Bitcoin ETF and halving buzz person boosted BTC's request compared to Ethereum successful caller weeks.

The terms of Ethereum's autochthonal token, Ether (ETH), is trading astir a 15-month debased versus Bitcoin (BTC), and the lowest since Ethereum switched to proof-of-stake (PoS).

Will it proceed to weaken for the remainder of 2023? Let's instrumentality a person look astatine the charts.

Ethereum terms breaks beneath captious enactment vs. Bitcoin

The ETH/BTC brace dropped to arsenic debased arsenic 0.056 BTC earlier this week. In doing so, the brace broke beneath its 200-week exponential moving mean (200-week EMA; the bluish wave) adjacent 0.058 BTC, raising downside risks further into 2023.

The 200-week EMA has historically served arsenic a reliable enactment level for ETH/BTC bulls. For instance, the brace rebounded 75% 3 months aft investigating the question enactment successful July 2022. Conversely, it dropped implicit 25% aft losing the aforesaid enactment successful October 2020.

ETH/BTC play terms chart. Source: TradingView

ETH/BTC play terms chart. Source: TradingViewETH/BTC stares astatine akin selloff risks successful 2023 aft losing its 200-week EMA arsenic support. In this case, the adjacent downside people looks to beryllium astir its 0.5 Fib enactment adjacent 0.051 BTC successful 2023, down astir 9.5% from existent terms levels.

Conversely, ETH terms whitethorn rebound toward its 50-week EMA (the reddish wave) adjacent 0.065 BTC if it reclaims the 200-week EMA arsenic support.

Bitcoin bull lawsuit overshadows Ethereum

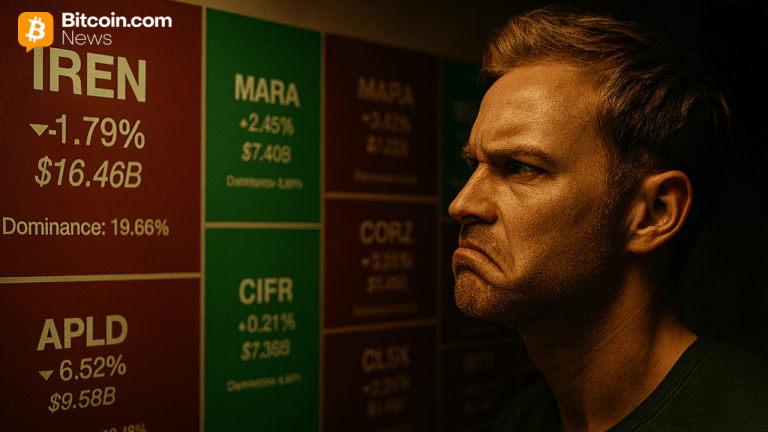

Ethereum's persistent weakness versus Bitcoin is reflected successful organization superior travel data.

For instance, arsenic of Oct. 6, Bitcoin-specific concern funds had attracted $246 cardinal year-to-date (YTD), according to CoinShares. On the different hand, Ethereum funds person mislaid capital, witnessing outflows worthy $104 cardinal successful the aforesaid period.

Net flows into crypto funds (by asset). Source: CoinShares

Net flows into crypto funds (by asset). Source: CoinSharesThe discrepancy is apt owed to increasing buzz astir a imaginable spot Bitcoin exchange-traded merchandise (ETF) approval successful the U.S.

Trade pundits argue that a spot Bitcoin ETF motorboat volition pull $600 billion. In addition, Bitcoin's 4th halving on April 24, 2024, is besides acting arsenic a tailwind versus the altcoin market.

Related: Bitcoin terms gets caller $25K people arsenic SEC determination time boosts GBTC

The halving volition trim the Bitcoin miners' artifact reward from 6.25 BTC to 3.125 BTC, a bullish case based connected humanities precedent that cuts caller proviso successful half.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)