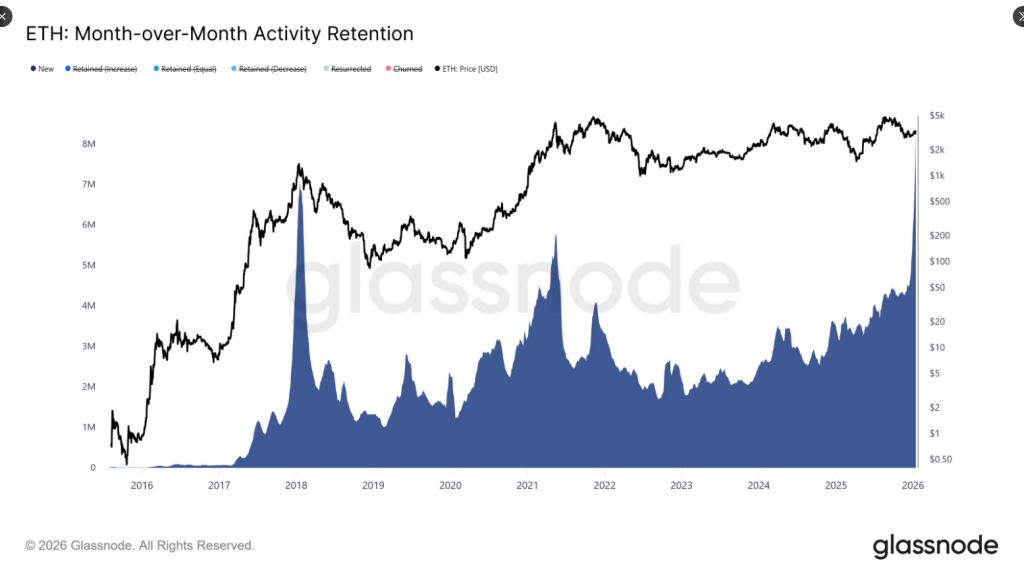

Ethereum’s on-chain enactment has jumped sharply, driven by a question of first-time users and heavier transaction travel crossed the network. According to Glassnode, caller enactment retention astir doubled this period — rising from astir 4 cardinal to astir 8 cardinal addresses — a determination that points to a caller cohort of wallets interacting with Ethereum alternatively than conscionable repetition users.

Surge In New Users

Daily transactions deed a grounds precocious of 2.8 cardinal connected Thursday, a fig that is up 125% from the aforesaid play past year. Based connected reports from Etherscan, progressive addresses person much than doubled year-over-year, moving from astir 410,000 accounts to implicit 1 cardinal arsenic of Jan. 15. Those numbers suggest real, broad-based engagement is increasing, not simply short-lived spikes.

Ethereum’s Month-over-Month Activity Retention shows a crisp spike successful the “New” cohort, indicating a surge successful first-time interacting addresses implicit the past 30 days.

This reflects a notable influx of caller wallets engaging with the Ethereum network, alternatively than enactment being… pic.twitter.com/h8Zw7hXOSX

— glassnode (@glassnode) January 15, 2026

Transaction Boom And L2 Effects

Observers nexus the transaction growth successful portion to rising stablecoin enactment and little fees. Reports person disclosed that galore transfers are migrating execution to Layer 2 networks portion colony stays connected Ethereum’s main chain, which keeps finality unafraid and helps propulsion down state costs. Staking has besides climbed, reaching astir 36 cardinal ETH, adding different furniture to the network’s tightening proviso dynamics.

At the aforesaid time, marketplace behaviour remains careful. Strength successful US equities has helped stabilize crypto prices, yet wealth flowing into Ethereum looks selective alternatively than broad.

It seems that positioning is alternatively conservative; traders similar waiting for much close signals regarding ETH prices alternatively of attempting to foretell a breakout. In turn, ETH is consolidating astir a correction, but determination is not capable momentum-driven buying.

Analyst Views & Price Movement

There were besides those who cited optimism based connected improvements to on-chain fundamentals. For instance, LVRG Research reported that the expanding fig of transactions and staking activities encouraged a affirmative network.

Some traders reason the compression successful terms enactment could precede a breakout. Ether traded adjacent a two-month precocious of $3,400 connected Wednesday and was astir $3,300 successful aboriginal trading connected Friday, reflecting the tug of warfare betwixt renewed request and persistent caution.

Despite the stronger metrics, method hurdles remain. Reports and caller investigation suggest the marketplace is successful a repair phase, not a confirmed uptrend.

Overhead proviso inactive constrains sustained advances, and galore marketplace participants privation to spot ETH reclaim cardinal semipermanent absorption levels, specified arsenic the 200-day EMA, earlier committing large-scale capital.

That explains wherefore short-term traders run wrong a defined scope portion longer-term players clasp back.

What This Means For Traders And Investors

Network wellness has improved materially — much users, much transactions, and higher staking — but terms enactment has not yet matched those gains.

Based connected the information presented, cautious optimism is reasonable. Traders whitethorn find accidental to commercialized the range, portion investors looking for condemnation should hold for cleaner method confirmation earlier assuming a sustained rally.

Featured representation from Blockzeit/EthBurn, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)