Ethereum’s (ETH) Shanghai and Capella — Shapella — updates accrued capitalist confidence, which led to $17 cardinal worthy of inflows into ETH-based concern products during the week of April 17-23, according to CoinShares’ play report.

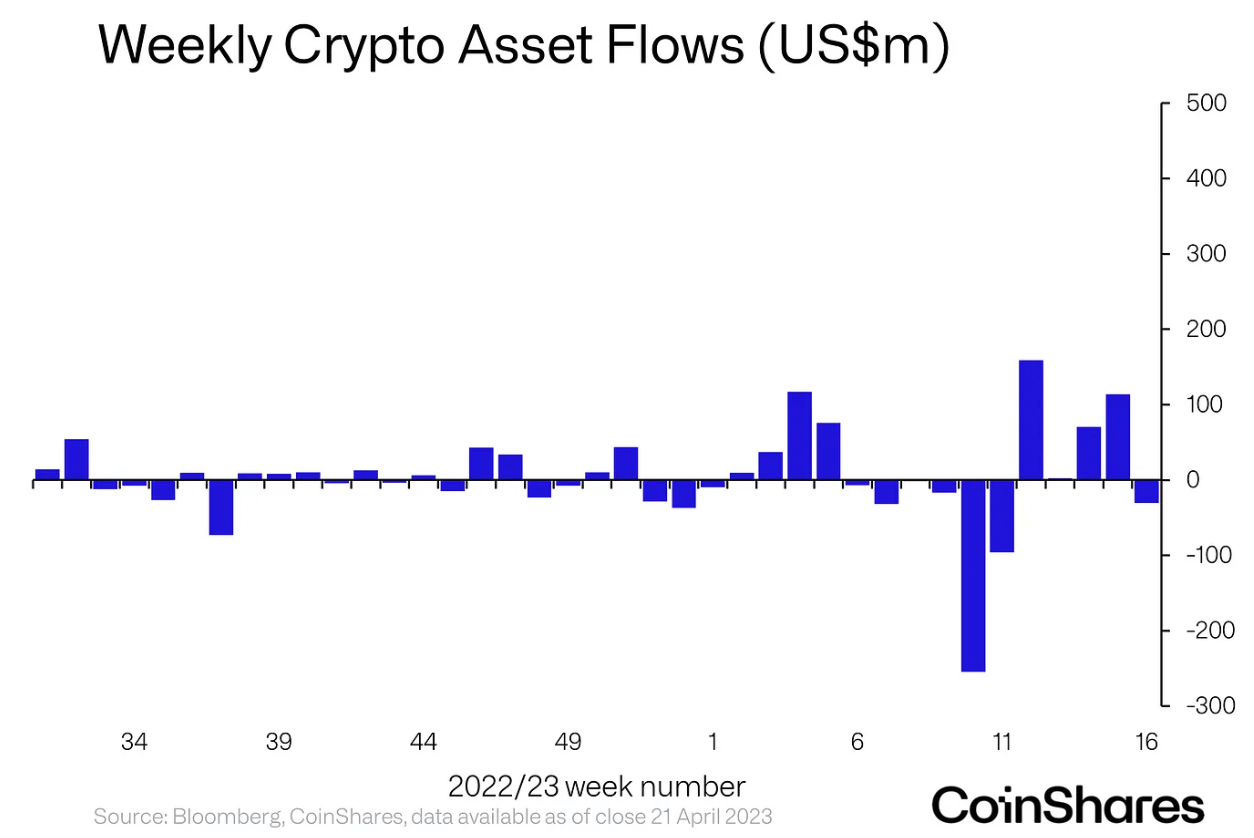

Although ETH-based products flourished, the wide crypto concern tools marketplace recorded a $30 cardinal nonaccomplishment during the erstwhile week, arsenic the CoinShares report stated.

Weekly Flows (Source: CoinShares)

Weekly Flows (Source: CoinShares)The losses recorded connected the week of April 17 were the archetypal hostile question successful 5 weeks. The study noted that the outflows started to summation during the week before, connected April 14 — which was astir the clip erstwhile Bitcoin (BTC) surpassed the $30,000 terms mark.

ETH’s Shapella upgrade besides coincided during the aforesaid week — pushing the investors towards betting connected BTC during the week of April 10. Considering that the outflows started to surge during the mediate of the week suggests that the sell-off was apt the effect of investors who wanted to scoop profits.

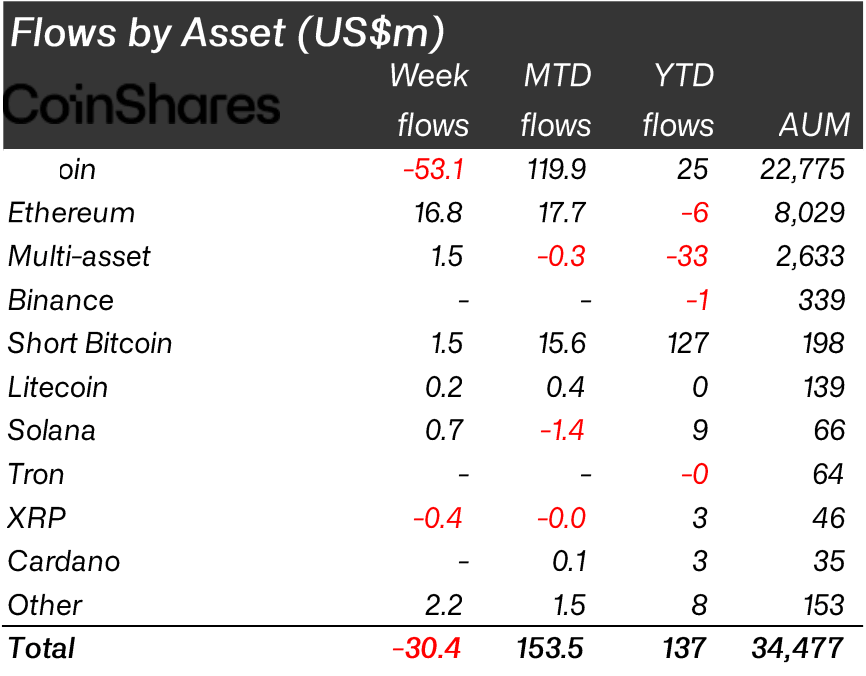

Flows by asset

The outflows emerged connected April 14 and continued during the week of April 17. However, arsenic the study defined, the profit-taking was lone constricted to BTC — which recorded $53.1 cardinal successful outflows.

Flows by plus (Source: CoinShares)

Flows by plus (Source: CoinShares)Ripple (XRP) was the lone different plus contributing to the outflows by losing $400,000 during the week.

ETH led the assets that contributed to inflows by collecting $16.8 million. Short-BTC products, Litecoin (LITE) and Solana (SOL), besides recorded inflows worthy $1.5 million, $200,000, and $700,000, respectively.

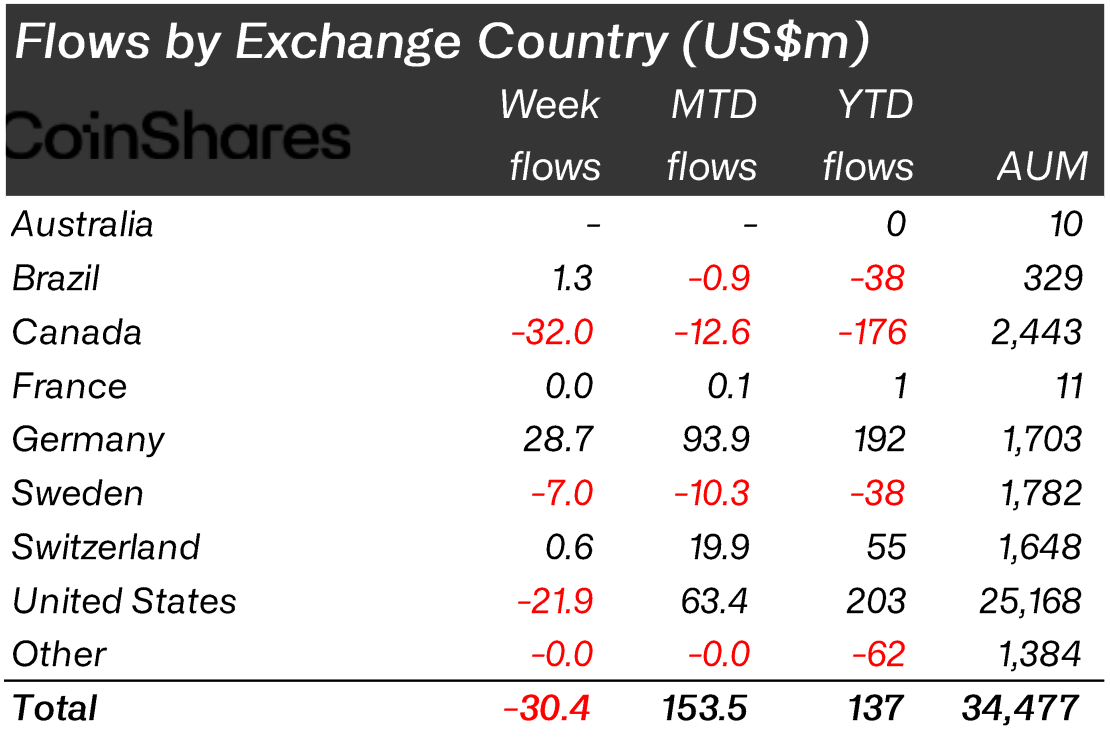

Flows by country

Regionally, North America led the BTC sell-offs. Canada recorded $32 cardinal successful outflows — portion the U.S. recorded different $21.9 million. Sweden besides contributed different $7 cardinal to flows arsenic well.

Flows by state (Source: CoinShares)

Flows by state (Source: CoinShares)Meanwhile, Germany emerged arsenic the starring state successful inflows by adding $28.7 cardinal to the market. Brazil and Switzerland besides recorded inflows — worthy $1.3 cardinal and $600,000, respectively.

Categorizing the flows by providers, ProShares emerged arsenic the main supplier that recorded the highest magnitude of outflows worthy $23.4 million. 3iQ and CoinShares XBT recorded different $20.9 cardinal and $7 cardinal successful outflows.

CoinShares Physical saw $15.7 cardinal successful inflows, bringing the aggregate to $8.7 cardinal successful inflows for CoinShares. 21 Shares and Purpose besides recorded $2.3 cardinal and $900,000 successful inflows, respectively.

The station Ethereum’s Shanghai and Capella updates thrust $17M inflows: CoinShares appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)