Summary:

- Ethereum’s 24-hour liquidations astatine $140 cardinal person topped the database exceeding Bitcoin’s.

- Ethereum has been deed by a sell-off that has seen the worth of ETH driblet to arsenic debased arsenic $1,473.

- The selling of ETH could beryllium attributed to anxiousness linked to the depegging of stETH connected the assorted decentralized platforms specified arsenic Curve Finance and Lido Finance.

The fig of liquidations related to the trading of Ethereum connected the assorted futures platforms has exceeded that of Bitcoin.

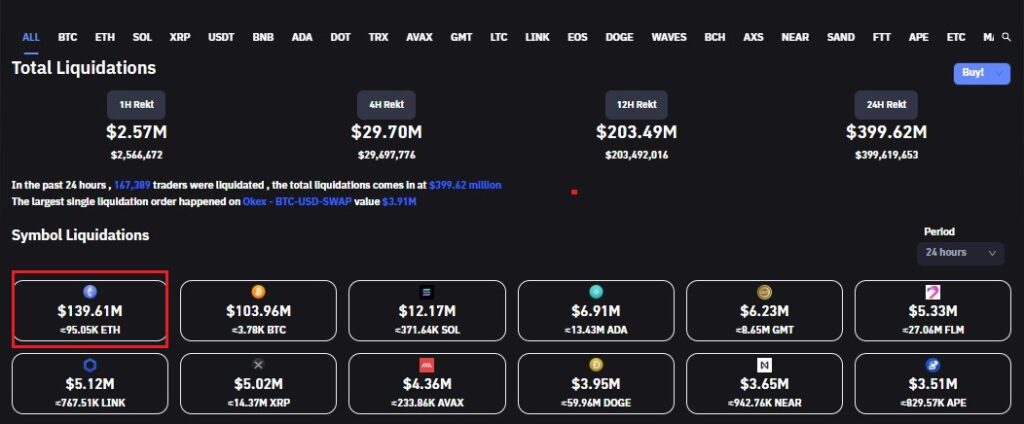

At the clip of writing, Ethereum liquidations successful the past 24-hours person deed $140 cardinal arsenic highlighted successful the pursuing screenshot courtesy of Coinglass.com. Furthermore, the magnitude of Ethereum liquidations correspond 35% of the full liquidations of $339 cardinal successful the past 24-hours.

24-hour liquidations. Source, Coinglass.com.

24-hour liquidations. Source, Coinglass.com.Ethereum Hits a Local Low of $1,473

The liquidations related to Ethereum are a effect of ETH hitting a section debased of $1,423 earlier today. The section debased is besides astir the $1,400 enactment level which is besides adjacent to Ethereum’s erstwhile all-time precocious of $1,440 acceptable successful January 2018 during the 2017/2018 bull market. The regular ETH/USDT illustration beneath provides a ocular cue of the terms enactment related to Ethereum.

Also from the chart, it tin beryllium observed that the regular commercialized measurement of Ethereum continues to beryllium 1 of selling. This information is further confirmed by the reddish histograms of the regular MACD. The regular MFI and RSI besides corroborate a downtrend for Ethereum with the earlier stated $1,400 terms level acting arsenic the past enactment of enactment earlier a plunge to the adjacent disposable enactment astir $1,274.

Anxiety Surrounding the Depegging of stETH Could beryllium To Blame for Ethereum’s Woes successful the Crypto Markets.

As to wherefore Ethereum is experiencing a sizeable downtrend, crypto-twitter is abuzz with observations that stETH is depegging connected the assorted defi protocols specified arsenic Curve Finance and Lido Finance.

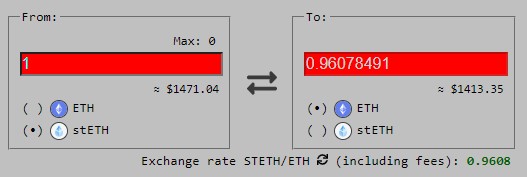

The depegging of stETH comparative to the existent worth of Ethereum was highlighted by the squad astatine WuBlockchain done the pursuing tweet. Further checking Curve Finance reveals that stETH is trading astatine 0.9607 ETH.

In the past 24h, ETH fell by 9.3%, and the liquidation magnitude reached $179m. In contrast, Bitcoin fell conscionable 2.5%. The terms of StETH successful the Curve excavation is inactive de-pegged, due to the fact that radical thought Celsius whitethorn merchantability much STETH.

— Wu Blockchain (@WuBlockchain) June 11, 2022

stETH depegging connected Curve Finance. Source, Curve.fi/steth.

stETH depegging connected Curve Finance. Source, Curve.fi/steth.stETH Depegging Could Be Causing Inaccurate Comparisons with UST’s Depeg Event successful Early May

The depegging of stETH could beryllium creating flashbacks of UST’s depegging aboriginal past month, arsenic explained done the pursuing connection by crypto-twitter assemblage subordinate @ChainLinkGod. He said:

The TerraUSD illness truly got radical paranoid and confused Equating $stETH is $UST is illogical astatine a cardinal level.

One is simply a afloat collateralized derivative of a staked token, the different was an undercollateralized ‘stablecoin’ Don’t confuse illiquidity with insolvency.

Similarly, the co-founder of Three Arrows Capital, Su Zhu, besides believes determination is nary request to panic arsenic stETH is backed with existent Ethereum. His investigation of stETH tin beryllium recovered successful the pursuing tweet.

Most of the steth just discount investigation ive seen misses that from an onchain functionality perspective, steth is astir pari passu w eth functionality successful defi

It is the astir dependable root of autochthonal protocol output connected Ethereum

This makes it an charismatic portion of an eth-denom port

— Zhu Su 🔺 (@zhusu) June 12, 2022

3 years ago

3 years ago

English (US)

English (US)