As much than 2 thirds of the staking powerfulness of the Ethereum 2.0 concatenation is moving connected a azygous lawsuit software, what happens if this lawsuit is deed by a superior vulnerability, and what tin the assemblage bash to hole the issue?

Cover art/illustration via CryptoSlate

Around the mediate of this year, Ethereum, the second-largest blockchain successful presumption of monetary value, and with hundreds of billions of dollars worthy of assets depending connected its operation, volition modulation from the Proof-of-Work statement algorithm securing the strategy today, to the Proof-of-Stake strategy of time – a process described by galore arsenic changing the motor of an airplane portion flying it. Ethereum can, nether nary circumstances whatsoever, halt producing valid blocks.

Unlike astir blockchains, for example, Bitcoin, Ethereum’s developer community, encouraged by the Ethereum Foundation (EF) and galore of the community’s salient figures, has agreed connected processing respective versions of the lawsuit softwares implementing the protocol of the Proof-of-Stake statement blockchain, often referred to arsenic Ethereum 2.0. The antithetic versions of the lawsuit bundle are separated by programming connection and by the idiosyncratic teams processing them.

Post merge, determination volition beryllium 2 types of nodes

The modulation volition beryllium a merger, often simply referred to arsenic The Merge, betwixt the Ethereum web nodes of today, among which a subset functions arsenic miners, and nodes moving the alleged beacon concatenation that is already up and moving since December 2020. At the aforesaid time, determination volition beryllium a separation of the duties of nodes. Today, nodes execute some the execution of transactions and validation of those aforesaid transactions.

Post merge, determination volition beryllium 2 types of nodes: 1 benignant volition contiguous the Ethereum Virtual Machine, the EVM, to users and astute contracts, execute transactions and nonstop these to validator nodes to validate them. Execution nodes connected the execution concatenation volition fundamentally execute the aforesaid duties arsenic they bash now, but that the validation volition beryllium taken attraction of by the validator nodes connected the statement chain.

The Merge

The MergeThe 2 types of clients stock immoderate code, fixed they are developed successful the aforesaid programming language, and the execution clients person been updated to a tiny grade to accommodate the merge. Most parts of the execution client, specified arsenic the EVM tin beryllium reused with flimsy modifications. Eventually, the execution clients whitethorn altogether driblet the parts of the codification that does the validation connected the contiguous Proof-of-Work chain.

The merge, then, is not really a merge successful the communal consciousness that 2 chains volition go one, but alternatively that astatine a definite constituent successful time, astatine a definite artifact tallness to beryllium correct, today’s nodes volition halt validating transactions, a work which volition alternatively beryllium carried retired by validators. This is simply a classical enhancement of robustness by the separation of duties into antithetic logical layers.

66% connected 1 lawsuit could mean crippled over

The reasoning down having respective lawsuit softwares is that a fault, a bug, oregon vulnerability, successful 1 of the clients won’t impact different clients, due to the fact that they don’t stock the aforesaid codification oregon adjacent programming languages.

It’s just to inquire wherefore this is not the lawsuit with, say, Bitcoin. The crushed is that the Bitcoin protocol, and its implementation of it, is precise elemental compared to Ethereum’s protocol. Ethereum is simply a overmuch much analyzable machine, by an bid of magnitude than Bitcoin, and added complexity, by nature, means a higher hazard of vulnerabilities and much onslaught surfaces.

This is each good arsenic agelong arsenic the organisation of the antithetic clients is even, oregon adjacent to even, and successful peculiar successful specified a mode that nary 1 lawsuit is utilized by much than 33% of the staking powerfulness successful the network. If not, and surely if 1 lawsuit is utilized by much than 66% of the staking power, which is the lawsuit today, past the full thought of having antithetic codification bases for antithetic clients is beauteous overmuch useless.

Without going excessively overmuch into the weeds of however antithetic distributions tin person antithetic effects connected the cognition of the network, it suffices to accidental that if a superior bug hits a lawsuit with little than ⅓ of the staking power, past nary harm is done. The web volition proceed to run without immoderate hiccups. The bug volition beryllium fixed and everything volition spell backmost to normal.

Without going excessively overmuch into the weeds of however antithetic distributions tin person antithetic effects connected the cognition of the network, it suffices to accidental that if a superior bug hits a lawsuit with little than ⅓ of the staking power, past nary harm is done. The web volition proceed to run without immoderate hiccups. The bug volition beryllium fixed and everything volition spell backmost to normal.

If the aforesaid happening happens to a lawsuit with betwixt ⅓ and ½ of the staking power, past it’s a spot much superior but users won’t instrumentality notice. Automatic mechanisms of assorted sorts volition instrumentality attraction of it. If a superior bug hits a lawsuit with much than ½ of the staking power, past a big of mechanisms volition automatically beryllium executed that volition yet mend the situation, but determination volition beryllium complications and disturbances to the network, and users volition beryllium affected.

If, however, a bug hits a lawsuit that is utilized by much than ⅔ of the staking power, it’s fundamentally crippled over. The buggy clients person a super-majority and each the powerfulness that comes with it, and the buggy concatenation volition finalize. In essence, each the non-buggy clients tin bash is to either permanently divided the chain, successful which lawsuit we volition person 2 Ethereums, oregon articulation the buggy concatenation and unrecorded with immoderate the bug has caused.

Readers funny successful speechmaking up connected the details are highly recommended to work jmcook. eth’s article connected Mirror.

Supermajority connected Prysm, not an perfect situation

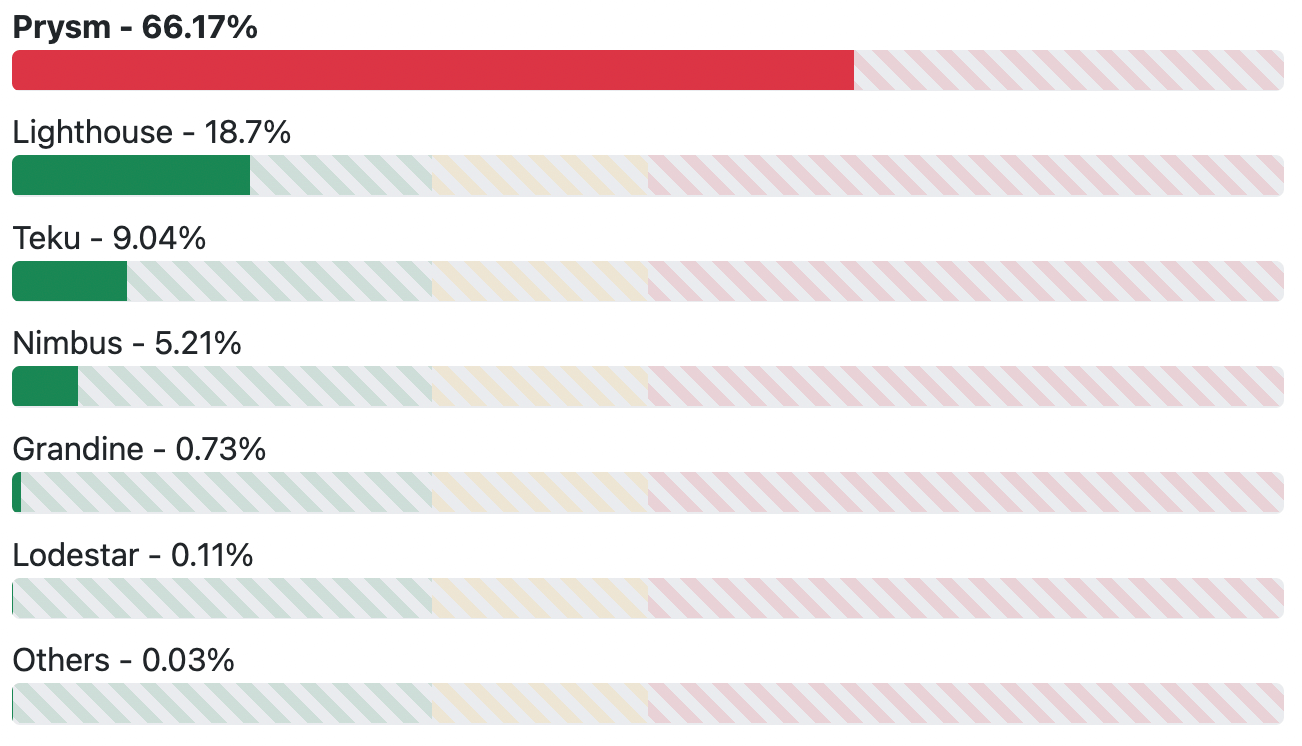

As of today, astir ⅔ of the network’s staking powerfulness runs the Prysm lawsuit implementation, developed by Prysmatic Labs. This is, to accidental the least, not an perfect concern successful lawsuit the Prysm lawsuit would crook retired to incorporate a bug, and the bug whitethorn beryllium exploited successful a mode that causes a statement nonaccomplishment connected the network. To beryllium fair, this script is unlikely, but nevertheless non-zero.

The different clients connected the marketplace are Lighthouse, Teku, Nimbus, Grandine, and Loadstar. Of these Grandine and Loadstar person precise tiny marketplace shares, some good beneath 1%. Grandine is the lone 1 published nether a closed root license.

The organisation of statement clients arsenic of property clip is shown successful the illustration below. As the scholar tin see, Prysm’s dominance is acold beyond satisfying, but conscionable beneath the captious ⅔ level. For up-to-date details and resources, sojourn clientdiversity.org.

Client organisation of the beacon chain.

Client organisation of the beacon chain.A just question to inquire is wherefore the Prysm lawsuit is truthful dominant; determination indispensable beryllium immoderate crushed wherefore radical and organizations that tally validator nodes chose Prysm? To reply the question, CryptoSlate reached retired to Marius van der Wijden, Ethereum halfway developer moving connected the Geth (Golang Ethereum) Proof-of-Work client.

Prysm rules owed to first-mover advantage

“I deliberation the large reasons for Prysms occurrence are a first-mover advantage, tooling, and golang. Prysm was the archetypal prototype implementation of a beacon client. Thus they could commencement optimizing their lawsuit aboriginal connected and they had much clip to make further tooling (e.g. the Web UI) and bully documentation.”

“Another large vantage is the programming connection utilized by prysm – golang – which is reasonably performant and precise casual to work and make in. Go-ethereum is besides written successful golang, frankincense devs acquainted with Geth could besides easy recognize and audit prysm,” van der Wijden says.

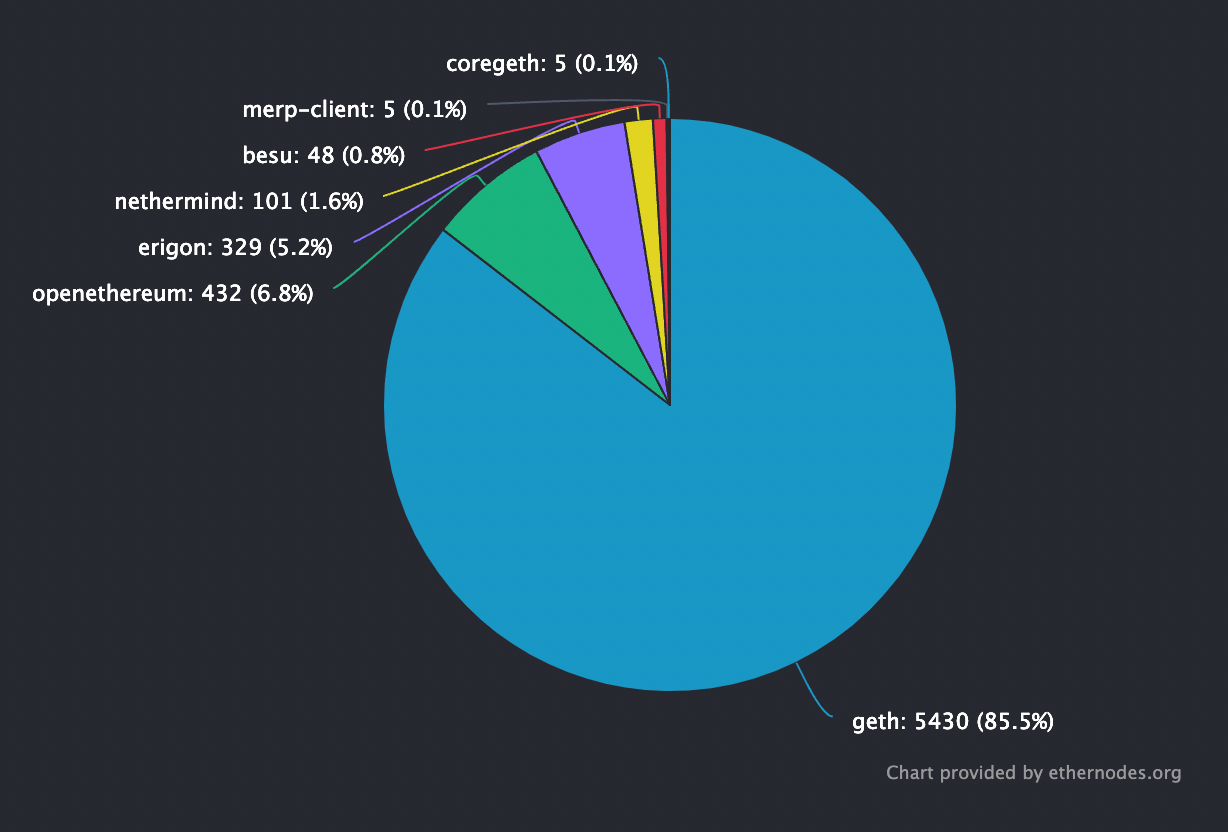

The second is important since the deficiency of adjacent organisation betwixt Proof-of-Work execution clients is adjacent worse than with statement clients. At the clip of writing, Geth’s “market share” is implicit 85%. However, successful a post-merger world, this is not arsenic overmuch of a occupation since execution nodes simply execute transactions, but they don’t supply information the mode statement clients do.

Distribution of the Proof-of-Work clients.

Distribution of the Proof-of-Work clients.“Go-ethereum presently has a supermajority of 85% connected the execution layer. It volition beryllium a spot amended post-merge since stakers tin tally aggregate execution furniture clients, with 1 beacon client, successful bid to ever extremity up connected the close chain,” van der Wijden says.

Big exchanges are the large Prysm contributors

Now, not each node operators are equal. On the contrary, immoderate node operators person staked vastly much ether than others, and frankincense they wield much staking powerfulness than their lesser peers. The biggest stakers are alleged staking services and/or pools, providing the accidental to involvement ether connected the beacon concatenation without the request for coughing up 32 ETH, and if it wasn’t for each of the large staking services moving the Prysm client, the lawsuit diverseness contented wouldn’t beryllium an issue.

These staking services person acquainted names: Coinbase, Kraken, and Binance. Yes, the same.

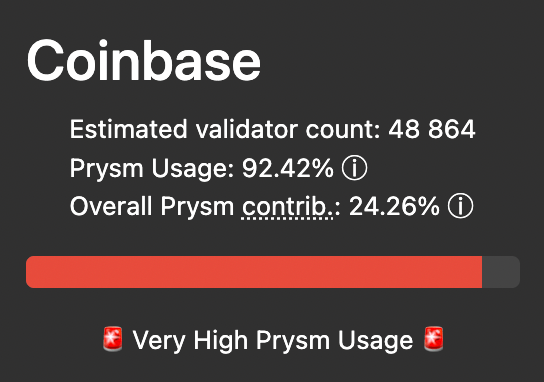

With 278,407 validator nodes connected the beacon concatenation today, Coinbase alone, with its 48,864 validators (17.5%) and 92.4% of those validators moving Prysm, contributes 24.3% to the diverseness issue.

When CryptoSlate reached retired to Coinbase to inquire however they presumption the lawsuit diverseness issue, the company’s publication to it, and what, if anything, Coinbase would bash to deflate the issue, Coinbase’s communications Jaclyn Sales pointed to a tweet thread by Coinbase Cloud from the 22nd of February.

Coinbase’s Prysm contribution.

Coinbase’s Prysm contribution.In the thread, Coinbase chiefly points to information arsenic the information down the prime to tally Prysm.

“Coinbase uses aggregate eth2 staking providers to maximize information and lawsuit distribution. When launching eth2 staking, Coinbase evaluated existing clients and providers to maximize these traits, which meant starting with Prysm due to the fact that it was the lone viable lawsuit supporting distant signers.”

“Remote signers let validators to make and store keys successful isolated environments alternatively of keeping them connected the validator itself, which greatly increases the information of the eth2 validators connected Coinbase.”

Coinbase: Prysm had amended information features

As per the tweet, distant signers besides let Coinbase Cloud to connection treble signing extortion done precocious watermark bundle which helps support validators from immoderate issues with the signing modules successful clients.

“On the Coinbase Cloud team, we work Coinbase Retail, but besides galore different customers. We person supported Lighthouse for astir a year, and worked with @sigp_io to adhd distant signer enactment to Lighthouse precocious past year,” the tweet continues.

Kraken’s Prysm contribution.

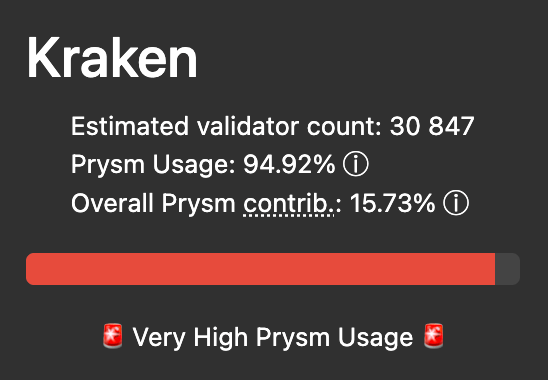

Kraken’s Prysm contribution.As for Kraken, with a validator number of 30,847 (11%), a Prysm usage of 94.9%, and an wide Prysm publication of 15.7%, Brian Hoffman, Senior Product Manager astatine Kraken answers successful an email that,

“When we archetypal built our ETH2 staking model, we recovered Prysm the astir due solution owed to its maturity and stability.”

“Following discussions with the Ethereum Foundation, some Kraken and Staked person besides started to rotation retired caller validators that are built connected Teku, arsenic good arsenic migrate immoderate existing ones. This mode we tin summation diverseness successful our validator lawsuit bundle and connection clients an adjacent much resilient on-chain staking service.”

Binance’s Prysm contribution.

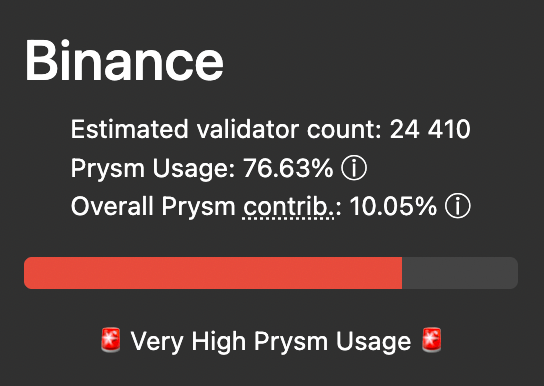

Binance’s Prysm contribution.Binance with 24,410 validators (8.7%), a Prysm usage of 76.6%, and an wide Prysm publication of 10% did not reply CryptoSlate’s petition for comment.

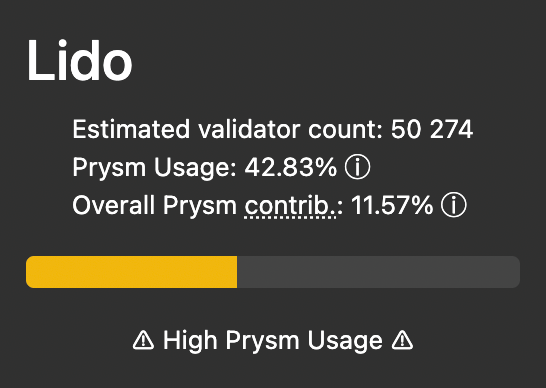

The third-largest staking service, Lido, with 50,274 validators (18%) has doubly arsenic galore validators than Binance, but the Prysm usage is astatine slightest “only” 42.8%, and truthful Lido contributes 11.5% to the Prysm dominance.

Lido’s Prysm contribution.

Lido’s Prysm contribution.Decentralized, Rocket Pool leads the way

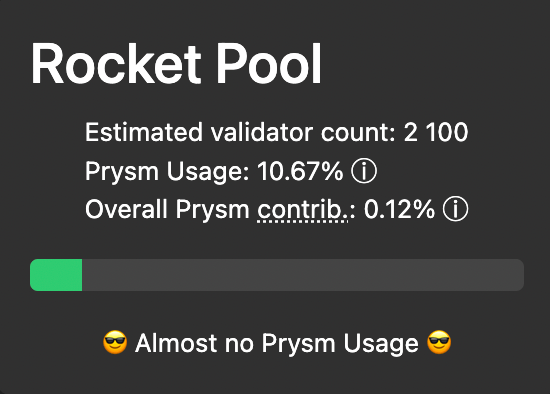

There are, of course, exceptions but these are precise small. Decentralized staking excavation Rocket Pool, for one, has a validator number of 2,100 (0.75%) with lone 10.6% of the validators moving Prysm, whereby Rocket Pool contributes a specified 0.12% to the Prysm domination.

Rocket Pool’s Prysm contribution.

Rocket Pool’s Prysm contribution.All successful all, the 4 large staking services and pools person it wrong their scope to lick the situation, and connected the agleam broadside of things, determination are ongoing discussions betwixt the staking services, and betwixt the staking services and the Ethereum Foundation. According to Ethereum halfway developer Marius van der Wijden, the progression of these discussions are “good”.

“Yes, determination are talks astir this, some internally and externally. I deliberation large staking pools are moving connected switching parts of their infrastructure to different clients. They request to update their metrics and monitoring infrastructure for the caller clients, truthful it mightiness instrumentality longer for them to power than location validators,” van der Wijden says.

According to van der Wijden, it’s neither risky nor hard for a node relation to power lawsuit software.

“All large implementations are beauteous good tested and maintained. If a idiosyncratic is already staking, they should unopen down and persist their slashing database, if they don’t person a slashing database, they should hold for a mates of minutes (> 7 minutes) betwixt shutting down the aged lawsuit and starting the caller client. The lone difficulties mightiness originate for bigger stakers arsenic immoderate clients supply antithetic APIs than others,” van der Wijdens says.

Is The Merge harmless to pursue?

With the merge lone months away, the Ethereum assemblage volition astir apt person to judge a little than perfect lawsuit distribution; the likelihood that Prysm domination volition autumn beneath 33% indispensable beryllium seen arsenic precise small. This, however, does not discourage Marius van der Wijden nor the different Ethereum halfway developers from pursuing the merge.

“I deliberation it’s harmless to pursue. The chances of a statement nonaccomplishment happening are precise tiny successful my opinion. We person large investigating and fuzzing infrastructure that runs permanently to find differences betwixt clients. Even if a statement nonaccomplishment occurs, we volition beryllium capable to propulsion retired caller releases and resoluteness forks rapidly and easily.”

“We besides person beardown statement that we volition not bail retired stakers that tally a bulk lawsuit if their clients misbehave,” van der Wijden says.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)