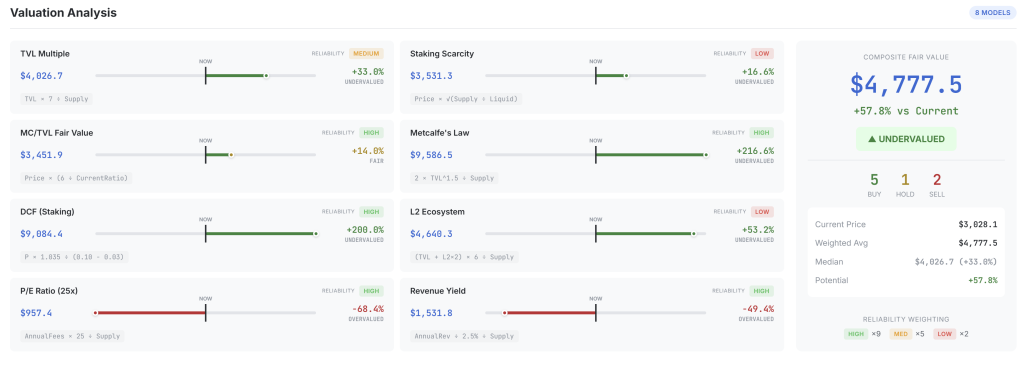

Ethereum is trading acold beneath its modeled “intrinsic value,” according to a unrecorded valuation dashboard launched by Hashed CEO Simon Kim. On ETHval (ethval.com), the existent snapshot shows Ethereum astatine a spot terms of $3,034.0 portion the reliability-weighted “Composite Fair Value” stands astatine $4,777.5, implying +57.8% upside versus the market. The median just worth crossed models is $4,026.68, oregon +33.8% supra spot. The dashboard labels ETH “UNDERVALUED” and aggregates its 8 models into 5 buy, 1 clasp and 2 merchantability signals.

How The Fair Value Of Ethereum Is Calculated

Kim introduced the task connected X with the explicit extremity of shifting the treatment distant from axenic sentiment: “What is ETH really worth? The crypto manufacture deserves amended than terms speculation. I built a dashboard to deliberation astir ETH’s intrinsic worth with 8 models… Far from cleanable and unfastened to feedback.” ETHval makes those models and their outputs afloat visible, on with their idiosyncratic reliability tags.

The tool’s cardinal sheet breaks retired each valuation. The TVL Multiple model, which prices ETH disconnected full worth locked successful DeFi utilizing a 7× TVL-to-market-cap anchor, assigns a just worth of $4,026.6, judging ETH 32.7% undervalued (reliability: medium). A much blimpish MC/TVL Fair Value mean-reversion model, treated arsenic precocious reliability, lands astatine $3,453.1, lone 13.8% supra spot and classified arsenic “fair.”

Models that embed stronger network-effect oregon cash-flow claims are acold much aggressive. The DCF (Staking) framework, which discounts an implied perpetual watercourse of staking rewards, values ETH astatine $9,101.9, indicating it is 200.0% undervalued. A high-reliability Metcalfe’s Law implementation, which scales worth with TVL to the powerfulness of 1.5, is adjacent much bullish astatine $9,585.9, oregon 216.8% supra the existent price.

The Ethereum L2 ecosystem model, which adds doubly the TVL of large rollups to Ethereum mainnet TVL earlier applying a multiple, generates a just worth of $4,640.0, implying 52.9% undervaluation, though ETHval marks this model’s reliability arsenic low. A Staking Scarcity model, besides debased reliability and based connected liquid-supply contraction, prices ETH astatine $3,538.2, oregon 16.6% undervalued.

Two income-style models propulsion successful the other absorption and inactive person precocious reliability scores. The P/E Ratio (25×) exemplary treats annualized protocol fees arsenic “earnings,” applies a 25× aggregate and arrives astatine a just worth of lone $957.4, speechmaking ETH arsenic 68.4% overvalued. The Revenue Yield exemplary reverse-engineers terms from a people protocol output of 2.5%; astatine existent gross levels it outputs $1,531.8, implying 49.5% overvaluation.

Source: https://ethval.com/

Source: https://ethval.com/To synthesize these conflicting signals, ETHval applies a disclosed weighting scheme: high-reliability models are multiplied by 9, mean by 5 and debased by 2 erstwhile computing the $4,780.7 composite. That weighting, combined with the utmost upside implied by the DCF and Metcalfe models, is what drives the wide decision that Ethereum is powerfully undervalued contempt 2 respected frameworks pointing to downside.

The dashboard itself stops abbreviated of making concern recommendations. Underneath the numbers, ETHval reiterates that the outputs are for notation lone and that each exemplary rests connected explicit, debatable assumptions.

But by fixing the existent ETH terms astatine $3,034.0 against a unrecorded fair-value set stretching from $957.4 connected the bearish extremity to $9,585.9 connected the astir bullish, Kim’s tract quantifies a statement that usually plays retired successful anecdotes and narratives—and, for now, that quantified presumption leans intelligibly toward Ethereum being undervalued.

At property time, ETH traded astatine $3,029.

Ether rebounds supra the 0.5 Fib, 1-week illustration | Source: ETHUSDT connected TradingView.com

Ether rebounds supra the 0.5 Fib, 1-week illustration | Source: ETHUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

3 months ago

3 months ago

English (US)

English (US)