The Ethereum terms has followed Bitcoin’s pb and has seen a 10.3% terms summation implicit the past 7 days. News of BlackRock’s Bitcoin spot ETF filing with the US Securities and Exchange Commission took the full marketplace by astonishment and besides breathed caller beingness into altcoins. For 1 trader connected the decentralized perpetual speech GMX, however, the quality is not truly bully news, but alternatively a nightmare.

Ethereum Short Seller Getting Rekt?

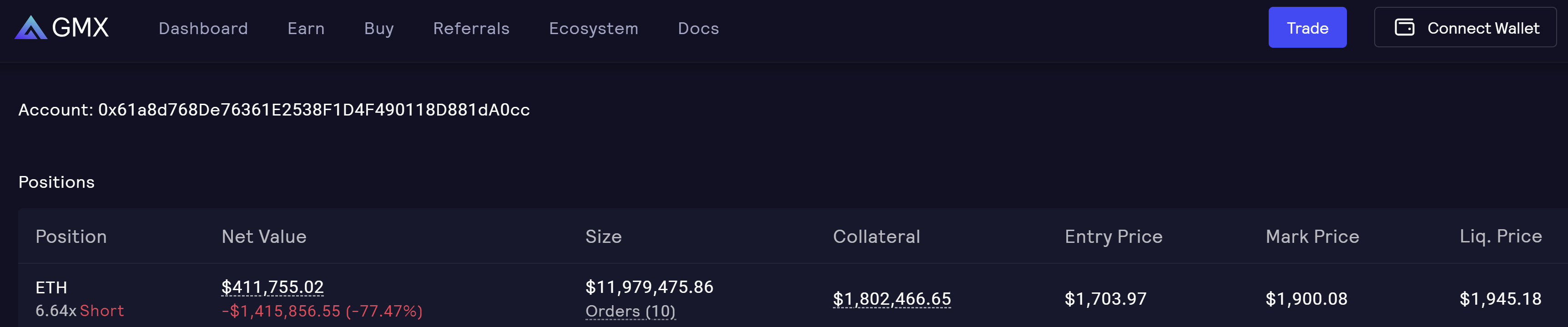

The largest abbreviated seller connected GMX is utilizing 6.64x leverage to abbreviated Ether (ETH) astatine an introduction terms of $1,703.97. A full of $1.8 cardinal of collateral is astatine involvement for the anonymous trader. At property time, the presumption was down 77.4% for a full of -$1.416 million.

GMX ETH abbreviated seller | Source: GMX

GMX ETH abbreviated seller | Source: GMXAs it stands, the trader’s abbreviated presumption of astir $12 cardinal successful ETH volition beryllium liquidated erstwhile the Ethereum terms reaches $1,945.18. According to a report from Chinese writer Colin Wu, it could beryllium the proprietor of rebelvarma.lens.

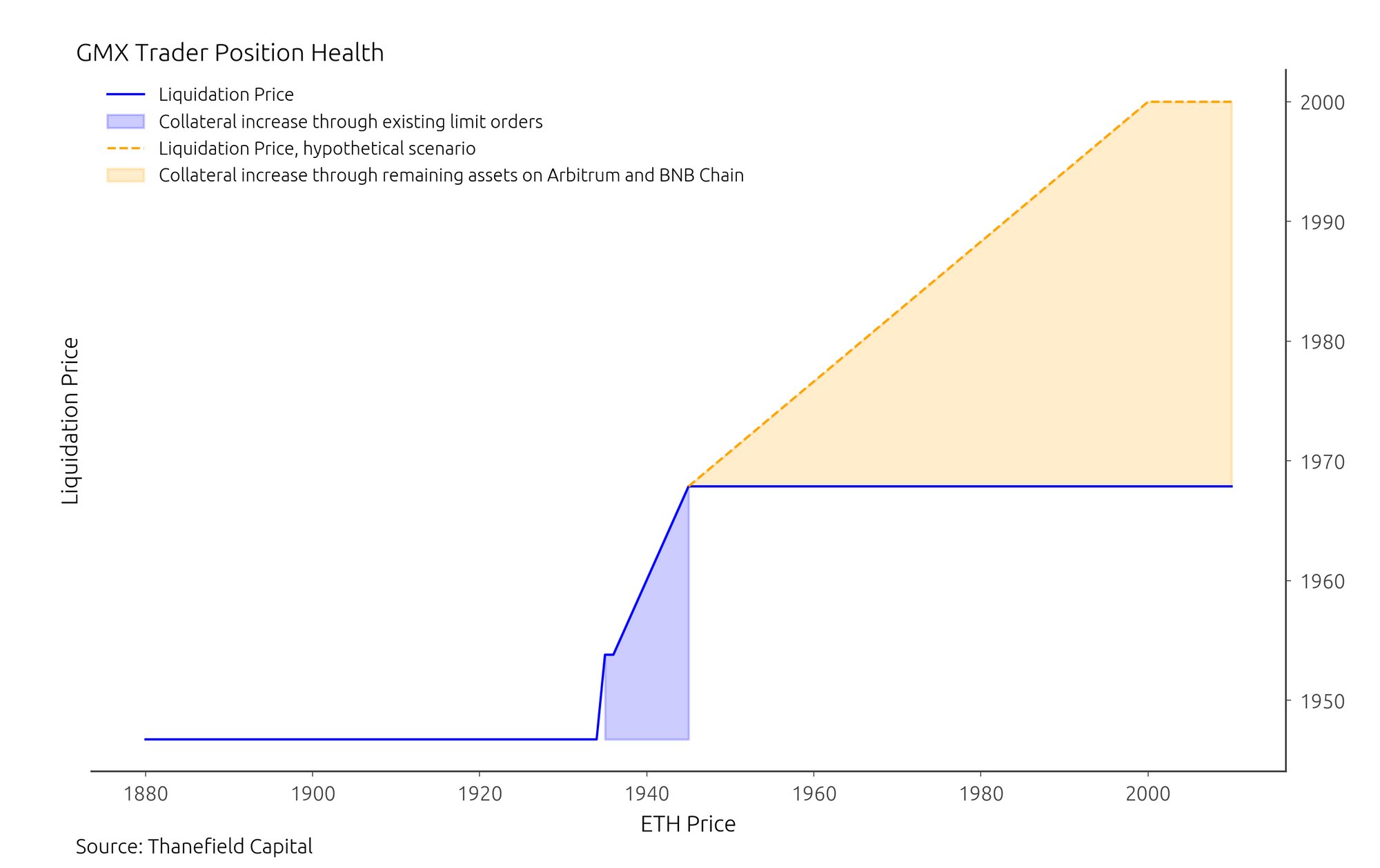

As fashionable expert An Ape’s Prologue speculates, the ETH abbreviated seller could adjacent treble down connected his bet. As the expert writes, the statement assumes that the abbreviated presumption volition beryllium liquidated erstwhile ETH reaches $1945. However, determination are bounds orders that could adhd a full of $149,000 to the trader’s collateral wrong the $1935 and $1945 terms range. If triggered, this could summation the liquidation terms to astir $1967.

The analyst’s illustration beneath shows however his liquidation terms changes with ETH terms swings. Until Ethereum reaches $1935, the liquidation terms remains astatine $1945, but bounds orders are triggered erstwhile ETH enters the $1935 and $1945 range, expanding the liquidation terms to $1967.

Liquidation terms of Ethereum abbreviated seller connected GMX | Source: Twitter @apes_prologue

Liquidation terms of Ethereum abbreviated seller connected GMX | Source: Twitter @apes_prologueIn addition, the expert notes that the code holds astir $224,000 worthy of different assets dispersed crossed Arbitrum and the Binance Smart Chain: $90,000 successful USDT, $51,000 successful USDC, $64,000 successful WBTC and $21,500 successful AAVE.

“With a past of mitigating liquidation hazard by bridging tokens from different chains to Arbitrum for collateral, we’ll astir apt spot a akin strategy if ETH prices increase. The $224k successful disposable assets could beryllium utilized to apical up collateral successful this scenario,” the expert notes.

If the ETH abbreviated seller uses up each of its assets and puts them up arsenic collateral, the maximum liquidation terms could emergence to astir $2,000, representing a further 6.5% terms summation from the existent price. Hence, Twitter idiosyncratic @apes_prologue concludes:

While his presumption appears risky, the information of liquidation is not arsenic imminent arsenic popularly believed, arsenic helium has mechanisms astatine his disposal to support his position. Additionally, it is besides imaginable helium could person hedged his presumption successful different markets that we are unaware of.

ETH On The Verge Of Breaking Above $2,000?

Rumors are circulating successful the crypto assemblage that the liquidation of the GMX short-seller could trigger a breakout of ETH supra $2,000. The 1-hour illustration of Ether shows that the terms is presently stuck successful the terms scope betwixt $1,964 and $1,930 for the moment. A breakout to the upside oregon downside could beryllium decisive for the adjacent move.

ETH terms trading range, 1-hour illustration | Source: ETHUSD connected TradingView.com

ETH terms trading range, 1-hour illustration | Source: ETHUSD connected TradingView.comA look astatine the 1-day illustration reveals that a breakout supra $1,930 does not needfully mean a follow-through to supra $2,000. The 78.6% Fibonacci retracement level is astatine $1,975, wherever large absorption is expected. Ethereum bulls tin lone people the psychologically important $2,000 level if they interruption retired supra this terms level.

Featured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)