The post Ethereum Price Prediction January 2026: On-Chain Signals Align With ETF Demand appeared first on Coinpedia Fintech News

The Ethereum price prediction January 2026 is gaining traction as ETH extends an upward trend that began in late November 2025. By mid-January, Ethereum retested its 200-day EMA while ETF inflows, improving on-chain metrics, and shifting market psychology strongly pointing toward strengthening momentum that might result in a rally soon.

Ethereum Price Prediction January 2026: Trend Structure Strengthens

Since late November 2025, the Ethereum price chart has consistently printed higher lows, which displayed an emerging uptrend following $2620 low witnessed in November 2025.

But this bullish structure matured further by mid-January as ETH revisited the 200-day EMA band, aligning near the $3300 area.

Meanwhile, the Ethereum price today continues to hover near the 200-day EMA, reflecting resilient demand around $3,300 despite broader market volatility.

Importantly, Ethereum ETF activity has added more value to current price setup. Becuase, over the past week alone, Ethereum ETFs recorded approximately $480 million in net inflows, underscoring renewed institutional appetite. These flows have helped stabilize its price while improving confidence in the broader Ethereum price forecast narratives.

On-Chain Metrics Signal a Shift Into Markup Phase

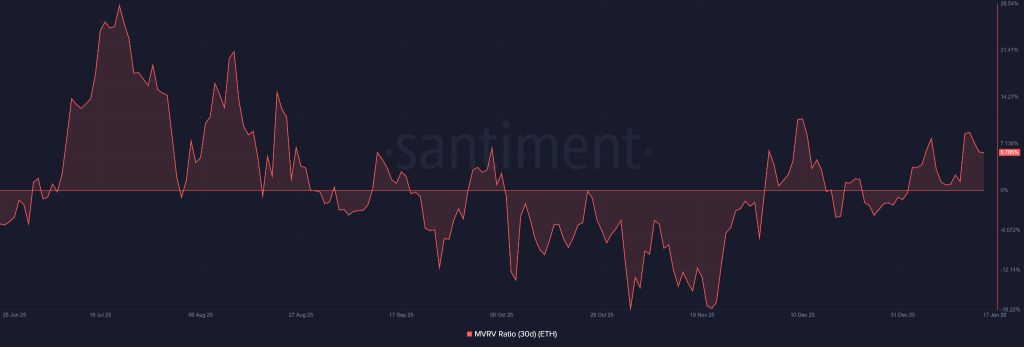

Beyond price action, on-chain data adds weight to the Ethereum price prediction January 2026 narrative. The MVRV 30-day metric currently sits near 5.8%, having flipped decisively above the neutral zero line earlier this month. This transition typically marks the end of an accumulation phase and the start of a markup phase, where price appreciation is supported by real buying conviction.

Notably, this level remains far below historical “overheated” thresholds. Santiment analytics MVRV 30-D readings above 10% often invite profit-taking, while levels beyond 20% suggest excessive correction possibilities. For now, the relatively muted MVRV positioning implies room for upside without immediate structural risk, aligning with a healthier Ethereum price outlook.

Network Activity and Whales Reinforce Bullish Bias

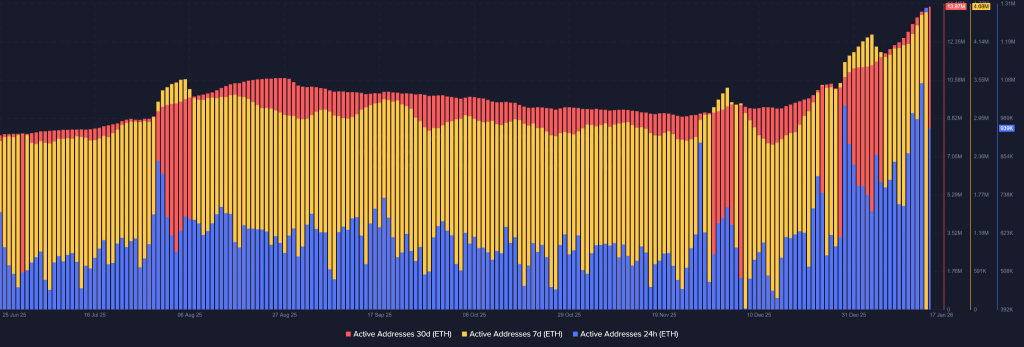

At the same time, Ethereum crypto activity has picked up meaningfully. Active addresses across 30-day, 7-day, and 24-hour timeframes have all increased, indicating renewed user engagement.

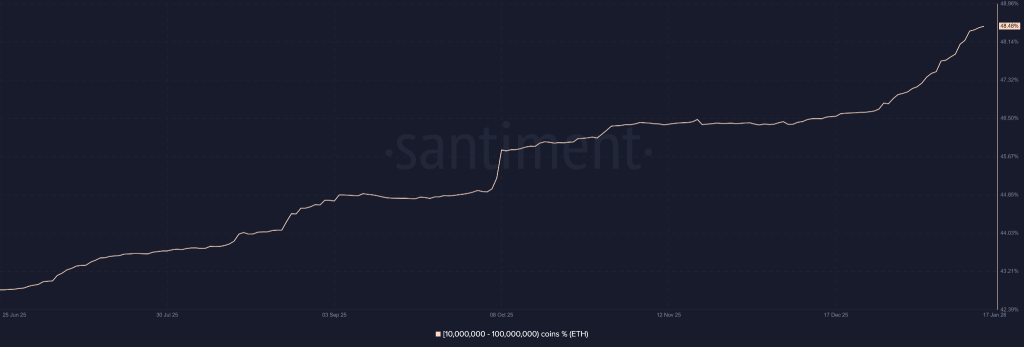

In parallel, wallets holding between 10 million and 100 million ETH have grown noticeably, pointing to increased involvement from large holders. This pattern often reflects strategic positioning by smart money during early trend reversals, rather than late-cycle speculation.

Historically, such expansions in network participation and strategic positioning by smart money during early trend reversals, confirms bullish outlook.

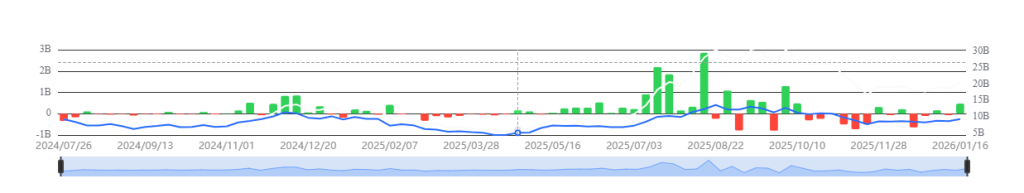

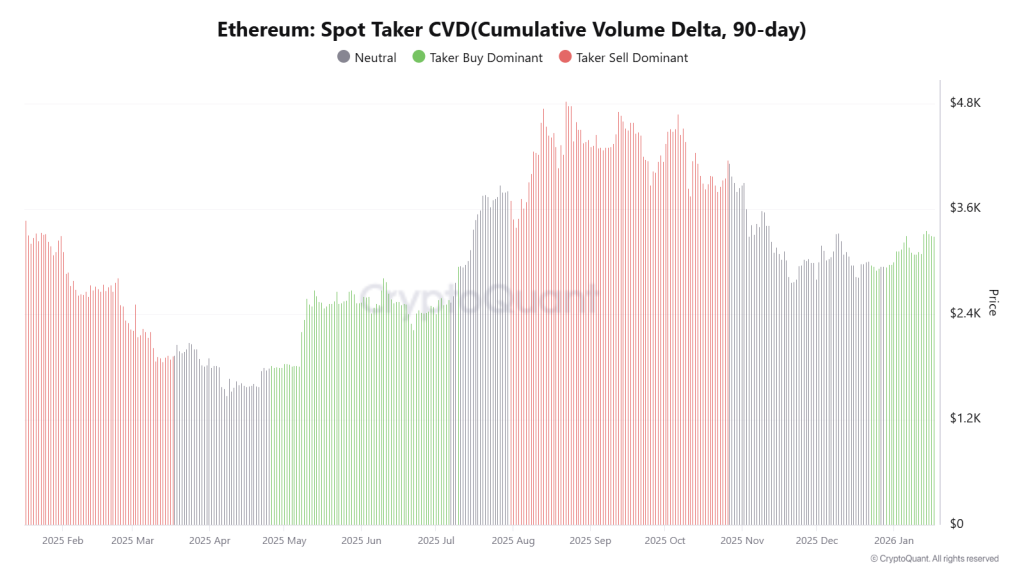

A Taker-buy Dominant Phase Confirms Shifts in Sentiment

CryptoQuant’s data further complements the bullish thesis. The 90-day Spot Taker CVD has shifted firmly into a taker-buy dominant phase, reversing the sell-heavy conditions seen during Q3 and late 2025. This change highlights improving sentiment and sustained demand absorption, a key feature of early bull phases.

Additionally, from a technical standpoint, a confirmed break above the 200-day EMA in ETH/USD could unlock the next upside zones. In the short term, resistance levels around $3,827 and $4,218 stand out, implying potential gains exceeding 25% from current levels.

As long as on-chain conditions remain balanced, the Ethereum price prediction January 2026 continues to favor gradual expansion rather than an abrupt spike.

1 month ago

1 month ago

English (US)

English (US)