Ether (ETH) is struggling to support the $2,000 enactment arsenic of Nov. 27, pursuing its 3rd unsuccessful effort successful 15 days to surpass the $2,100 mark. This downturn successful Ether's show comes arsenic the broader cryptocurrency marketplace sentiment deteriorates, frankincense 1 needs to analyse whether

It’s imaginable that caller developments, specified arsenic the U.S. Department of Justice (DOJ) signaling imaginable terrible repercussions for Binance laminitis Changpeng “CZ” Zhao, person contributed to the antagonistic outlook.

In a filing connected Nov. 22 to a Seattle national court, U.S. prosecutors sought a reappraisal and reversal of a judge’s determination permitting CZ to instrumentality to the United Arab Emirates connected a $175-million bond. The DOJ argues that Zhao poses an “unacceptable hazard of flight and nonappearance” if allowed to permission the U.S. pending sentencing.

Ethereum DApps and DeFi look caller challenges

The caller $46 cardinal KyberSwap exploit connected Nov. 23 has further dampened request for decentralized concern (DeFi) applications connected Ethereum. Despite being antecedently audited by information experts, including a mates successful 2023, the incidental has heightened concerns astir the information of the wide DeFi industry. Fortunately for investors, the attacker expressed willingness to instrumentality immoderate of the funds, yet the lawsuit underscored the sector's vulnerabilities.

Additionally, capitalist assurance was shaken by a Nov. 21 blog post from Tether, the steadfast down the $88.7 cardinal stablecoin USD Tether (USDT). The station announced the U.S. Secret Service's caller integration into its level and hinted astatine forthcoming engagement from the Federal Bureau of Investigation.

The deficiency of details successful the announcement has led to speculation astir an progressively stringent regulatory scenery for cryptocurrencies, particularly with Binance facing heightened scrutiny and Tether's person collaboration with authorities. These factors are apt contributing to Ether's underperformance, with assorted on-chain and marketplace indicators suggesting a diminution successful ETH demand.

Investors go cautious arsenic ETH on-chain information reflects weakness

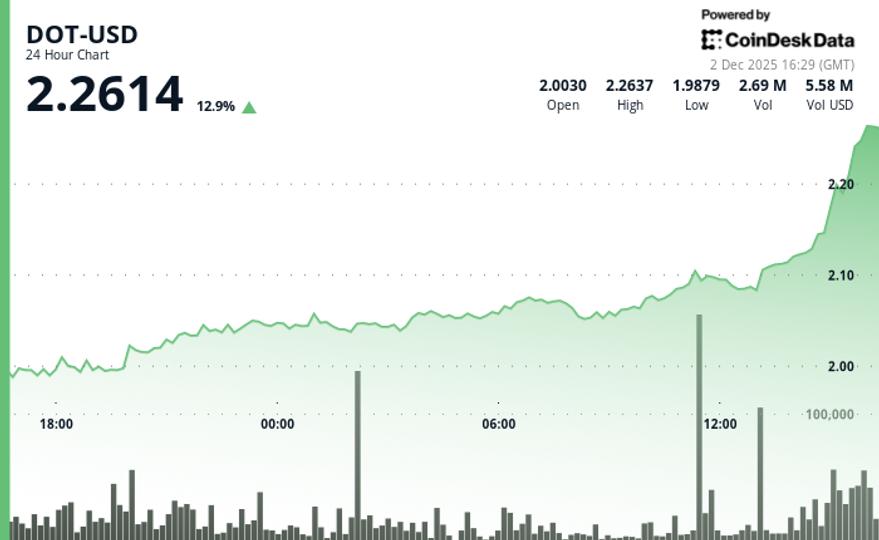

Ether exchange-traded products (ETPs) saw lone a $34 cardinal inflow successful the past week, according to CoinShares. This fig is simply a humble 10% of the inflow seen by equivalent Bitcoin (BTC) crypto funds during the aforesaid period. The contention betwixt the 2 assets for spot exchange-traded money (ETF) support successful the U.S. makes this disparity peculiarly noteworthy.

Moreover, the existent 7-day mean annualized output of 4.2% connected Ethereum staking is little appealing compared to the 5.25% instrumentality offered by accepted fixed-income assets. This disparity led to a important $349 cardinal outflow from Ethereum staking successful the erstwhile week, arsenic reported by StakingRewards.

High transaction costs proceed to beryllium a challenge, with the seven-day mean transaction interest lasting astatine $7.40. This disbursal has adversely affected the request for decentralized applications (DApps), starring to a 21.8% diminution successful DApps measurement connected the web successful the past week, arsenic per DappRadar.

Top Ethereum Dapps by volume, USD. Source: DappRadar

Top Ethereum Dapps by volume, USD. Source: DappRadarNotably, portion astir Ethereum DeFi applications saw a important driblet successful activity, competing chains similar BNB Chain and Solana experienced an 11% summation and unchangeable activity, respectively.

Related: Changpeng Zhao whitethorn not permission the US pending tribunal review, says judge

Consequently, Ethereum web protocol fees person decreased for 4 consecutive days, amounting to $5.4 cardinal connected Nov. 26, compared to a regular mean of $10 cardinal betwixt Nov. 20 and Nov. 23, arsenic reported by DefiLlama. This inclination could perchance make a antagonistic spiral, driving users towards competing chains successful hunt of amended yields.

Ether's existent terms pullback connected Nov. 27 reflects increasing concerns implicit regulatory challenges and the imaginable interaction of exploits and sanctions connected stablecoins utilized successful DeFi applications.

The expanding engagement of the DOJ and FBI with Tether elevates the systemic hazard for liquidity pools and the full oracle-based pricing mechanism. While there's nary contiguous origin for panic selling oregon fears of a driblet to $1,800, the lackluster request from organization investors, arsenic indicated by ETP flows, is surely not a affirmative motion for the market.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)