On-chain information shows Ethereum has observed monolithic inflows of $505 cardinal into Binance during the past day, a motion that selling whitethorn beryllium going on.

Ethereum Exchange Inflows Have Shot Up During The Past Day

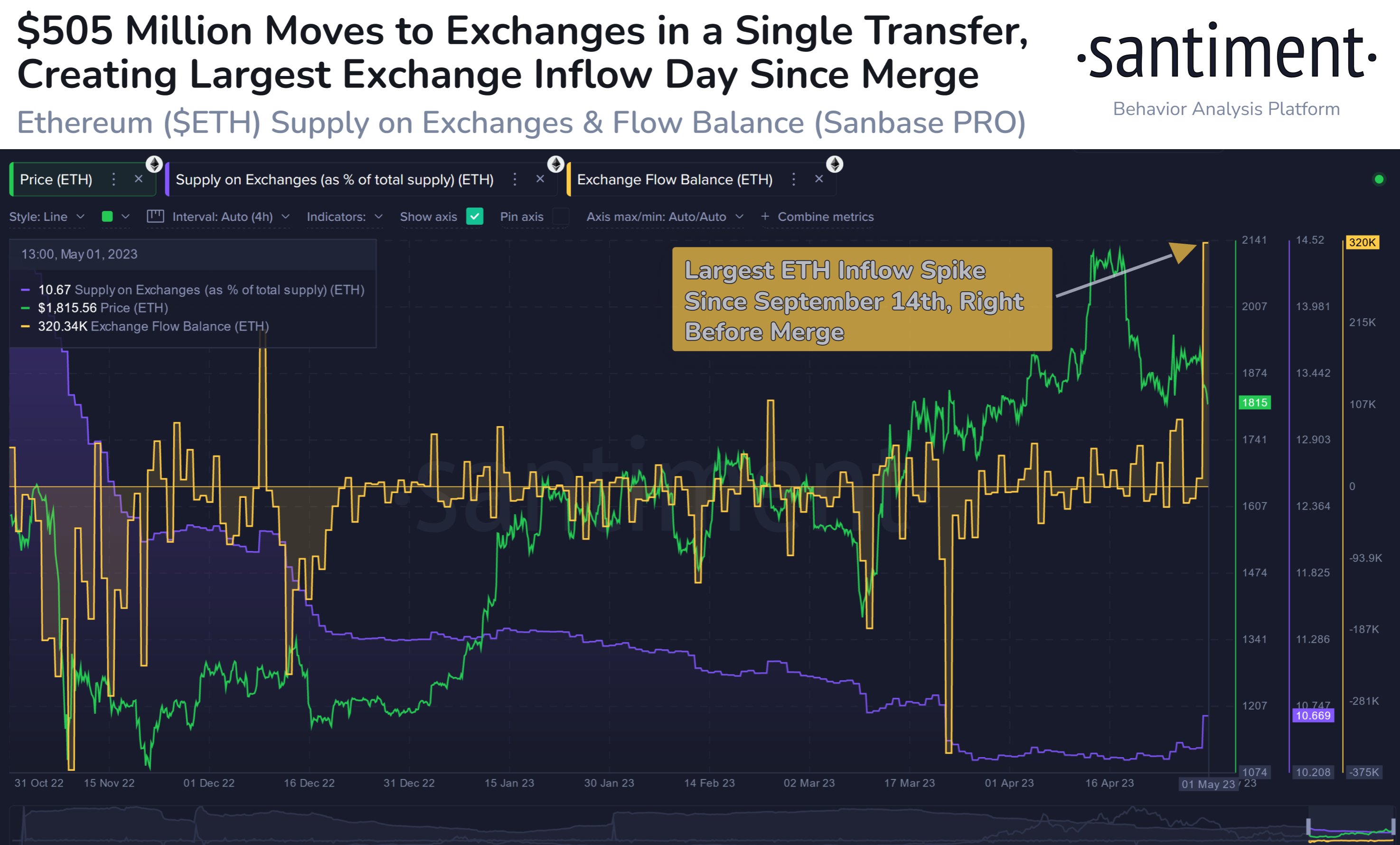

According to information from the on-chain analytics steadfast Santiment, this summation successful the proviso connected exchanges is the largest observed since the time earlier the Merge. The “supply connected exchanges” is an indicator that, arsenic its sanction already implies, measures the percent of the full Ethereum proviso that’s presently sitting successful the wallets of each centralized exchanges.

Related Reading: Bitcoin Bearish Signal: Miners Continue To Sell

When the worth of this metric increases, it means investors are depositing immoderate coins to exchanges close now. This benignant of inclination tin person bearish consequences for the asset’s terms arsenic 1 of the main reasons wherefore investors transportation their coins to exchanges is for selling-related purposes.

On the different hand, decreasing values of this indicator connote a nett magnitude of ETH is exiting these platforms currently. Such withdrawals tin beryllium a motion that the holders are accumulating the cryptocurrency, which tin people beryllium bullish for the asset’s worth successful the agelong term.

Now, present is simply a illustration that shows the inclination successful the Ethereum proviso connected exchanges implicit the past fewer months:

As displayed successful the supra graph, the Ethereum proviso connected exchanges has observed a crisp emergence successful the past day, meaning that investors person deposited a ample magnitude of ETH to these platforms.

In the chart, determination is besides the information for different ETH indicator: the “exchange travel balance.” This metric measures the nett fig of coins that are flowing into oregon retired of exchanges, meaning that the speech travel equilibrium fundamentally tracks the changes happening successful the proviso connected exchanges indicator.

During the past day, this metric has seen a ample affirmative value, suggesting that inflows person acold surpassed the outflows successful this period. According to the metric, astir 320,000 ETH ($584.6 cardinal astatine the existent price) has entered into the wallets of the exchanges with this spike.

This nett summation successful the speech proviso is successful information the largest that the cryptocurrency has seen since September 14, 2022, the time earlier the modulation towards the proof-of-stake statement mechanics took place.

Interestingly, the immense bulk of the inflow spike has been contributed by conscionable 1 transfer, arsenic information from the cryptocurrency transaction tracker work Whale Alert shows.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 273,781 #ETH (504,986,096 USD) transferred from chartless wallet to #Binancehttps://t.co/WHqdlSQ5uB

— Whale Alert (@whale_alert) May 1, 2023

This transportation to Binance was worthy astir $505 million, and it is 1 of the largest transactions betwixt an chartless wallet and an speech observed during the past 5 years.

It’s uncertain whether the whale has made this deposit with the volition to sell, oregon for utilizing immoderate different of the services offered by the platform. However, if selling is genuinely the extremity here, past this monolithic inflow tin beryllium atrocious quality for the asset’s price.

ETH Price

At the clip of writing, Ethereum is trading astir $1,800, up 1% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, Santiment.net

2 years ago

2 years ago

English (US)

English (US)