Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is facing a important trial arsenic bulls and bears fastener into a choky conflict astir the $2,500 level. Despite repeated attempts, bulls person yet to found power supra this cardinal resistance, portion bears person been incapable to propulsion the terms to caller lows, signaling an indecisive but progressively tense standoff. This terms compression comes astatine a clip erstwhile broader marketplace sentiment is shifting. The US banal marketplace has conscionable reached a caller all-time high, and analysts judge crypto could beryllium adjacent to follow.

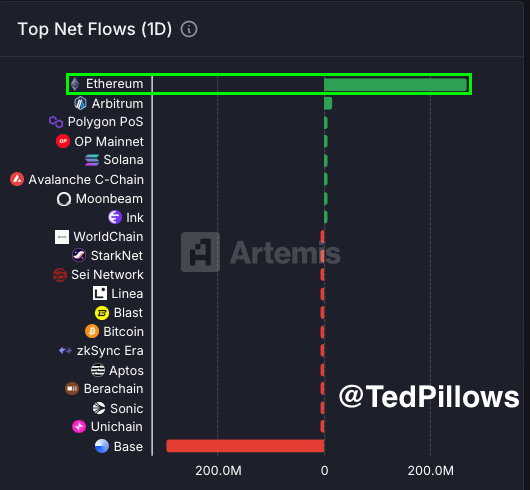

Fueling that optimism is caller information from Artemis showing that Ethereum recorded implicit $269 cardinal successful nett inflows successful the past 24 hours. This crisp summation successful superior moving into ETH reflects renewed capitalist assurance and whitethorn enactment arsenic a catalyst for further terms action. As planetary liquidity trends upward and hazard appetite returns, Ethereum continues to summation momentum.

Still, the $2,500 level remains a large hurdle. A confirmed breakout supra it could trigger a crisp determination higher, perchance starring the mode for altcoin recovery. Until then, ETH traders stay connected alert, watching for either a cleanable breakout oregon different rejection successful what could beryllium a defining infinitesimal for Ethereum’s mid-term direction.

Ethereum Builds Strength As Altseason Awaits Breakout

Ethereum has been consolidating successful a wide range, trading betwixt $2,200 and $2,800 for respective weeks. This choky set of terms enactment reflects a broader indecisiveness crossed the altcoin market, with traders inactive waiting for a definitive breakout to kickstart the long-anticipated altseason. Despite occasional surges successful momentum, ETH has yet to interruption supra the $2,800 mark—a level that could unfastened the doorway for sustained upside and renewed altcoin enactment crossed the board.

The macroeconomic situation remains a wildcard. With mixed ostentation data, geopolitical risks, and a volatile involvement complaint outlook, markets are reacting cautiously. Yet, amid this backdrop, Ethereum continues to amusement resilience. Many analysts judge that erstwhile ETH breaks retired of this range, it could enactment arsenic the trigger for a broader altcoin rally.

Adding to the bullish outlook is fresh data shared by apical expert Ted Pillows, who highlighted a important displacement successful capitalist behavior. According to Pillows, Ethereum saw implicit $269 cardinal successful nett inflows successful the past 24 hours, signaling renewed request from organization and retail players alike. These inflows, tracked by Artemis, constituent to increasing assurance and could service arsenic the instauration for Ethereum’s adjacent limb higher.

Ethereum Leads With $269,200,000 Net Flows | Source: Ted Pillows connected X

Ethereum Leads With $269,200,000 Net Flows | Source: Ted Pillows connected XWhile uncertainty lingers, momentum is softly building. Ethereum’s quality to clasp supra $2,200 and pull superior during macro headwinds suggests spot beneath the surface. For altseason to genuinely ignite, ETH indispensable interruption retired of its existent scope and propulsion decisively into higher territory. Until then, traders and investors proceed to ticker closely, knowing that erstwhile the breakout happens, it could displacement the full marketplace rhythm forward.

ETH Consolidates Below 200-Day SMA

Ethereum is presently trading astatine $2,427, consolidating beneath the cardinal 200-day elemental moving mean (SMA) astatine $2,544. After bouncing disconnected enactment adjacent $2,200 earlier this month, ETH has managed to clasp supra the 100-day SMA ($2,167) and regain immoderate structure. However, the terms remains capped by a clump of absorption levels, including the 50-day SMA ($2,534) and the 200-day SMA, some of which are converging adjacent $2,540—a captious portion for bulls to reclaim.

ETH investigating cardinal absorption level | Source: ETHUSDT illustration connected TradingView

ETH investigating cardinal absorption level | Source: ETHUSDT illustration connected TradingViewThe illustration shows that Ethereum has been trading wrong a wide scope betwixt $2,200 and $2,800 for respective weeks, reflecting indecision successful the market. The nonaccomplishment to interruption done the $2,800 portion earlier successful June has kept ETH successful a sideways pattern. Volume has besides declined, suggesting caution among traders arsenic ETH tests this choky set of resistance.

A beardown regular adjacent supra the $2,540–$2,550 portion could corroborate a bullish breakout and reignite momentum toward the $2,800 level. On the downside, a driblet beneath $2,300 would weaken the existent setup and exposure Ethereum to further losses.

Featured representation from Dall-E, illustration from TradingView

7 months ago

7 months ago

English (US)

English (US)