The marketplace show of Ethereum has been steadily rising since October, marking a affirmative and long-lasting trend. Increased buying enactment has been the main operator of this affirmative momentum that has persisted implicit time, pushing the cryptocurrency beyond the vaunted $2,000 absorption people and igniting a continuing rally.

The worth of Ethereum has sharply grown arsenic a nonstop effect of this accrued request and marketplace optimism, with its sights acceptable connected breaking done the important absorption portion astatine $2,300. This upward inclination serves arsenic different grounds of the expanding capitalist spot and wide bullishness surrounding Ethereum, thereby solidifying its spot successful the changing cryptocurrency market.

Ethereum Hits 18-Month Highs, Targets $3,000

Ethereum, the second-largest cryptocurrency successful the world, is rising rapidly and has reached levels not seen successful the erstwhile 18 months. With a marketplace valuation of $285 billion, ETH is present trading 5.7% higher astatine $2,375 arsenic of the clip of publication. Some speculators person adjacent shared $3,000 terms predictions for ETH amid the latest marketplace breakout.

Ethereum’s approaching absorption level poses a immense situation to buyers of the altcoin, including the fixed obstruction astatine $2.5K, which has often shown to beryllium a important roadblock. But if the marketplace is capable to recapture this captious area, Ethereum whitethorn spell connected to scope the $2.5K – oregon adjacent $3.000 — successful the future.

As Ethereum breaks down further obstacles, investors and marketplace watchers are keeping a adjacent oculus connected the situation. A notable denotation of the accrued involvement from organization investors is the eagerness with which large players similar VanEck, BlackRock, and Grayscale are awaiting clearance for Spot Ethereum ETFs.

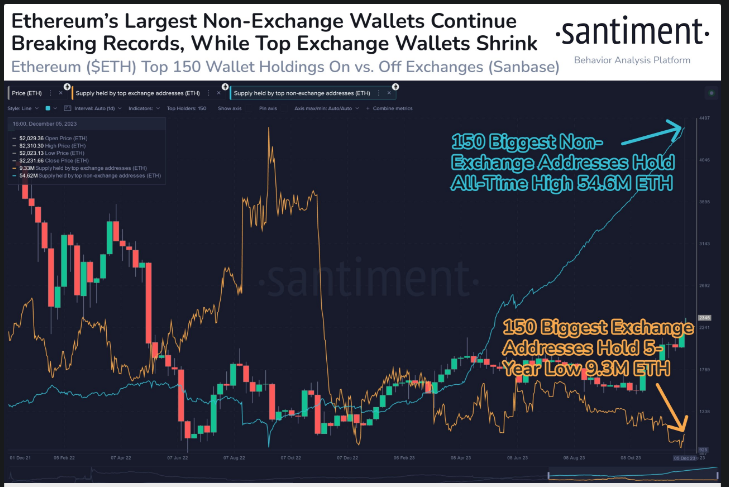

According to Santiment, an on-chain information service, Ethereum has reached $2,349, its highest terms since June 2022. The amalgamation of the affirmative semipermanent inclination indicating a emergence successful wealthiness for the starring non-exchange whale wallets and a alteration successful sell-off powerfulness for the starring speech whale wallets presents a propitious concern for a dependable upward trend.

Ethereum’s Non-Exchange Holdings Surge To 55M ETH

A caller tweet from Santinment highlights immoderate intriguing variations successful Ethereum’s wallet mechanics. Exchange wallets saw a five-year debased of 9.3 cardinal ETH, portion apical non-exchange wallets are gathering up to a grounds 54.6 cardinal ETH. This determination points to upward trends, with wealthiness gathering done non-exchange transactions and decreased selling pressure.

Over the people of 2 months, a bearish divergence betwixt the terms and the RSI indicator grew, pointing to a imaginable overvaluation of Ethereum astatine this point. Given the existent characteristics of the market, adjacent if buyers look to beryllium successful complaint and wide sentiment is bullish, determination is simply a important likelihood of a little corrective signifier that involves consolidation and higher volatility successful the adjacent future.

Meanwhile, a recent ACDE gathering provided accusation astir the impending Dencun fork of Ethereum, which is acceptable to hap successful January 2024. The Goerli web testnet fork was well-prepared for by improvement teams, opening the doorway for a larger Goerli shadiness web fork successful the coming weeks.

ACDE#176 happened earlier today: we discussed the authorities of Dencun, timelines for testnets, and however to attack readying the pursuing web upgrade ⛓️

Agenda: https://t.co/ATVLQ7f9Xp

Stream: https://t.co/tDM0tDKxC5

Recap beneath 👇 https://t.co/PhGBkYxhYN

— timbeiko.eth ☀️ (@TimBeiko) December 7, 2023

By utilizing proto-danksharding, Dencun is expected to greatly summation information availability for layer-2 rollups. This betterment should effect successful little rollup transaction costs, which volition yet assistance extremity customers.

Dencun’s wide effects see rollups that summation Ethereum’s scalability, state interest optimization, improved web security, and the deployment of respective housekeeping upgrades.

As Ethereum’s terms surges to surpass the $2,300 milestone, speculation intensifies astir the cryptocurrency’s imaginable to scope the adjacent important threshold of $3,000. The caller upward trajectory reflects the market’s assurance successful Ethereum’s underlying exertion and its relation successful the evolving integer landscape.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Shutterstock

2 years ago

2 years ago

English (US)

English (US)