Ethereum is showing aboriginal signs of betterment aft a melodramatic sell-off connected Friday that sent prices plunging to $3,450. The driblet came amid what analysts picture arsenic the largest liquidation lawsuit successful crypto marketplace history, wiping retired billions successful leveraged positions crossed large exchanges. While bulls concisely mislaid power during the panic, ETH has since begun to stabilize, with renewed buying involvement emerging adjacent cardinal request zones.

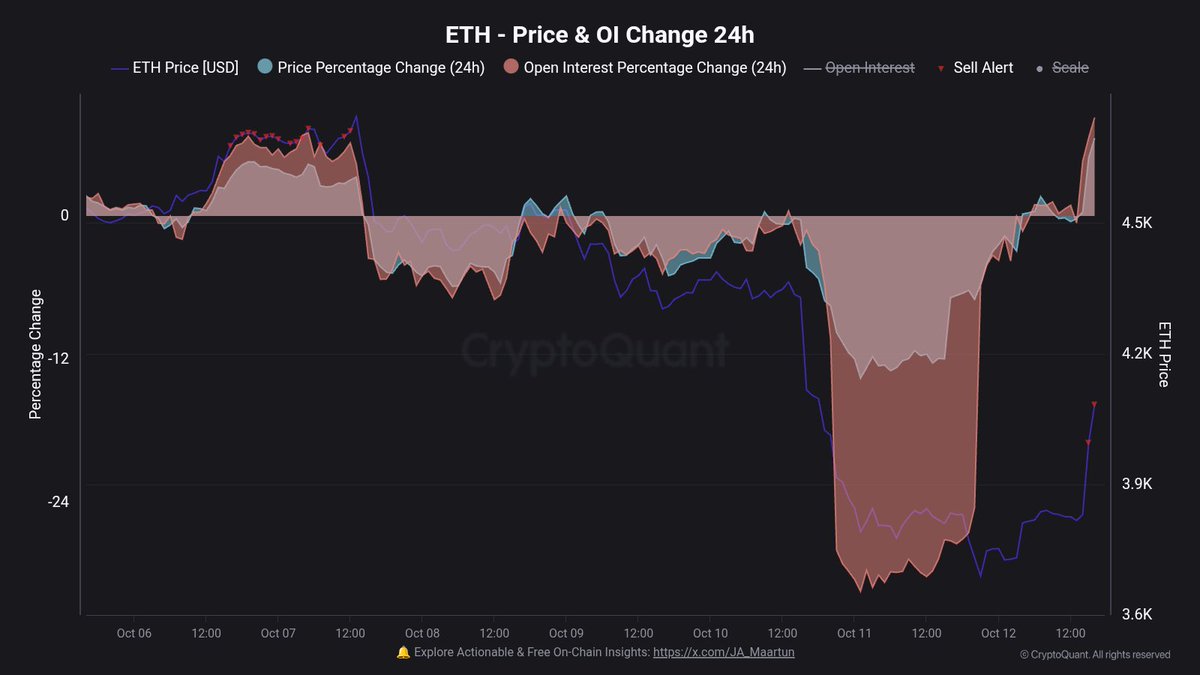

Onchain expert Maartunn highlighted that leverage is erstwhile again gathering up connected Ethereum, signaling that traders are returning to the marketplace pursuing the reset. According to his data, unfastened involvement connected ETH surged importantly implicit the past 24 hours — a motion that speculative enactment is resuming arsenic volatility cools. This renewed leverage could acceptable the signifier for different decisive move, either fueling a short-term alleviation rally oregon inviting further liquidations if momentum fades.

The coming days volition beryllium important for Ethereum, arsenic bulls effort to reclaim the $4,000 level to corroborate a sustainable recovery. Market sentiment remains cautious but optimistic, with onchain data showing ample holders and institutions continuing to accumulate ETH contempt caller turbulence — a imaginable awesome of semipermanent assurance successful the asset’s resilience.

Leverage Returns to Ethereum: A Risky Revival In Market Activity

According to Maartunn, Ethereum’s Open Interest has surged by +8.2% wrong the past 24 hours — a wide motion that leverage is flowing backmost into the market. This accelerated emergence comes conscionable days aft the largest liquidation lawsuit successful crypto history, wherever overleveraged traders were wiped retired during the abrupt crash. Now, it seems galore are trying to “trade their wealth back,” reigniting short-term volatility and speculation crossed exchanges.

ETH Price and OI alteration | Source: Maartunn

ETH Price and OI alteration | Source: MaartunnMaartunn notes that portion these alleged “revenge pumps” often make beardown intraday rallies, they seldom prolong semipermanent momentum. Historically, astir 75% of akin leverage-driven recoveries thin to revert, starring to renewed pullbacks erstwhile liquidity and backing rates normalize. Only astir 25% negociate to widen into lasting uptrends, typically erstwhile supported by caller spot buying oregon renewed organization inflows.

This information underscores the precarious equilibrium Ethereum presently faces. The leap successful Open Interest signals revived marketplace participation, but besides introduces the hazard of different question of forced liquidations if traders overextend their positions. For now, ETH’s short-term betterment remains mostly fueled by derivatives enactment alternatively than spot demand.

The adjacent fewer days volition beryllium pivotal successful determining Ethereum’s direction. If terms holds supra the $4,000 portion with sustained volume, it could corroborate that bulls are regaining control. However, a abrupt driblet successful Open Interest oregon crisp backing spikes could awesome that the rally is overextended — mounting the signifier for different correction.

Ethereum Rebounds, But Resistance Looms Ahead

Ethereum is showing a coagulated betterment aft past week’s melodramatic sell-off that drove prices down to the $3,450 level. The regular illustration shows that ETH rapidly rebounded from the 200-day moving mean (red line), confirming it arsenic a large country of demand. Price is present consolidating adjacent $4,150, attempting to physique momentum aft a beardown bullish candle connected precocious measurement — a imaginable motion that buyers are regaining control.

ETH reclaims cardinal levels | Source: ETHUSDT illustration connected TradingView

ETH reclaims cardinal levels | Source: ETHUSDT illustration connected TradingViewHowever, ETH faces contiguous absorption adjacent the $4,250–$4,300 zone, which coincides with the 50-day moving mean (blue line). This country antecedently acted arsenic beardown support, and reclaiming it would beryllium indispensable for confirming a displacement backmost into bullish structure. The 100-day moving mean (green line) is present flattening, reflecting the market’s cautious sentiment pursuing the monolithic liquidation event.

If bulls negociate to prolong terms enactment supra $4,000, the adjacent targets prevarication adjacent $4,500 and yet $4,750. Conversely, nonaccomplishment to clasp the 200-day MA could unfastened the doorway to a deeper retest of $3,600 oregon lower. For now, Ethereum’s betterment remains technically constructive, but it indispensable flooded these absorption levels to corroborate that the caller rebound is much than conscionable a short-term absorption to oversold conditions.

Featured representation from ChatGPT, illustration from TradingView.com

3 months ago

3 months ago

English (US)

English (US)