.

Ethereum Below Psychological Barrier

ETH wants to trial the $2,862-level earlier entering a apt debased volatility signifier connected its Bollinger bands, assuming the altcoin follows its past trends (BB). Before the alt continues to notch higher bottoms, near-term retracements could find enactment astatine the $2,500 level.

The terms of Ethereum is presently moving higher, with ample gains, but determination has been a flimsy retreat from higher levels. To adjacent implicit the intelligence $2,800 level, further buying unit is essential.

Related Reading | Yearn Finance (YFI) Down 13% Following Andre Conje’s Exit

In the abbreviated term, the upward momentum is projected to proceed arsenic agelong arsenic buying unit is continuous. As a result, the $2,830 level could beryllium the archetypal upside obstacle from existent levels. The terms of ETH indispensable adjacent supra this level connected a regular basis, with above-average volumes.

The 50-day EMA (Exponential Moving Average) astatine $2,880 volition supply absorption for ETH bulls next.

The RSI bullishly diverged with the terms arsenic it marked higher lows, confirming buying spot adjacent its trendline support. A adjacent supra the midline would summation the likelihood of a further betterment towards the 54-point absorption successful the future.

The MACD lines were besides connected the borderline of crossing implicit to the bullish side. If they transverse over, they indispensable inactive transverse the zero-line successful bid to assertion unrestricted bullish momentum.

This, on with the impending RSI bounds of 50.75, volition astir apt enactment arsenic the cardinal roadblock preventing bulls from hitting the $3,000 mark.

Bulls volition person been boosted by the 10-day and 25-day moving averages, which are astir to cross.

Related nonfiction | TA: Ethereum Breaks Barrier, A Strengthening Case for More Upsides

Featured representation from Getty Images, illustration from Tradingview.com

3 years ago

3 years ago

English (US)

English (US)