Celsius Network, the bankrupt cryptocurrency lending company, is gearing up to unstake astir $465 cardinal worthy of Ethereum (ETH) arsenic portion of its efforts to compensate creditors. This improvement follows the company’s bankruptcy filing successful July 2022, leaving creditors successful a prolonged 18-month hold for fiscal recompense.

Celsius’s determination to unstake a important magnitude of ETH is seen arsenic a indispensable measurement to guarantee liquidity for creditor compensation. The company’s authoritative announcement, made via X (formerly Twitter), highlights the strategical quality of this move:

“In mentation of immoderate plus distributions, Celsius has started the process of recalling and rebalancing assets to guarantee ample liquidity. Celsius volition unstake existing ETH holdings, which person provided invaluable staking rewards income to the estate, to offset definite costs incurred passim the restructuring process. The important unstaking enactment successful the adjacent fewer days volition unlock ETH to guarantee timely distributions to creditors,” the announcement reads.

Celsius Responsible For Over 86% Of ETH In Exit Queue?

Blockchain analytics steadfast Nansen states that Celsius possesses astir 1 3rd of the full Ether successful the unstaking exit queue, totaling astir 206,300 ETH. This fig translates to a marketplace worth of astir $465 million. To date, Celsius has already withdrawn implicit 40,249 ETH.

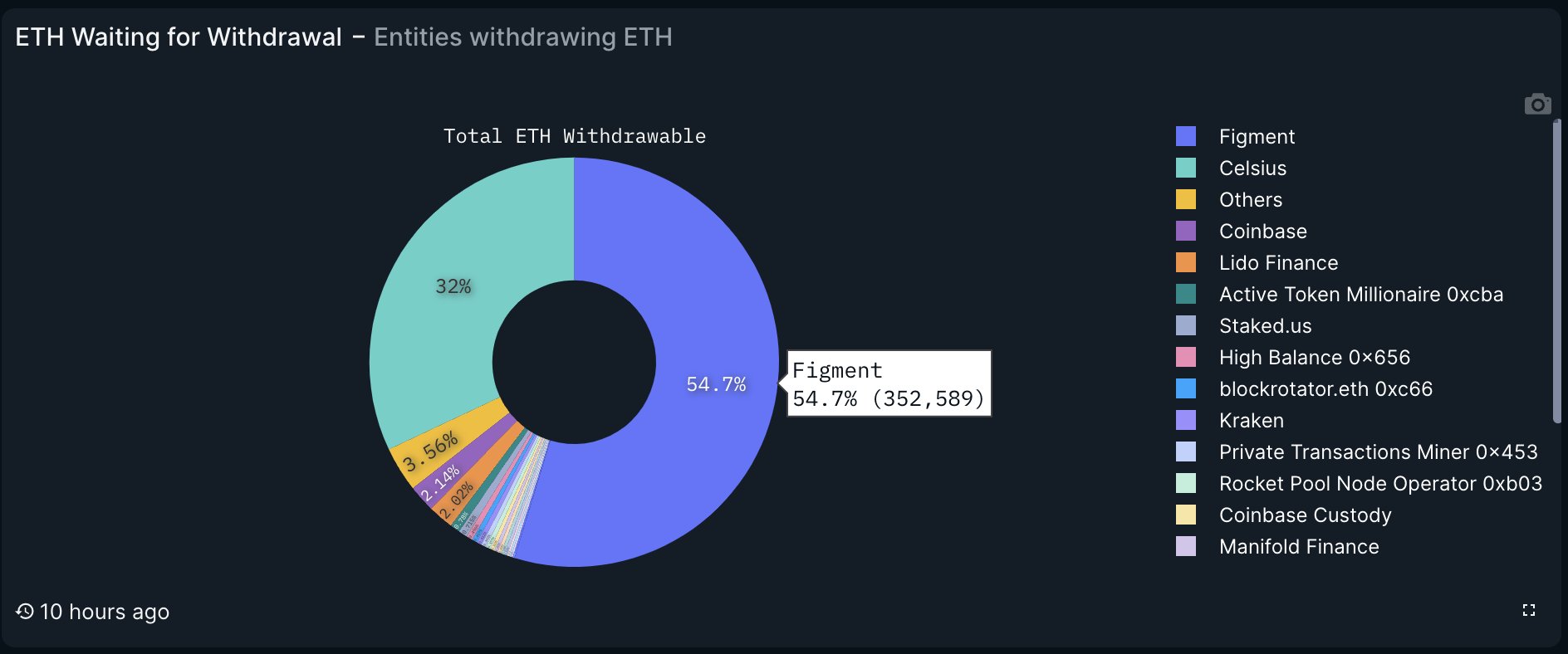

Tom Wan, an on-chain information expert astatine 21.co (parent institution of 21Shares), elaborated connected the situation, “Over 540k staked ETH (16,670 Validators) are presently withdrawing from the Ethereum Beacon chain. To afloat exit and retreat now, it volition necessitate 14.5 days.” The researcher added that 352,000 ETH (54.7%) waiting to beryllium withdrawn belongs to Figment and 206,000 ETH (32%) belongs to Celsius.

ETH waiting for withdrawal | Source: X @tomwanhh

ETH waiting for withdrawal | Source: X @tomwanhh“It is besides apt that the withdrawal by Figment belongs to Celsius. Earlier successful June, erstwhile Celsius redeemed 428.000 stETH from Lido, they person re-staked 197.000 ETH via Figment,” helium added. Therefore, Celsius mightiness beryllium liable for unstaking 86.7% of each ETH successful the queue.

Ethereum Price Crash Looming?

While immoderate investors explicit interest that the merchandise of specified a ample measurement of tokens from staking could adversely interaction Ethereum’s price, others support a much composed outlook, believing that the marketplace is robust capable to sorb this further volume.

Even successful the improbable lawsuit that each ETH from the queue is sold, liquidity appears to beryllium beardown capable to sorb specified a process, which would beryllium gradual alternatively than sudden. According to Coinmarketcap, the existent ETH trading measurement stands astir $11.35 billion, suggesting that the marketplace could withstand the imaginable merchantability of Celsius’ full ETH holdings without immoderate large ETH terms crash. Fear-mongering is truthful superfluous.

After receiving support for its colony plan, Celsius has allowed eligible users to retreat 72.5% of their cryptocurrency holdings, with this enactment disposable until February 28. A tribunal papers filed successful the erstwhile September revealed that astir 58,300 users person a full of $210 cardinal successful assets, which the tribunal has classified arsenic “custody assets.”

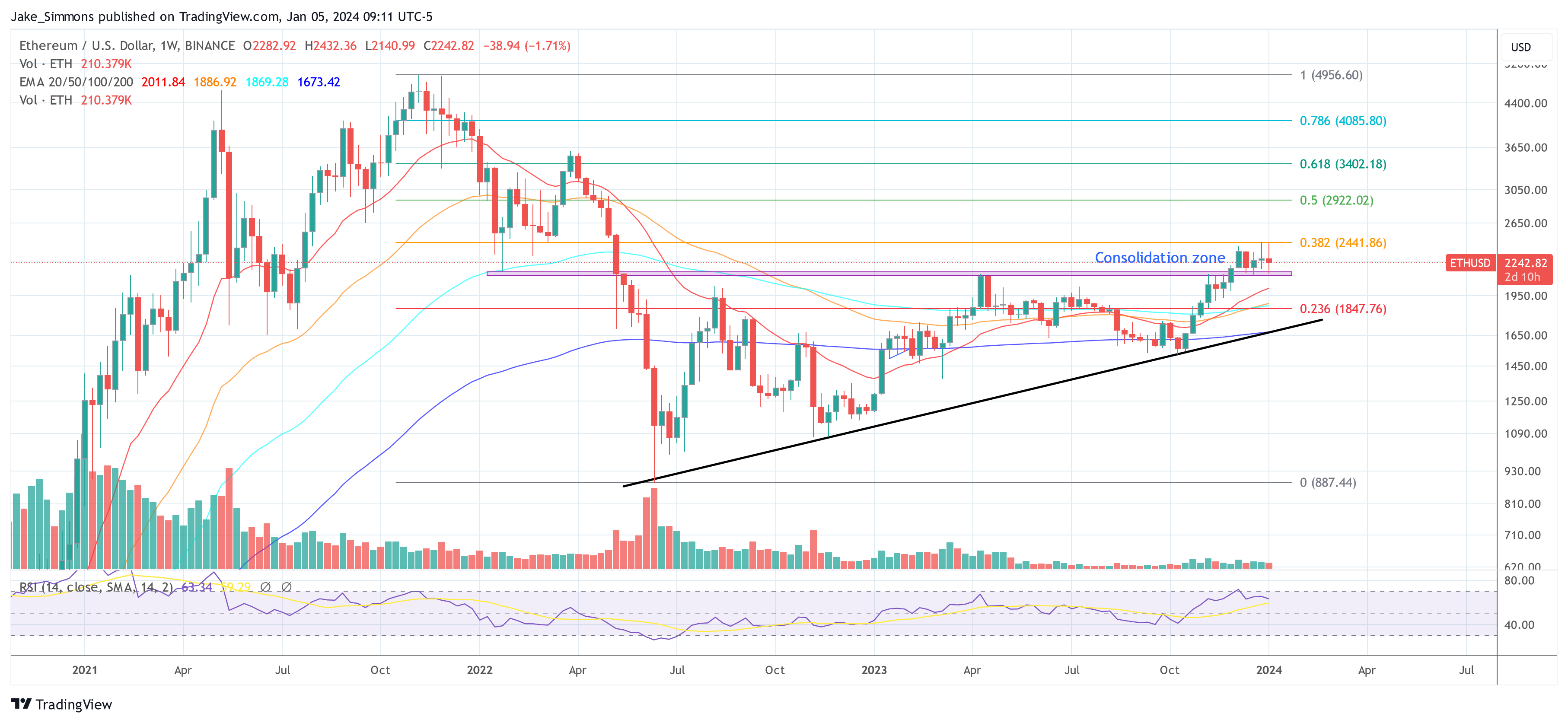

At property time, ETH traded astatine $2,250. The 1-week illustration for ETH/USD indicates that, implicit the past 5 weeks, the terms of Ethereum has formed a consolidation range. The illustration defines this portion with a little bound astatine $2,125, indicated by the reddish area, and an precocious bound astatine the 0.382 Fibonacci retracement level, located astatine $2,441.

ETH terms establishes consolidation zone, 1-day illustration | Source: ETHUSD connected TradingView.com

ETH terms establishes consolidation zone, 1-day illustration | Source: ETHUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)