Today, a week aft Ethereum co-founder Vitalik Buterin doubled down connected his content successful rollups, I hoped it mightiness beryllium utile to supply an instauration to the exertion down rollups and the antithetic approaches utilized successful their implementation.

So, arsenic defined by the Ethereum Foundation, rollups are a solution for scaling Ethereum that performs transaction execution extracurricular of the network’s furniture 1, yet posts the transaction information to Ethereum and inherits its information properties. In short, rollups marque Ethereum transactions cheaper without importantly sacrificing the inherent information of the basal blockchain. It's important to enactment that not each rollups are built the same; the astir fashionable implementations person precise antithetic information models and idiosyncratic experiences.

Optimistic rollups bash not bash immoderate computation by default; rather, they presume each authorities changes are valid (hence optimistic) and station the off-chain transactions to Ethereum’s furniture 1 arsenic calldata. In bid to support against fraudulent transactions, the rollup has quality periods successful which immoderate 3rd enactment tin people a fraud proof. The fraud impervious volition cross-check furniture 1 and furniture 2 and corroborate that each transactions are valid. If not, the invalid transactions and each pursuing affected transactions volition beryllium reverted. Arbitrum, Optimism and Metis are a fewer of the protocols implementing Optimistic rollup exertion to make a afloat Ethereum Virtual Machine (EVM) situation with idiosyncratic acquisition being a cheaper and faster mentation of mainnet.

Optimistic rollups bash not mostly alteration the spot assumptions of Ethereum, arsenic immoderate idiosyncratic is susceptible of moving a sequencer (Arbitrum afloat node) that processes transactions and allows users to retreat funds to mainnet. Sequencers are required to enactment up a “fidelity bond” connected mainnet, thereby creating a fiscal inducement to beryllium truthful. If different idiosyncratic disputes the sequencer’s transactions, and they are recovered to beryllium dishonest, the fidelity enslaved is paid retired to the disputer. Financial incentives and aggregate sequencers volition let the furniture 2s to person beardown uptime show and thin connected Ethereum’s information without the interest of interference.

By socializing gas cost crossed bundled users and lone posting calldata to mainnet, Optimistic rollups are capable to execute transaction fees 10-100x cheaper than the corresponding transaction connected Ethereum furniture 1. These fees volition proceed to get cheaper arsenic information retention is optimized connected mainnet for rollups and sharding, splitting the web successful aggregate chains to relieve congestion, is yet implemented.

Zero cognition (zk) rollups clump unneurotic hundreds of off-chain transactions utilizing extended computation and station them bundled to mainnet successful what is known arsenic a “validity proof.” The validity impervious is the already computed authorities of the furniture 2 that is sent to mainnet for storage, which contains overmuch little information than the calldata utilized successful Optimistic rollups. Starkware, Polygon Hermez and zkSync are a fewer of the archetypal implementations of Ethereum based zk rollups creating debased cost, exertion circumstantial furniture 2s.

Since zk rollups are truthful computationally intensive, it is astir intolerable to recreate the afloat EVM situation that furniture 1 and Optimistic rollups are capable to run. Therefore, this scaling solution is confined to azygous types of transactions and cannot big a wide assortment of projects connected a azygous network. However, since zk rollups compute and verify transactions connected their own, the exertion is capable to connection accelerated finality and transaction costs that are importantly little than Optimistic rollups and magnitudes little than mainnet.

The modulation to rollups is inactive astatine an highly aboriginal stage, with the astir enactment inactive seen connected Ethereum mainnet and a fistful of alternate furniture 1s. Until ample liquidity providers and developers determine to determination superior and protocols implicit to rollups, it volition beryllium hard to accidental which solution is favorable. Obviously it whitethorn not beryllium a binary answer, with immoderate applications favoring an application-specific concatenation and others favoring afloat EVM compatibility and the surrounding composability.

As of today, protocols person appeared to favour Arbitrum, which falls nether the Optimistic category. Arbitrum has gained $2.3 cardinal successful full worth locked (TVL) according to DeFiLlama, making it the 10th largest idiosyncratic chain. DyDx however, utilized zk rollup exertion to alteration leveraged derivatives products that gained monolithic traction earlier successful 2021. The exertion has astir $1 cardinal successful TVL unsocial and noted that they chose Starkware’s ZK exertion for its further committedness to decentralization and idiosyncratic experience.

To get a amended knowing of wherever Ethereum is moving next, I volition beryllium attending ETHDenver aboriginal this week! If the panels and speakers are immoderate hint, furniture 2 improvement and the modulation to proof-of-stake volition beryllium connected the agenda. I’ll beryllium definite to outline the important takeaways successful articles this play and successful adjacent week's variation of the newsletter!

Welcome to different contented of Valid Points.

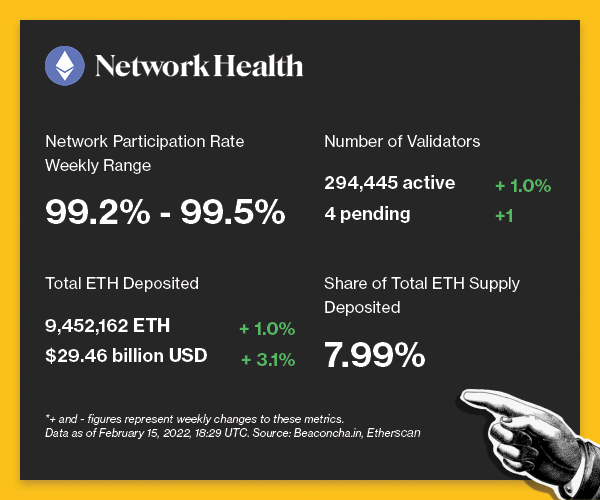

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

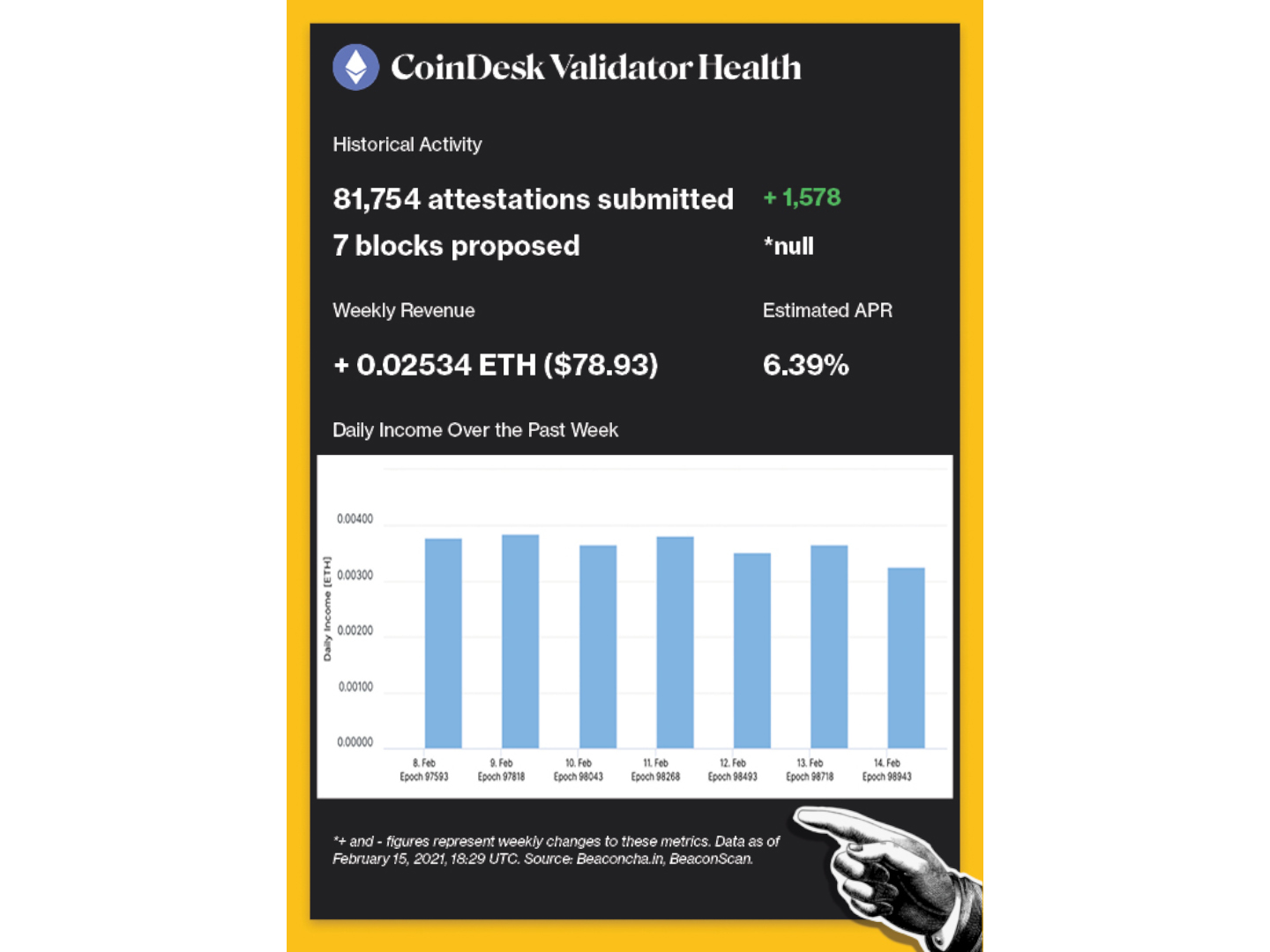

(Beaconcha.in, BeaconScan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

LooksRare NFT marketplace is called retired for a squad payout, which again brings into question the longevity of decentralized protocols. BACKGROUND: The protocol’s mechanics were transparently stated successful the documents, but caused backlash this week erstwhile the squad received a ample payout successful wrapped ether. While the payout mightiness person been unnecessarily large, the squad did not merchantability immoderate of the Looks token and had been moving connected the task unpaid for implicit six months.

A caller Ethereum Improvement Proposal (EIP) would acceptable the instauration for staked ether withdrawals aft the modulation to proof-of-stake. BACKGROUND: While the EIP won’t instantly let validator withdrawals, it sets the signifier for the elemental upgrade that makes the process possible. Ethereum halfway developers are estimating the Merge volition instrumentality spot successful the aboriginal summer, and this connection would further beforehand the roadworthy to proof-of-stake.

The U.S. Department of the Treasury reiterated that the IRS would not classify miners, stakers oregon developers arsenic “brokers” nether the caller Infrastructure bill. BACKGROUND: Months ago, the crypto proviso seen successful the infrastructure measure would person subjected miners and validators to intolerable reporting requirements that could termination the U.S. crypto industry. A azygous legislator made the determination to artifact an informed amendment to the provision, but the section acknowledged that it would beryllium intolerable for wallet providers, stakers and miners to travel transaction reporting arsenic brokers.

Canadian Prime Minister Justin Trudeau enacted the Emergencies Act that would grow the scope of Canada’s anti-money laundering and counter-terrorist rules to screen crowdfunding platforms and the outgo work providers they use. BACKGROUND: The measurement is portion of a determination to support against anti-government and vaccine protests that person impacted the country’s superior and borderline successful caller weeks. With banks and governments present having the authorization to frost and adjacent accounts thought to beryllium associated with backing the protests, crypto enthusiasts person pointed to the value of the unbiased fiscal services and accounts Bitcoin and Ethereum could perchance provide.

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site!

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)