Ethereum has experienced a monolithic drop, losing implicit 27% of its worth successful little than 5 days arsenic the marketplace faces utmost fearfulness and uncertainty. The accelerated sell-off has fueled speculation that a carnivore marketplace could beryllium connected the horizon, with galore analysts calling for further downside successful the coming months.

However, contempt the overwhelming bearish sentiment, determination is inactive a accidental for Ethereum to retrieve arsenic the terms is present investigating a important request level. If bulls negociate to clasp this area, ETH could signifier a beardown rebound and displacement momentum backmost successful favour of buyers.

Top expert BigCheds shared a method investigation connected X, noting that ETH is reapproaching a captious monthly request level, which could specify Ethereum’s adjacent large move. Historically, terms reactions astatine this level person led to either a beardown bounce oregon further capitulation, making the current marketplace conditions a pivotal infinitesimal for Ethereum’s semipermanent trajectory.

The adjacent fewer days volition beryllium important arsenic Ethereum attempts to stabilize and reclaim cardinal terms levels. If buyers measurement successful aggressively, ETH could commencement a betterment rally, but nonaccomplishment to clasp enactment whitethorn pb to further downside risks.

Ethereum Struggles Below $2,200

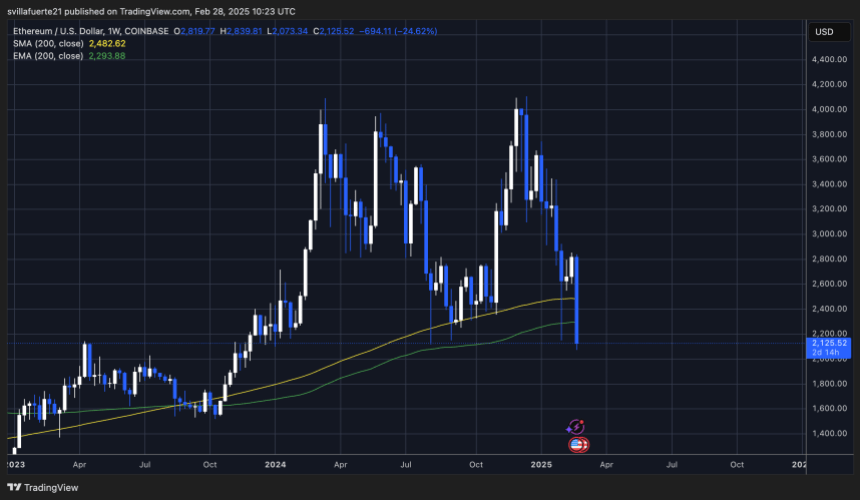

Ethereum is trading beneath $2,200, struggling to regain momentum aft a terrible market-wide correction. The altcoin assemblage continues to bleed, and ETH has present mislaid astir 50% of its worth since peaking astatine $4,100 successful mid-December. Bulls look a captious trial arsenic they indispensable support cardinal request levels to forestall further selling unit and pull beardown buying interest.

The concern is highly volatile, with marketplace sentiment shifting toward utmost fear. Investors interest that Ethereum could proceed its diminution if bulls neglect to clasp enactment and initiate a meaningful recovery. Many analysts stay cautious, informing that ETH could participate a prolonged consolidation signifier if it fails to regain mislaid ground.

BigChed’s insights connected X item that Ethereum is present re-approaching a cardinal high-timeframe request portion of astir $2,000. According to Cheds, this is simply a must-hold level—losing this portion could trigger a deeper correction, portion a beardown defence could pave the mode for a imaginable betterment rally.

Ethereum re-approaching cardinal level | Source: BigCheds connected X

Ethereum re-approaching cardinal level | Source: BigCheds connected XThe adjacent fewer days volition beryllium important for Ethereum. If bulls negociate to reclaim $2,200 and propulsion toward $2,500, a reversal could instrumentality place. However, nonaccomplishment to clasp $2,000 could spot ETH driblet further, perchance investigating little request zones successful the coming weeks.

Price Testing Demand – Can Bulls Regain Control?

Ethereum is trading astatine $2,120 aft enduring days of monolithic selling unit that pushed the terms to its lowest level successful months. ETH is presently holding supra a high-timeframe request level astir $2,000, a important portion that indispensable beryllium defended to debar further downside. However, sentiment remains fragile, and if Ethereum fails to clasp this level, it could trigger a melodramatic sell-off starring to adjacent little prices.

ETH investigating multi-year enactment | Source: ETHUSDT illustration connected TradingView

ETH investigating multi-year enactment | Source: ETHUSDT illustration connected TradingViewBulls look an urgent situation to regain power of terms action. The $2,200 level present acts arsenic the archetypal cardinal resistance, and a breakout supra this people would beryllium the archetypal measurement toward stabilization. Beyond that, ETH indispensable propulsion supra $2,500 arsenic soon arsenic imaginable to corroborate a imaginable inclination reversal and awesome the commencement of a betterment rally.

If bulls neglect to clasp the $2,000 support, Ethereum could look accrued volatility and a steep decline, perchance investigating little request zones. The adjacent fewer trading sessions volition beryllium critical, arsenic ETH’s quality to enactment supra cardinal levels volition find whether the marketplace stabilizes oregon enters a deeper correction signifier successful the coming weeks.

Featured representation from Dall-E, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)