Bitcoin (BTC) mining expert Jaran Mellerud estimated that the Ethereum (ETH) merge mightiness person led to a 40% driblet successful Hive Blockchain’s revenue.

Hive conscionable mislaid its ether mining currency cow.

I estimation its revenues to person fallen by 40% owed to "the merge". pic.twitter.com/1vq0U6EUze

— Jaran Mellerud (@JMellerud) December 5, 2022

Mellerud highlighted that the mining firm’s ETH concern was much profitable than its Bitcoin activities, meaning the merge lawsuit could pb to a 60% nonaccomplishment successful its operating currency flow.

Hive pivots to ETC and Bitcoin mining

The steadfast has started mining Ethereum Classic (ETC) to remedy the loss. But its main absorption is to repurpose its Ethereum mining facilities for BTC mining and summation capableness from 2.8 EH/s to 3.3 by February 2023.

With the miner present looking to spell into sustainable Bitcoin mining, Hashrate Index examined its finances to spot if it tin marque this move.

Hive finances stay strong

According to Hashrate Index, the company’s equilibrium expanse looks comparatively stable, with lone $26 cardinal successful interest-bearing debts. This means the institution does not person to walk truthful overmuch connected indebtedness servicing and tin sphere currency flows, which volition assistance its liquidity.

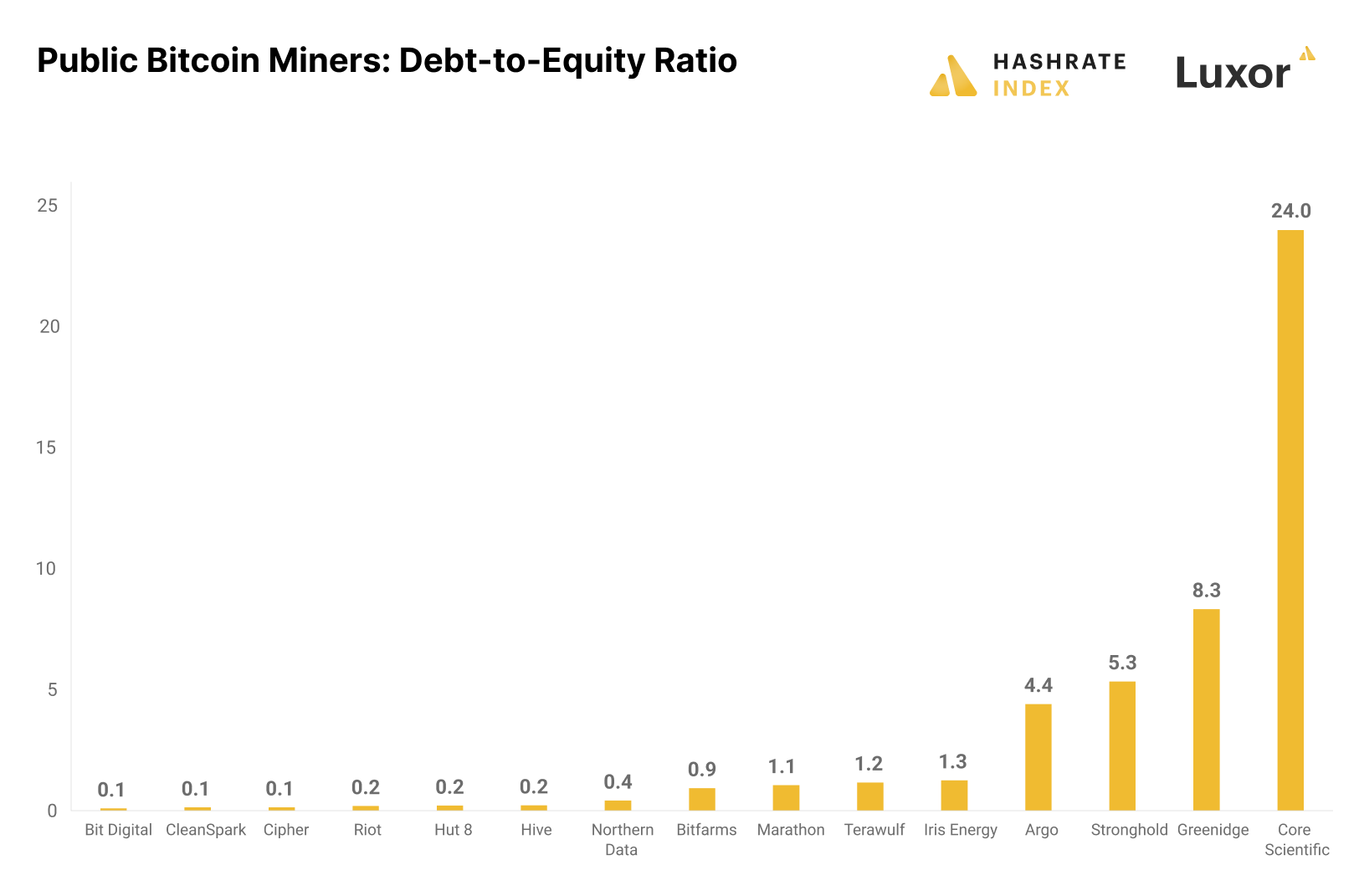

In wide liquidity, the steadfast has 1 of the lowest debt-to-equity ratios among nationalist miners and has a speedy ratio of 3 for its equilibrium expanse liquidity. Only 4 different nationalist miners successful the apical 15 by endeavor worth person a much liquid equilibrium sheet.

Source: Hashrate Index

Source: Hashrate IndexIts liquidity is mostly successful its 3,311 Bitcoin holdings, with lone $8 cardinal successful cash. At the existent value, Hive’s BTC holding is worthy $57 cardinal and represents 88% of its liquidity.

The institution besides has comparatively beardown gross margins owed to its mining operations’ reliance connected geothermal and hydro-powered grids. These grids are not exposed to rising vigor costs and person lesser downtime.

Hashrate Index wrote that the steadfast has been capable to excavation much efficiently, producing betwixt 5% and 30% much BTC than competitors, chiefly due to the fact that of its accordant hydropower supply.

Additionally, the miner has been capable to support administrative costs debased compared to competitors similar Marathon.

Meanwhile, the monolithic diminution successful the worth of Bitcoin, coupled with precocious vigor costs and accrued mining difficulty, has made BTC mining unprofitable for astir miners facing higher operating costs owed to indebtedness servicing.

The station Ethereum merge mightiness person resulted successful 40% nonaccomplishment for Hive Blockchain revenue appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)