On blockchain networks similar Ethereum, decentralized validation underpins the full ecosystem. Yet paradoxically, the highly-technical process of constructing the blocks that store transactions whitethorn beryllium softly accruing power successful the hands of conscionable a few.

According to an analysis by Ethereum researcher Thomas Thiery, artifact gathering has evolved into a high-stakes strategical arena. Specialized builders present utilize proprietary algorithms, privileged partnerships, and micro-optimized arbitrage strategies to maximize profits and the probability of artifact rights.

By quantifying bid timing, latency optimization, bid travel sources, and transaction bundles, Thiery’s enactment exposes the competitory dynamics eroding Ethereum’s decentralized ethos.

The information proves that economical incentives thrust builders toward consolidation, cooperation, and specialization successful the relentless quest for profits.

According to Thiery, near unchecked, these trends basal to undermine Ethereum’s halfway worth proposition – a satellite machine operated by a distributed web of stakeholders, not an oligarchy of elites.

Thiery’s probe illuminates the world of artifact gathering today, mounting the signifier for informed dialog connected imaginable solutions. The coming sections distill captious insights from his investigation into an accessible synopsis for the crypto community.

The lucrative satellite of artifact creation

Creating caller blocks connected blockchain networks similar Ethereum is carried retired by builders who vie to bundle transactions into blocks and gain profits successful 2 superior ways:

Collecting Transaction Fees

The archetypal root of gross stems from packaging transactions into a artifact and collecting the associated fees. When users taxable transactions to the network, they tin optionally specify a “gas price,” which compensates the builder for executing their transaction. The full fees collected from each transactions successful a artifact correspond 1 gross watercourse for builders.

Optimizing this requires efficiently packing successful arsenic galore invaluable transactions arsenic imaginable from the nationalist mempool queue. Builders make algorithms and strategies to maximize the cumulative interest gross from each artifact they construct.

Profiting from Arbitrage Bundles

The second, much lucrative gross root involves arbitrage opportunities that exploit marketplace inefficiencies. Specialized “searchers” place arbitrages similar terms discrepancies betwixt exchanges, past bundle the transactions required to capitalize connected the opportunity.

These exclusive bundles, often involving a centralized exchange, are transmitted straight to the builder alternatively than the nationalist mempool. Builders tin cod a information of the profitable dispersed by including arbitrage bundles successful a block.

Some builders signifier exclusive partnerships with searchers to summation entree to these backstage bundles, which studies bespeak supply astir 80% of full builder revenue. The astir communal and profitable arbitrage identified involves exchanges betwixt centralized and decentralized platforms.

Strategies for Block Building Supremacy

By leveraging method expertise and strategical partnerships, blockchain builders employment analyzable strategies to optimize profits from artifact construction.

Understanding the incentives and competitory dynamics provides insights into centralization risks and informs mechanisms to amended strategy decentralization.

According to Thiery’s introspection of artifact operation dynamics, builders utilize assorted approaches to maximize their profits and probability of winning artifact rights. Thiery’s enactment elucidates builder behaviour and its implications by analyzing bid timing, ratio optimizations, bid travel sources, and profitable arbitrage strategies.

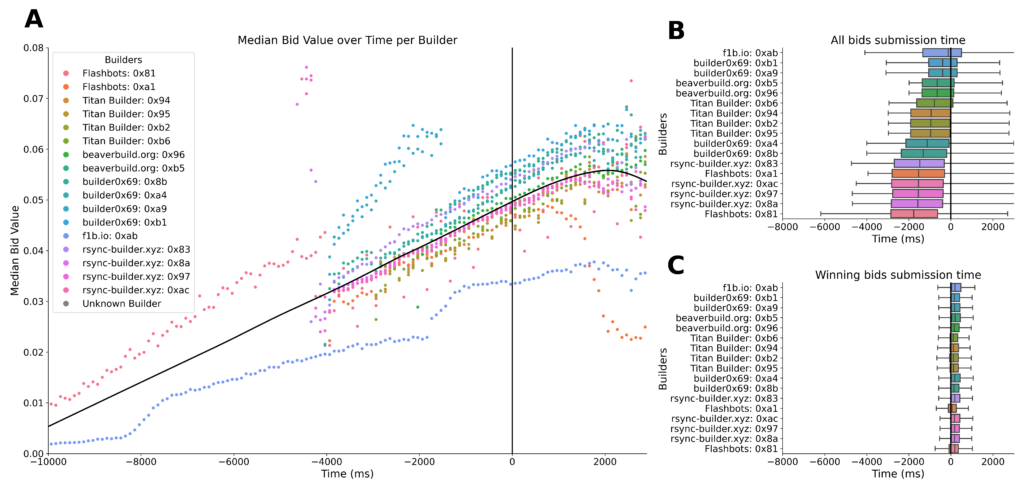

Source: Thomas Thiery

Source: Thomas ThieryBuilders summation their bids arsenic Ethereum’s 12-second slot progresses to incorporated further transactions and extractable value. However, astir winning bids hap toward the extremity of the slot, accordant with statement protocols.

Builders optimize latency and ratio otherwise – immoderate entities taxable bids often to bushed competitors, portion others absorption connected seamless artifact assembly. Occasional bid cancellations besides look to service arsenic a maneuver for concealing oregon adjusting value.

Quantifying Centralization Risk

Exclusive transaction bundles from searcher partners relationship for astir 80% of builder revenue, outweighing nationalist mempool transactions. Specifically, Thiery wrote,

“Exclusive transactions correspond 30% of the transaction count, but relationship for 80% of the total value paid to builders. This supports the proposal that the bulk of invaluable transactions generating MEV are packaged into bundles and transferred exclusively from searchers to builders.”

This highlights the value of strategical partnerships and vertical integration successful attaining proprietary bid flow.

Arbitrages betwixt centralized and decentralized exchanges proved the astir profitable among the transaction types analyzed. One specialized builder won implicit 60% of these transactions, exemplifying the maximization and centralization risks of over-optimization.

Thiery concludes that quantifying the strategies and behaviors of builders tin pass the operation of profiles that measure and code centralization tendencies.

The information proves that incentives pb builders toward consolidation, cooperation, and specialization – limiting decentralization. Mechanisms that promote diverseness of techniques and providers whitethorn counteract these forces.

Overall, the trends identified by Thiery item that prospering successful this high-stakes situation necessitates exploiting latency, partnerships, exclusivity, and absorption – with implications for planetary web structure. Understanding these issues tin enlighten solutions.

Builders’ Behavioral Profiles (BBPs)

By peering down the curtain of Ethereum’s block-building ecosystem, Thiery’s enactment sounds an alarm for the community.

Economic forces and incentives usher this domain toward greater centralization, cooperation, and consolidation amongst profitable entities. Left unaddressed, the drift contradicts the guiding imaginativeness of a decentralized satellite computer.

Yet anticipation remains – equipped with data-driven insights into builder behavior, Ethereum developers and researchers tin illuminate the mode forward. Thiery posits a Builders’ Behavioral Profiles (BBPs) exemplary with galore metrics. These encapsulate bid timing, advancements successful latency, bid withdrawal, entree to bid flow, and MEV strategies and widen to aspects similar on-chain and CEX-DEX arbitrages, sandwiches, and liquidation.

Thiery besides expressed his anticipation that the assemblage volition amplify the inferior of BBPs by integrating caller metrics and characteristics to shed airy connected the relation of builders successful their interactions with searchers, relays, and validators. According to him, this is simply a important determination towards processing sturdy mechanisms that curb tendencies towards centralization and foster an equitable and proficient proviso network.

The Ethereum assemblage is yet to respond to the research.

The station Ethereum MEV incentives bounds decentralization caller study shows appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)