Ethereum’s blue-chip DeFi tokens are garnering important attraction successful the crypto market, serving arsenic a barometer for the broader DeFi landscape. These tokens, including Uniswap (UNI), Aave (AAVE), Maker (MKR), Curve (CRV), Synthetix (SNX), Compound (COMP), Balancer (BAL), Sushiswap (SUSHI), correspond the astir established and wide utilized DeFi protocols. As cardinal players successful the DeFi ecosystem, their show provides invaluable insights into the wide wellness and trends wrong this innovative fiscal sector.

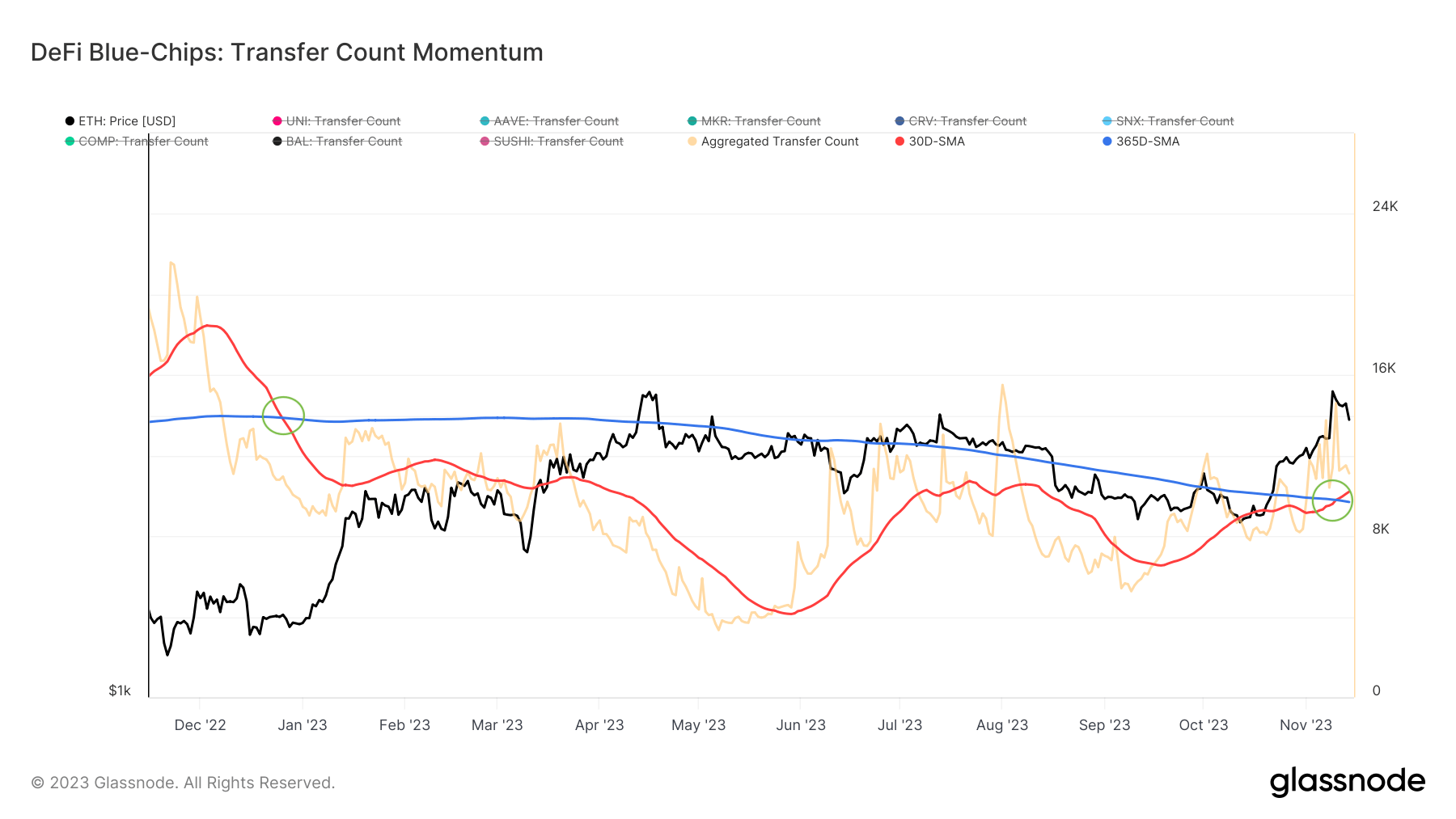

A captious facet of knowing these blue-chip tokens lies successful analyzing the momentum of DeFi token transfers. Transfer counts, a metric that measures the fig of token transactions implicit a period, connection a glimpse into the token’s inferior and demand. Specifically, comparing the 30-day Simple Moving Average (30D-SMA) and the 365-day Simple Moving Average (365D-SMA) provides a wide representation of short-term versus semipermanent trends. A monthly mean surpassing the yearly mean typically signals an enlargement successful on-chain activity, suggesting a increasing request for DeFi tokens. Conversely, a monthly mean falling beneath the yearly mean indicates a contraction.

Recent information indicates a important displacement successful this metric for Ethereum’s blue-chip DeFi tokens. As of Nov.14, the 30D-SMA stood astatine 12,208, surpassing the 365D-SMA of 9,699. This marks a notable summation successful on-chain enactment and points to a heightened involvement successful DeFi tokens. Such a inclination reversal, particularly aft a prolonged play of the 30D-SMA trailing beneath the 365D-SMA since precocious 2022, hints astatine a imaginable upswing successful the DeFi market.

Graph showing the monthly and yearly averages for transaction counts connected Ethereum’s blue-chip protocols from Nov. 14, 2022, to Nov. 14, 2023 (Source: Glassnode)

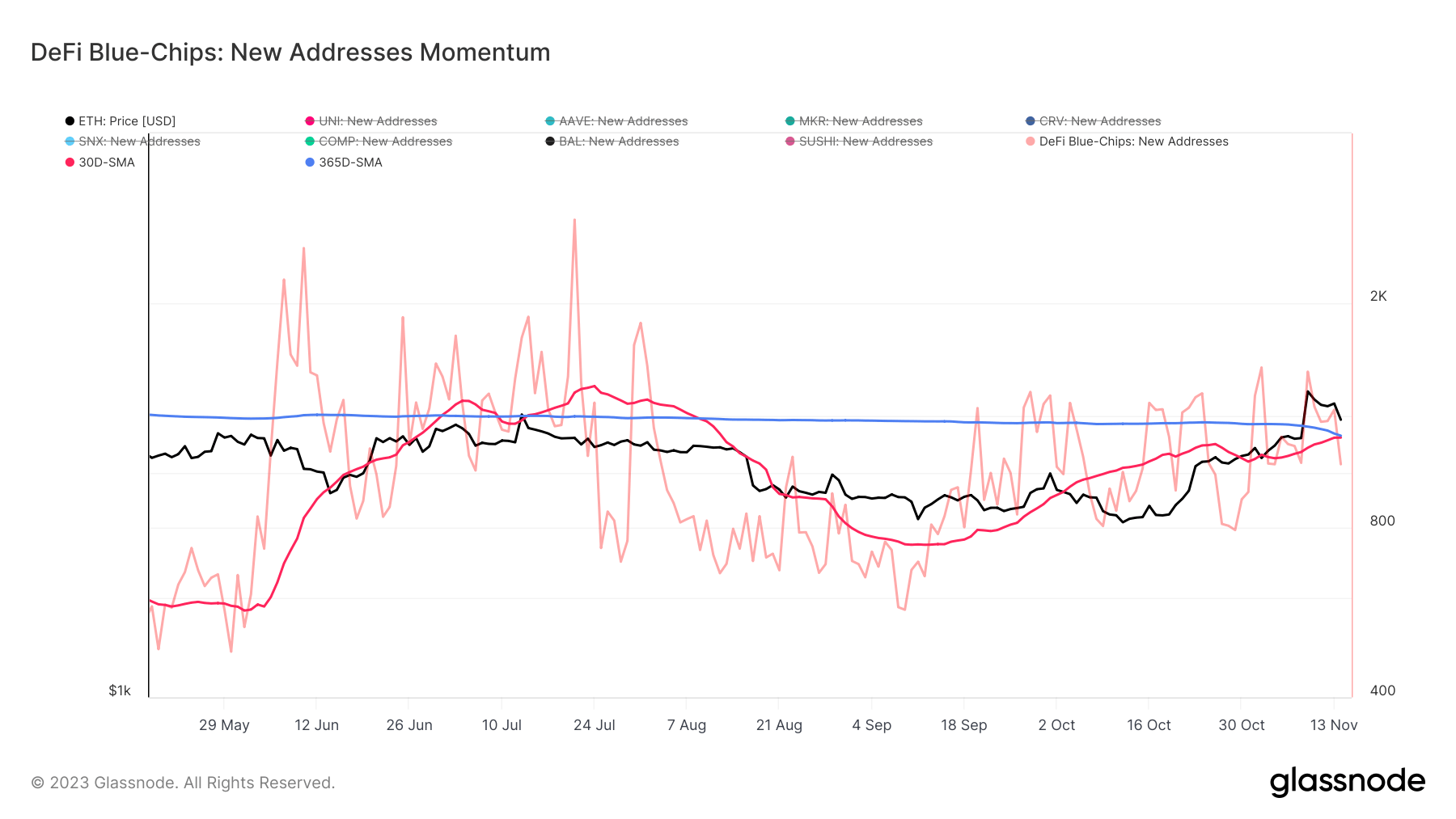

Graph showing the monthly and yearly averages for transaction counts connected Ethereum’s blue-chip protocols from Nov. 14, 2022, to Nov. 14, 2023 (Source: Glassnode)Another important origin successful assessing the DeFi abstraction is the momentum of caller DeFi addresses. The instauration of caller addresses connected the blockchain is simply a nonstop indicator of caller idiosyncratic adoption and marketplace expansion. Like transportation counts, comparing the monthly and yearly averages of caller addresses reveals important marketplace trends. When the monthly mean nears oregon surpasses the yearly average, it suggests an summation successful caller idiosyncratic adoption, reflecting increasing involvement successful DeFi products.

The information shows this is simply a pivotal infinitesimal for Ethereum’s blue-chip DeFi tokens regarding caller code creation. The 30D-SMA of caller addresses astir converged with the 365D-SMA connected Nov. 14, lasting astatine 1,155 compared to 1,165 respectively. This convergence indicates a resurgence successful caller idiosyncratic adoption, a captious motion of wellness and maturation successful the DeFi ecosystem.

Graph showing the monthly (red) and yearly (blue) averages for caller addresses connected Ethereum’s blue-chip protocols from May 18 to Nov. 14, 2023 (Source: Glassnode)

Graph showing the monthly (red) and yearly (blue) averages for caller addresses connected Ethereum’s blue-chip protocols from May 18 to Nov. 14, 2023 (Source: Glassnode)Currently, the DeFi marketplace is astatine a crossroads. The surge successful transportation counts and the near-convergence of caller code instauration some awesome a imaginable turnaround successful the market’s trajectory. This suggests a increasing request and utilization of DeFi tokens, coupled with an expanding involvement from caller oregon existing users creating much addresses.

However, the sustainability of the maturation successful caller addresses remains a cardinal origin to monitor. A continued summation successful caller idiosyncratic adoption could awesome a robust maturation signifier for DeFi, perchance starring to broader marketplace adoption and innovation.

The station Ethereum’s bluish spot DeFi tokens poised for growth appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)