Even though Ether (ETH) terms bounced implicit 20% from the $2,300 debased connected Feb. 22, derivatives information shows that investors are inactive cautious. To date, Ether's terms is down 24% for the year, and cardinal overhead resistances laic ahead.

Ethereum's astir pressing contented has been precocious web transaction fees and investors are progressively disquieted that this volition stay an contented adjacent aft the web integrates its long-awaited upgrades.

For example, the 7-day web mean transaction interest is inactive supra $18, portion the web worth locked successful astute contracts (TVL) decreased 25% to $111 cardinal betwixt Jan. 1 and Feb. 27. This antagonistic indicator could partially explicate wherefore Ether has been down-trending since aboriginal February.

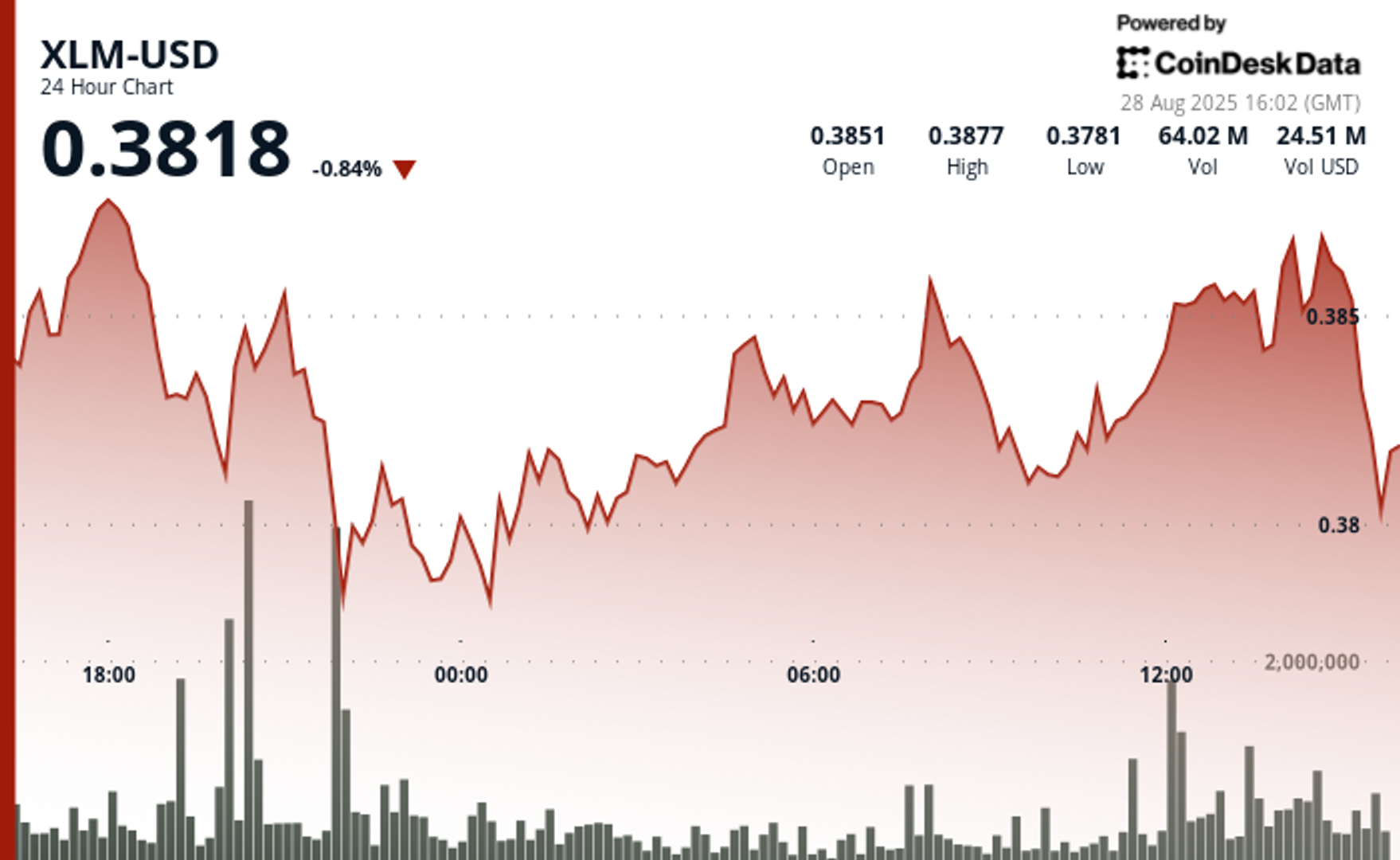

Ether/USD terms astatine FTX. Source: TradingView

Ether/USD terms astatine FTX. Source: TradingViewThe supra transmission presently shows absorption astatine $3,100, portion the regular closing terms enactment stands astatine $2,500. Therefore, a 14% rally from the existent $2,750 level needs to hap for the prevailing downward inclination to beryllium canceled.

Derivatives markets amusement fearfulness arsenic the prevailing sentiment

The 25% delta skew compares equivalent telephone (buy) and enactment (sell) options. The indicator volition crook affirmative erstwhile "fear" is prevalent due to the fact that the protective enactment options premium is higher than the telephone options.

The other holds erstwhile marketplace makers are bullish, causing the 25% delta skew to displacement to the antagonistic area. Readings betwixt antagonistic 8% and affirmative 8% are usually deemed neutral.

Deribit Ether 30-day options 25% delta skew. Source: laevitas.ch

Deribit Ether 30-day options 25% delta skew. Source: laevitas.chThe supra illustration shows that Ether enactment traders person been signaling bearishness since Feb. 11, conscionable arsenic Ether failed to interruption the $3,200 resistance. Furthermore, the existent 8.5% speechmaking shows nary assurance from marketplace markers and whales contempt the 7.5% terms summation connected Feb. 28.

Exchange-provided information highlights traders' long-to-short nett positioning. By analyzing each client's presumption connected the spot, perpetual and futures contracts, 1 tin amended recognize whether nonrecreational traders are leaning bullish oregon bearish.

There are occasional methodological discrepancies betwixt antithetic exchanges, truthful viewers should show changes alternatively of implicit figures.

Exchanges' apical traders Ether long-to-short ratio. Source: Coinglass

Exchanges' apical traders Ether long-to-short ratio. Source: CoinglassEven with Ether's 21.5% rally since Feb. 24, apical traders connected Binance, Huobi and OKX person decreased their leverage longs. More precisely, Huobi was the lone speech facing a humble simplification successful the apical traders' long-to-short ratio arsenic the indicator moved from 1.04 to 1.07.

However, this interaction was much than compensated by OKX traders expanding their bullish bets from 2.15 to 1.58 from Feb. 24 to Feb. 28. On average, apical traders decreased their longs by 8% implicit the past 4 days.

Top traders could beryllium caught by surprise

From the position of the metrics discussed above, determination is hardly a consciousness of bullishness contiguous successful the Ether market. Moreover, information suggests that pro traders are unwilling to adhd agelong positions arsenic expressed by some futures and options markets.

Of course, adjacent nonrecreational traders get it wrong, and a abbreviated screen should hap if Ether breaks the existent downtrend transmission $3,100 resistance. Still, it's besides important to astatine slightest admit that there's small involvement successful buying utilizing derivatives astatine the existent level.

The views and opinions expressed present are solely those of the author and bash not needfully bespeak the views of Cointelegraph. Every concern and trading determination involves risk. You should behaviour your ain probe erstwhile making a decision.

3 years ago

3 years ago

English (US)

English (US)