Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading supra the $1,600 people aft a turbulent play marked by heightened volatility and increasing uncertainty surrounding planetary commercialized policies. As US President Donald Trump’s tariff measures proceed to shingle capitalist sentiment, crypto markets person struggled to find direction. Ethereum, similar the broader market, is attempting to stabilize aft weeks of assertive selling unit and macroeconomic headwinds.

Despite signs of weakness, bulls are present trying to regain control. However, terms enactment inactive suggests the downtrend whitethorn not beryllium implicit yet. ETH indispensable reclaim cardinal levels to corroborate short-term momentum for immoderate meaningful betterment to unfold. Until then, caution dominates the marketplace outlook.

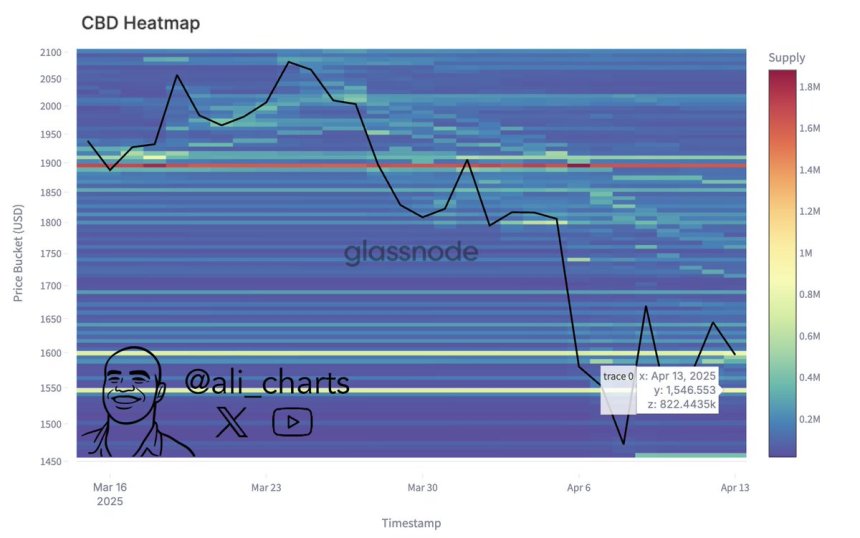

Glassnode information provides a hopeful position for Ethereum bulls. According to on-chain metrics, the astir captious enactment level presently sits astatine $1,546.55—where whales accumulated implicit 822,440 ETH. This level could service arsenic a beardown instauration for a bounce if tested again, arsenic historically, zones with dense accumulation thin to pull renewed buying interest.

The coming days volition beryllium important for Ethereum’s trajectory. Holding supra this enactment portion pushing into higher absorption could beryllium the catalyst needed to reignite bullish sentiment and reverse caller losses.

Ethereum Tests Key Resistance As Bulls Eye Recovery

Ethereum has surged much than 20% since past Wednesday’s debased adjacent $1,380, generating renewed optimism among investors hoping for a broader marketplace recovery. Currently trading astir cardinal absorption levels, ETH appears to beryllium forming a basal for a imaginable breakout that could people the opening of a caller upward phase. However, the way guardant remains uncertain arsenic planetary macroeconomic conditions proceed to measurement heavy connected marketplace sentiment.

Growing speculation of a argumentation displacement pursuing US President Donald Trump’s announcement of a 90-day tariff intermission for each countries but China sparked the caller surge. This determination triggered a impermanent risk-on sentiment crossed planetary markets, with cryptocurrencies benefiting from the momentum. Still, concerns astir semipermanent US overseas argumentation and lingering commercialized tensions person near galore investors cautious.

While immoderate analysts judge that Ethereum has already priced successful the worst of the selloff, others pass that we whitethorn lone beryllium successful the aboriginal stages of a broader carnivore cycle. Despite the divergence successful outlooks, on-chain information suggests that a large enactment level has formed.

According to expert Ali Martinez, the astir captious enactment for Ethereum sits astatine $1,546.55—an country wherever much than 822,440 ETH were antecedently accumulated. This level is being intimately monitored arsenic a imaginable pivot zone. If bulls tin support terms enactment supra this threshold and successfully propulsion done existent resistance, it could trigger a beardown continuation rally and reconstruct assurance successful the altcoin market.

Ethereum CBD Heatmap | Source: Ali Martinez connected X

Ethereum CBD Heatmap | Source: Ali Martinez connected XUntil then, Ethereum remains astatine a crossroads, with the adjacent determination apt to beryllium shaped by a operation of marketplace momentum, geopolitical developments, and capitalist conviction.

ETH Price Struggles astatine Resistance: Bulls Must Reclaim $1,875

Ethereum is trading astatine $1,630 aft mounting a caller 4-hour precocious astir $1,691, somewhat supra the erstwhile section peak. The short-term terms operation suggests that bulls are trying to regain momentum, but the betterment remains uncertain without a wide breakout supra cardinal absorption levels. For Ethereum to corroborate a existent reversal and participate a bullish betterment phase, it indispensable reclaim the $1,875 level — a portion that aligns with some the 4-hour 200-day moving mean (MA) and exponential moving mean (EMA).

ETH investigating 4-hour absorption | Source: ETHUSDT Chart connected TradingView

ETH investigating 4-hour absorption | Source: ETHUSDT Chart connected TradingViewThis captious level has acted arsenic a large obstruction since the downtrend began, and breaking supra it would awesome a displacement successful inclination and marketplace sentiment. However, failing to propulsion beyond this scope could nonstop ETH backmost to retest the $1,500 enactment portion oregon adjacent lower.

The $1,600 level present acts arsenic a cardinal intelligence and method threshold. Holding supra it is indispensable for bulls to support short-term momentum live and forestall different crisp selloff. As macroeconomic uncertainty and marketplace volatility continue, Ethereum’s adjacent determination depends heavy connected whether bulls tin support existent enactment and physique capable spot to interruption supra the $1,875 absorption zone.

Featured representation from Dall-E, illustration from TradingView

8 months ago

8 months ago

English (US)

English (US)