Trading Guru Peter Brandt has precocious commented connected the Ethereum vs. Bitcoin chart, offering intriguing insights into marketplace developments.

Brandt’s remark comes aft his anterior critiques of Ethereum, denigrating it arsenic a “junk coin” and its proponents arsenic “Etheridiots.” However, amidst Ethereum’s caller descent to its lowest presumption against Bitcoin successful astir 3 years, Brandt’s stance seems to person transformed.

Ethereum Plunges Against Bitcoin: A Bear Trap?

Upon analyzing the Ethereum-to-BTC chart, Brandt suggested the beingness of a “bear trap,” indicating that the ongoing diminution successful Ethereum’s worth compared to Bitcoin mightiness entice sellers into further abbreviated positions.

However, this could pb to an unexpected reversal, turning the evident breakdown successful enactment into a mendacious signal.

Bear trap? That is ever a anticipation erstwhile terms hits a caller 35-month low. pic.twitter.com/aKQg9k7TcD

— Peter Brandt (@PeterLBrandt) April 8, 2024

Brandt’s reflection of a imaginable carnivore trap highlights the complexities wrong the cryptocurrency marketplace and the value of considering aggregate factors erstwhile analyzing terms movements.

While Ethereum whitethorn beryllium experiencing a play of relative weakness against Bitcoin, Brandt’s cautious optimism suggests that determination whitethorn beryllium opportunities for a reversal shortly.

Bullish Signals Amid ETH/BTC Downturn

Despite Ethereum’s caller challenges, bullish signals person emerged, hinting astatine a imaginable turnaround. The options market, successful particular, has shown optimism, with a important information of Ethereum options unfastened involvement expiring by the extremity of April being bullish bets connected price.

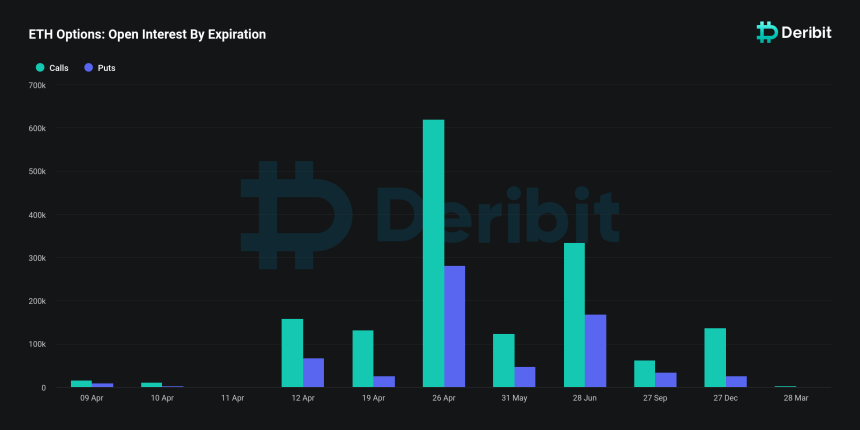

Ethereum unfastened involvement by expiration.| Source: Deribit

Ethereum unfastened involvement by expiration.| Source: DeribitDeribit information reveals that astir $3.3 cardinal worthy of notional ether options are scheduled to expire, with astir two-thirds of this sum allocated to calls. Moreover, the Ethereum put-call ratio for the April expiration stands astatine 0.45, signaling a somewhat much bullish stance than Bitcoin options.

Notably, a put-call options ratio beneath 1 suggests bullish sentiment, with traders favoring telephone options implicit enactment options. Moreover, the emergence of 2 caller Ethereum whales, according to the crypto tracking level Spot On Chain, identified arsenic 0x666 and 0x435, adds to Ethereum’s bullish sentiment.

These entities collectively withdrew a important magnitude of ETH from a large exchange, suggesting increasing assurance successful Ethereum’s prospects contempt its caller downtrend.

While Ethereum faces downward unit against Bitcoin, Bitcoin’s resilience successful the marketplace is evident. Crypto expert Ali has highlighted that Bitcoin appears to beryllium breaking out, with a imaginable upside people of $85,000 if it tin clasp supra $70,800.

#Bitcoin appears to beryllium breaking out! If $BTC tin clasp supra $70,800, the adjacent people becomes $85,000! pic.twitter.com/JPLf18KZvt

— Ali (@ali_charts) April 8, 2024

When writing, Bitcoin trades supra this captious level with a existent marketplace terms of $71,621, indicating a imaginable ascent towards $85,000 shortly.

Featured representation from Unsplash, Chart from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)