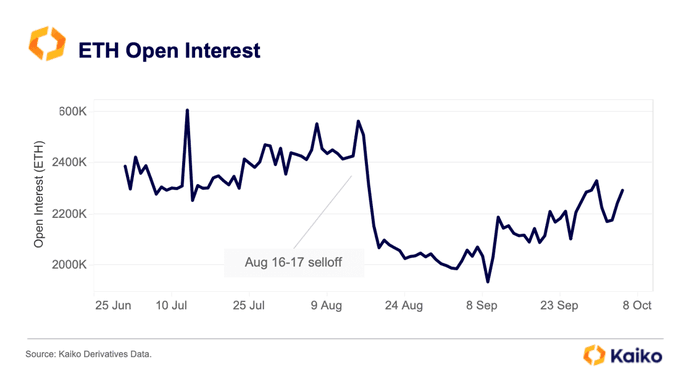

Ethereum prices mightiness beryllium stagnant astatine spot rates, weaving astir the $1,540 and $1,560 zone, looking astatine method charts. However, amid this play of consolidation and holders worrying astir Ethereum’s prospects, Kaiko notes that the coin’s unfastened involvement has been gradually rising since September 2023.

Ethereum Open Interest Rising: What Does It Mean?

As of October 10, Kaiko observes that determination are much than 2.2 cardinal contracts, and the fig has been rising steadily implicit the past fewer trading weeks. With expanding unfastened interest, it tin hint that bulls are successful the equation, which whitethorn enactment prices present that prices are nether immense pressure.

In crypto trading, unfastened involvement is the full fig of outstanding derivative contracts of a fixed coin. Meanwhile, derivatives are contracts that deduce worth from the underlying asset, successful this case, Ethereum. Herein, the full unfastened involvement information is accrued from ETH options, futures, and perpetual futures from platforms wherever traders tin usage leverage.

There tin beryllium antithetic interpretations of unfastened involvement depending connected the marketplace state. Since unfastened involvement includes agelong and abbreviated positions astatine immoderate time, gauging the directions of however marketplace participants are posting trades tin beryllium challenging.

Even so, rising unfastened involvement indicates that much traders are opening positions, which tin beryllium seen arsenic bullish, particularly if prices are expanding. Conversely, falling unfastened involvement suggests that traders are exiting, which means waning momentum and bearish sentiment.

ETH Consolidates Even After Ethereum Futures ETF Approval

Based connected this, Ethereum remains successful a captious presumption and support. Notably, the coin is moving sideways with debased trading volumes.

From the regular chart, ETH is astir the $1,500 and $1,550 superior support. Though buyers look to beryllium successful control, since prices are boxed wrong the June to July 2023 commercialized range, immoderate interruption beneath the enactment portion whitethorn trigger much losses.

The wide optimism explaining rising unfastened involvement could beryllium owed to the caller support of Ethereum Futures exchange-traded funds (ETFs). The United States Securities and Exchange Commission (SEC) approved aggregate Ethereum Futures ETFs for the archetypal time.

This determination saw Ethereum prices borderline higher successful aboriginal October. Though prices person since contracted, organization investors tin present find vulnerability successful Ethereum via structured and regulated products approved by the stringent regulator.

It is unclear whether the rising ETH unfastened involvement signals spot and if the coin volition retrieve going forward. From the regular chart, ETH has beardown liquidation astatine astir the $1,750 level and remains consolidated.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)