Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is erstwhile again nether dense selling unit aft losing the captious $2,000 level — a intelligence and method portion that bulls person struggled to support successful caller weeks. With terms enactment turning progressively bearish, capitalist sentiment is weakening, and analysts are informing that a deeper correction whitethorn beryllium connected the horizon. As Ethereum slides lower, concerns are increasing crossed the broader crypto market, which often relies connected ETH’s spot to pb betterment phases.

The existent concern is some tense and delicate. Ethereum’s inability to clasp cardinal enactment levels has rattled short-term holders and is present investigating the resoluteness of semipermanent investors. Many are present intimately watching for immoderate signs of stabilization oregon caller accumulation.

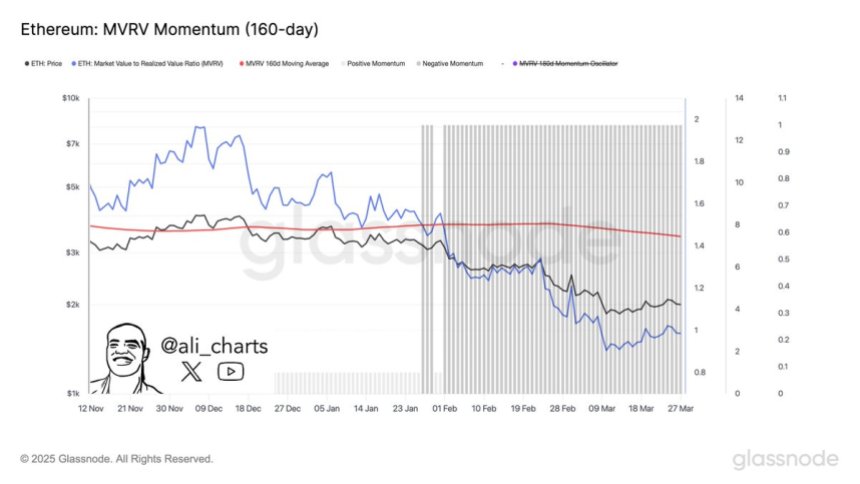

One promising on-chain awesome comes from Glassnode’s MVRV (Market Value to Realized Value) metric. Historically, a crossover of the MVRV ratio supra its 160-day moving mean has marked the opening of beardown Ethereum accumulation zones — often preceding important terms rebounds. That awesome is present approaching erstwhile again, and if confirmed, it could connection a glimmer of anticipation to bulls waiting for a shift successful momentum. Until then, Ethereum remains successful a fragile state.

Ethereum Faces Critical Breakdown As Accumulation Signal Nears

Ethereum is present successful a captious position, with bulls continuing to suffer power arsenic cardinal enactment levels interruption 1 by one. Selling unit has intensified implicit the past fewer weeks, dragging ETH further into a prolonged downtrend that began successful precocious December. Macroeconomic uncertainty, rising involvement rates, and heightened planetary tensions proceed to make a hostile situation for hazard assets — and the crypto marketplace has felt the interaction astir severely.

Currently, Ethereum is trading 55% beneath its section precocious of $4,100, reached earlier this cycle. The crisp diminution has shaken capitalist confidence, and the continued breakdown successful terms operation leaves small country for error. Without a swift betterment and beardown defence of enactment zones, Ethereum risks further downside, with analysts informing of continued weakness if sentiment doesn’t displacement soon.

Amid the decline, immoderate analysts are watching intimately for signs of a imaginable bottom. Top expert Ali Martinez shared a key penetration connected X, pointing to the MVRV (Market Value to Realized Value) ratio arsenic a reliable indicator of accumulation zones. According to Martinez, erstwhile the MVRV ratio crosses supra its 160-day moving average, it has historically marked beardown accumulation phases — moments erstwhile semipermanent investors statesman softly positioning for the adjacent limb higher.

Ethereum MVRV Momentum | Source: Ali Martinez connected X

Ethereum MVRV Momentum | Source: Ali Martinez connected XThis crossover has not yet occurred, but it is approaching. If confirmed, it could awesome that Ethereum is entering a high-value portion contempt the existent bearish conditions. While the marketplace remains fragile, specified on-chain metrics connection a glimmer of anticipation that accumulation is softly underway — adjacent arsenic terms enactment continues to look anemic connected the surface. Bulls volition request to enactment rapidly to reverse the trend, but for now, Ethereum’s outlook remains connected edge.

Bulls Defend Crucial $1,800 Support

Ethereum is trading astatine $1,830 aft suffering a crisp 14% driblet since past Monday, reflecting renewed selling unit crossed the crypto market. The steep diminution has pushed ETH toward a captious enactment level astatine $1,800 — a portion that present stands arsenic a must-hold for bulls. This level has historically acted arsenic a beardown pivot point, and losing it could trigger a deeper correction.

ETH investigating captious request levels | Source: ETHUSDT illustration connected TradingView

ETH investigating captious request levels | Source: ETHUSDT illustration connected TradingViewIf ETH fails to clasp supra $1,800, the adjacent important enactment lies adjacent the $1,500 zone, which would people a melodramatic displacement successful marketplace operation and apt accelerate bearish sentiment. A breakdown to this level would erase overmuch of the year’s gains and woody a superior stroke to capitalist confidence.

However, if bulls negociate to support $1,800 successfully, a rebound could follow, perchance pushing ETH backmost supra the $2,000 mark. Reclaiming this intelligence level would assistance reconstruct momentum and unfastened the doorway for a broader recovery.

The adjacent fewer days volition beryllium important for Ethereum’s short-term outlook. With macroeconomic uncertainty inactive looming, bulls indispensable measurement successful with condemnation — due to the fact that if $1,800 breaks, the autumn could beryllium accelerated and steep.

Featured representation from Dall-E, illustration from TradingView

10 months ago

10 months ago

English (US)

English (US)