Spot Ethereum ETFs recorded a robust trading debut successful the US connected July 24 aft months of speculation and regulatory uncertainty.

The ETFs recorded an awesome measurement of $1.11 billion connected the archetypal trading day, led by BlackRock’s $266.5 cardinal inflows. Within the archetypal 90 minutes of trading, ETH ETFs recorded $361 successful trading volume, reflecting beardown involvement and assurance successful Ethereum.

While the first-day trading measurement for Ethereum ETFs inactive represents astir a 4th of the measurement Bitcoin ETFs saw upon launch, it’s inactive a large improvement for ETH. Aside from a little spike successful spot price, the surge successful involvement for ETFs has besides affected the derivatives market.

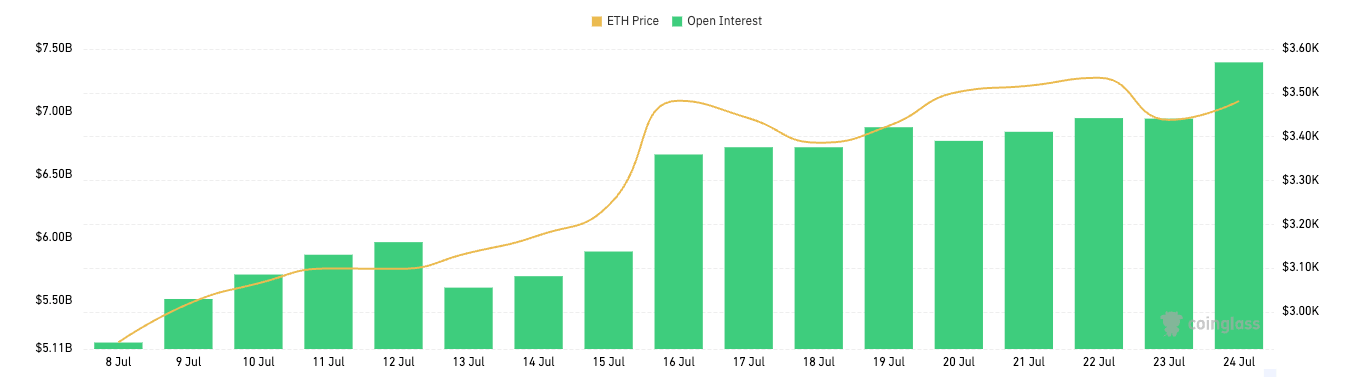

Ethereum derivatives saw a volatile June but had a comparatively calm July. Over the past week, the full derivatives marketplace saw gradual but noticeable maturation that seems to person sped up aft the ETFs launched. Data from CoinGlass showed a dependable ascent successful options unfastened interest, peculiarly connected July 24, erstwhile it reached $7.39 billion.

Chart showing unfastened involvement for Ethereum options from July 8 to July 24, 2024 (Source: CoinGlass)

Chart showing unfastened involvement for Ethereum options from July 8 to July 24, 2024 (Source: CoinGlass)Ethereum futures followed a akin trend, albeit the larger size of the marketplace meant that the $460 cardinal summation successful unfastened involvement didn’t amusement up arsenic specified a important uptick.

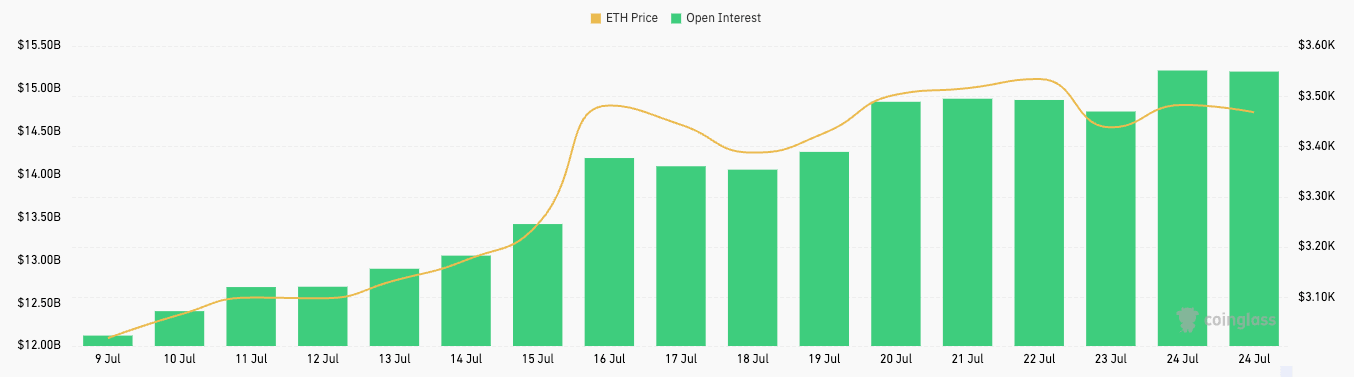

Chart showing unfastened involvement for Ethereum futures from July 8 to July 24, 2024 (Source: CoinGlass)

Chart showing unfastened involvement for Ethereum futures from July 8 to July 24, 2024 (Source: CoinGlass)A emergence successful unfastened involvement is important arsenic it often brings astir accrued liquidity and trading volume, providing Ethereum with a much robust marketplace structure. As the trading enactment astir ETH ETFs heats up successful the coming weeks, we tin expect the derivatives marketplace to proceed its upward trajectory.

The increasing organization involvement successful ETH ETFs could precise good construe into derivatives. Institutional and blase investors could statesman employing ground commercialized strategies, starring to an summation successful derivatives OI and volume.

Basis trading is simply a blase strategy that involves taking vantage of the terms quality betwixt the spot and futures market. It has go a important portion of the Bitcoin market, particularly aft the motorboat of Bitcoin ETFs. Previous CryptoSlate analysis recovered that the Bitcoin ground commercialized has importantly influenced the market, starring to level terms enactment that defies the inflows and measurement seen successful spot ETFs. With the instauration of Ethereum ETFs, a akin happening could besides hap successful the ETH market.

While this trading strategy suppresses immoderate important terms action, it could bode good for Ethereum by expanding OI, creating a much liquid and progressive derivatives market. Such a marketplace enhances terms find and hazard absorption capabilities.

However, if a ground commercialized involving Ethereum ETFs and derivatives gains a batch of traction, it could negatively impact the market. The astir important hazard for Ethereum comes from the imaginable for marketplace manipulation, wherever ample organization players could exploit discrepancies to manipulate prices.

Furthermore, if the ground commercialized becomes excessively crowded, it could trim the strategy’s profitability, starring to abrupt exits and perchance triggering crisp corrections. Given the size of Ethereum’s DeFi market, this could beryllium particularly unsafe for the coin.

The station Ethereum unfastened involvement grows arsenic marketplace hype grows astir spot ETFs appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)