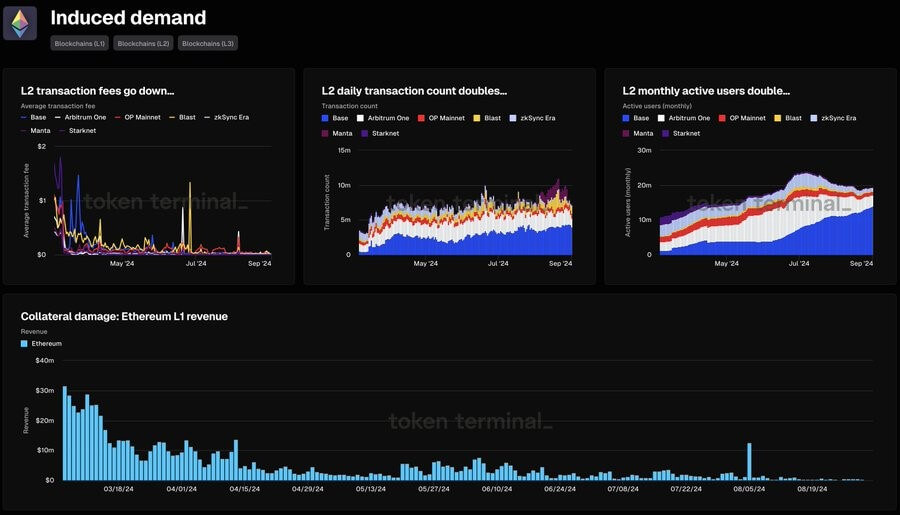

Ethereum’s layer-1 web has witnessed a drastic diminution successful revenue, plummeting by 99% since March 2024.

Data from Token Terminal reveals that web gross peaked astatine implicit $35 cardinal connected March 5. However, by Sept. 2, regular gross had plunged to a yearly debased of astir $200,000.

Ethereum Revenue (Source: Token Terminal)

Ethereum Revenue (Source: Token Terminal)Market observers property this diminution to the growth of layer-2 (L2) networks and the March Dencun upgrade, which reduced fees for L2 transactions and reshaped Ethereum’s revenue structure. Token Terminal stated:

“Key metrics that amusement however little transaction fees connected L2s person accrued usage, but besides driven down the gross connected the L1.”

Post-upgrade transaction enactment has shifted from Ethereum’s mainnet to L2 networks, starring to increased regular transactions and progressive users connected these platforms.

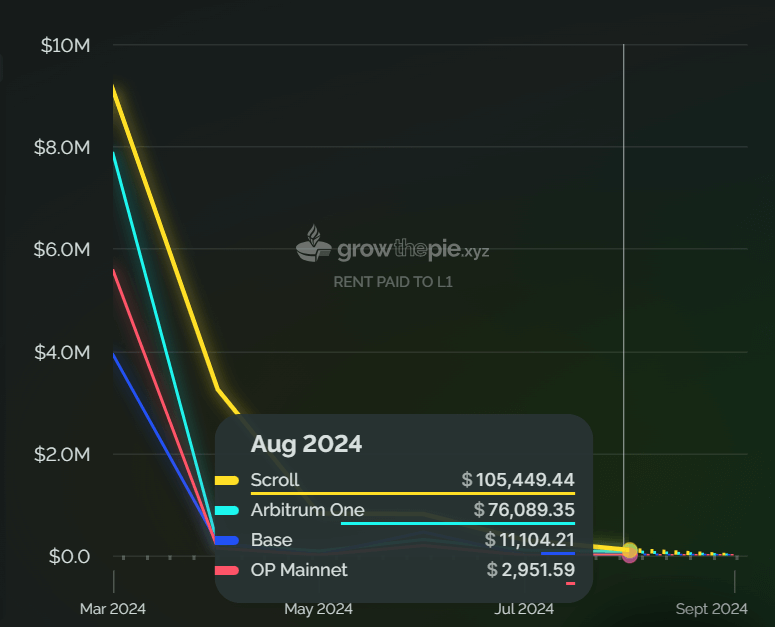

However, this migration has importantly impacted Ethereum’s interest revenue. For instance, Coinbase’s L2 network, Base, generated $2.5 cardinal successful gross successful August but paid lone $11,000 to settee connected the mainnet, underlining the displacement successful worth from Ethereum’s basal layer.

Rent L2 Networks Paid to Ethereum L1. (Source: GrowthePie)

Rent L2 Networks Paid to Ethereum L1. (Source: GrowthePie)Crypto expert Kun warned that if this inclination continues, L2 networks could predominate and perchance wantonness Ethereum’s mainnet, particularly for user applications. He emphasized the request for Ethereum to make invaluable usage cases connected its mainnet oregon hazard a terrible valuation issue.

He added:

“ETH L1 needs invaluable usage cases connected mainnet that cannot beryllium sieged oregon you person to anticipation that L2 usage is truthful large that fundamentally you request 100000 times the usage connected L2 to get the aforesaid worth you did connected mainnet with a tiny fraction which past creates a vale of valuation issues.”

‘Death spiral’

Bitcoin capitalist Fred Krueger has echoed these concerns, suggesting that Ethereum could look a “death spiral” if its debased gross concern persists.

He pointed retired that Ethereum’s existent interest gross of $200,000 per time equates to $73 cardinal annually, acold from capable to prolong its marketplace headdress of $300 billion.

Krueger argues that a much realistic valuation mightiness beryllium person to $3 billion, underscoring the disconnect betwixt Ethereum’s interest income exemplary and its marketplace valuation. He said:

“[Ethereum is] not equivalent to a institution making $73 cardinal a twelvemonth successful profit, oregon adjacent a institution making $73 cardinal a twelvemonth successful revenue. That $73 cardinal is not adjacent sufficient to bargain backmost each the ostentation that people comes to ETH validators.”

The station Ethereum’s web gross plunges by 99%, sparking ‘death spiral’ concerns appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)