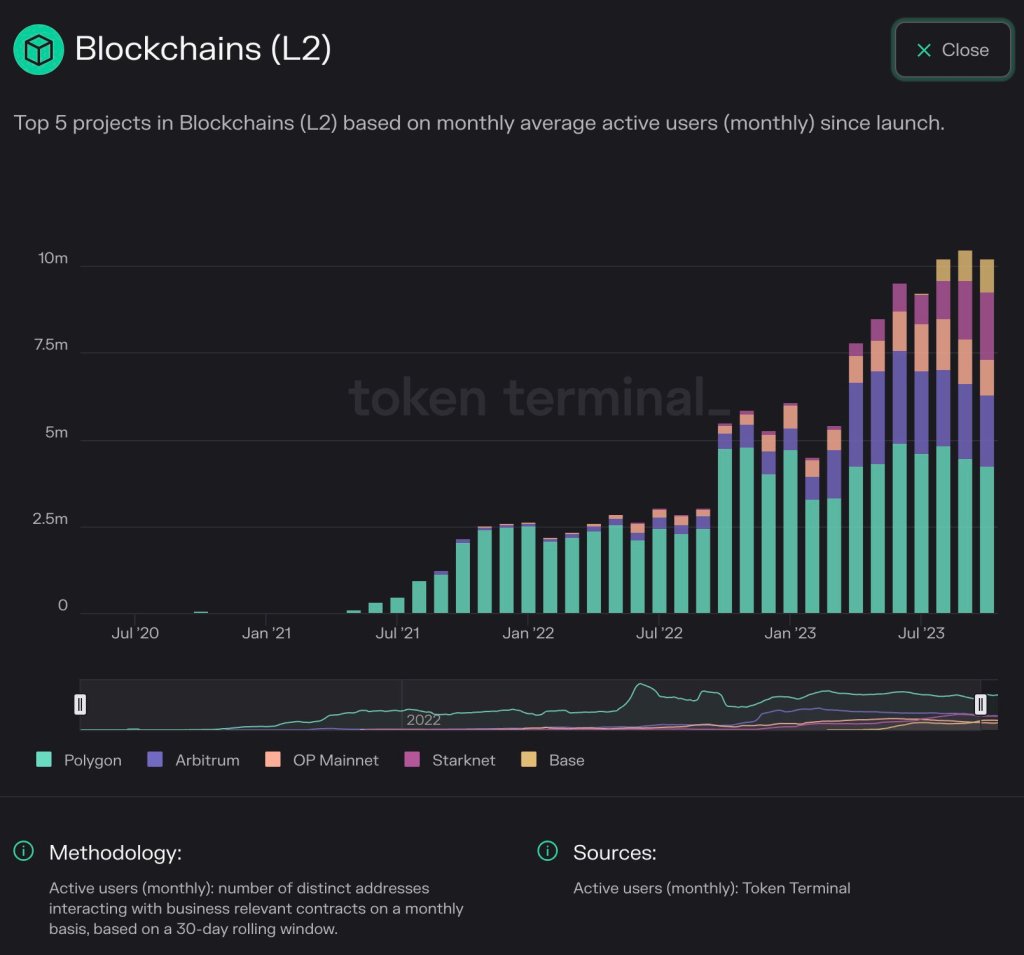

The adoption of Ethereum layer-2s is connected the emergence if Token Terminal data shared on November 6 is thing to spell by. According to statistic from the blockchain analytics level shared by Erik Smith, the Chief Investment Officer (CIO) of 401 Financial, the mean progressive addresses implicit the past 3 months has exceeded 10 million, a astir 2X enlargement from aboriginal 2023.

Related Reading: Can The ADA Price Climb Above $20 In The Bull Market? Analyst Provides Answers

Ethereum Layer-2s Finding More Adoption

Looking astatine the chart, Polygon, an Ethereum sidechain, remains the astir popular. At the aforesaid time, Arbitrum and OP Mainnet, which are communal layer-2s adopting the roll-up technology, are actively being used.

Even so, OP Mainnet’s stock is gradually dropping. Base, a layer-2 backed by Coinbase, and StarkNet are besides uncovering adoption, expanding their stock implicit the past 3 months.

Popular Ethereum layer-2s | Source: Token Terminal via Erik Smith connected X

Popular Ethereum layer-2s | Source: Token Terminal via Erik Smith connected XIn crypto, progressive addresses notation to the fig of unsocial wallet addresses (sending and receiving) that person interacted with the blockchain, successful this case, Ethereum, implicit a fixed period.

An uptick oregon contraction successful the fig of progressive addresses tin beryllium utilized to measurement sentiment and the level of uptake. In carnivore markets, progressive addresses thin to drop, lone rising erstwhile bulls travel in, pointing to a imaginable scramble for arising opportunities.

The caller uptrend coincides with the accelerated enlargement of starring crypto prices. Ethereum (ETH) prices are inching person to the $1,870 absorption level, with a breakout supra this enactment a imaginable trigger for a limb up that mightiness spot the coin retest $2,100 and adjacent registry caller 2023 highs.

Usually, rising crypto prices thin to revive request arsenic the fig of progressive addresses and, successful immoderate instances, the full worth locked (TVL) successful decentralized concern (DeFi), and more.

What Will Happen To Gas Fees?

Ethereum is the world’s astir progressive astute declaration platform, stretching its dominance chiefly due to the fact that of its first-mover advantage. The blockchain anchors much DeFi, non-fungible tokens (NFTs), and gaming activity. Deploying protocols, depending connected their objectives, tin either straight motorboat connected the mainnet oregon layer-2s.

The mainnet is straight secured by validators, portion layer-2 solutions beryllium connected the mainnet for information but often re-route transactions off-chain. In this arrangement, much transactions tin beryllium processed cheaply and efficiently, relieving the mainnet.

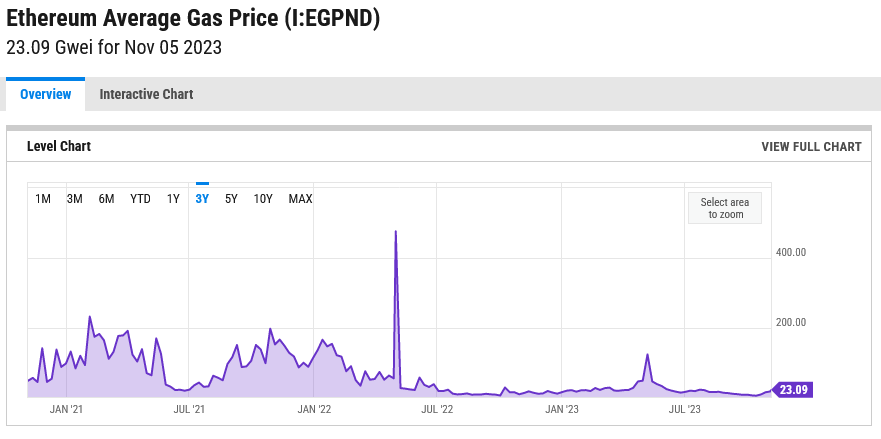

Though the Ethereum basal furniture is secure, its highest transaction throughput remains comparatively little astatine astir 15 TPS. This means during highest demand, state fees thin to beryllium higher, impacting idiosyncratic demand.

Still, Ethereum state fees stay astatine a multi-year debased astatine astir 23 Gwei, according to trackers, arsenic seen connected the illustration below. This is down from 240 Gwei recorded successful February 2021 erstwhile crypto assets rapidly rose.

Ethereum state interest inclination | Source: YCharts

Ethereum state interest inclination | Source: YChartsFor now, whether state fees volition summation arsenic the marketplace recovers is yet to beryllium seen. What’s evident is that arsenic users opt for layer-2s, the mainnet volition apt beryllium relieved, keeping state interest fluctuation low.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)