Ethereum (ETH) has slipped 6.1% successful the past 24 hours, falling beneath $4,300 aft bulls failed to support the important $4,500 absorption zone. The diminution comes contempt caller organization buying, with Tom Lee–led BitMine purchasing astir $84 cardinal worthy of ETH successful conscionable 24 hours, lifting its holdings to implicit 2.15 cardinal coins.

BitMine’s assertive accumulation, executed successful 5 abstracted tranches, proves the increasing organization adoption. However, the marketplace remains successful “fade-the-rally” mode, arsenic short-term traders proceed to merchantability into strength.

Fed Rate Cut Bounce Fizzles

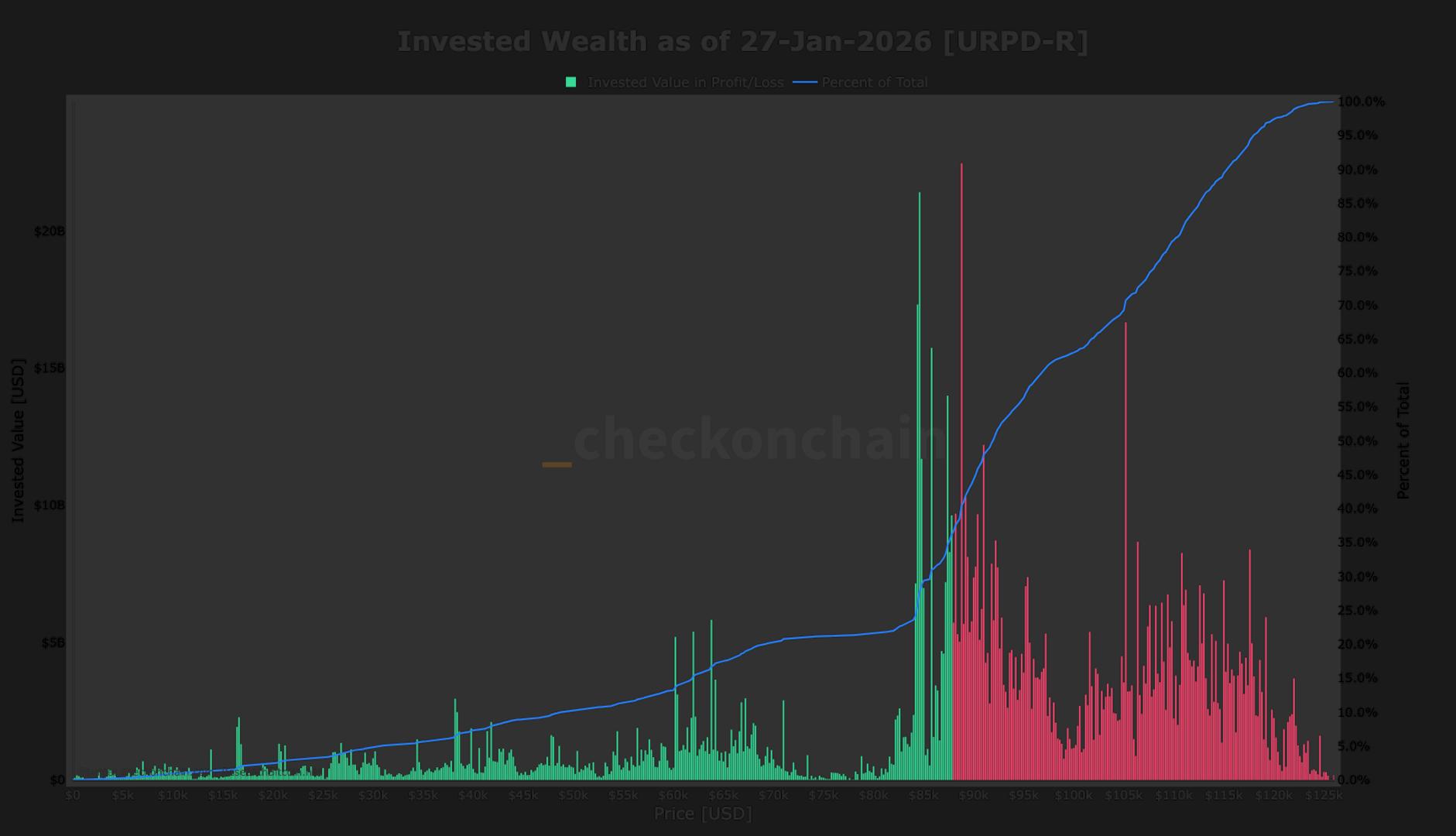

Ethereum (ETH) initially spiked supra $4,600 aft the U.S. Federal Reserve announced a 25 basis-point complaint chopped and hinted astatine a softer argumentation way for 2025. But the rally rapidly mislaid momentum, with selling unit intensifying arsenic unrealized profits among ample holders reached levels past seen successful 2021.

On-chain flows bespeak that much ETH is moving from staking contracts to centralized exchanges, signaling caution among whales. Likewise, debased web fees amusement subdued on-chain demand, reinforcing bearish short-term sentiment.

Technical Outlook: $4,000 Ethereum (ETH) Test successful Play

From a method perspective, Ethereum’s price enactment has turned antagonistic aft breaking beneath its 50-SMA ($4,502) and 200-SMA ($4,396) connected the two-hour chart. Analysts enactment that the breakdown candle resembled a Marubozu pattern, a beardown bearish awesome that often precedes further downside.

The Relative Strength Index (RSI) has plunged to oversold levels adjacent 18, suggesting conditions are stretched but not yet bullish. Immediate downside targets prevarication astatine $4,242, $4,159, and perchance $4,065 if selling unit persists.

A regular retest of the $4,395–$4,502 set is expected; nonaccomplishment to reclaim this level could pave the mode for a driblet toward $4,000 support.

For bulls, lone a decisive reclaim supra $4,502 would displacement momentum backmost toward $4,588 and $4,699. Until then, traders are advised to dainty rallies arsenic shorting opportunities alternatively than signs of recovery.

Short-Term Pain, Long-Term Conviction

Despite short-term weakness, organization accumulation inactive supports Ethereum’s semipermanent growth. BitMine’s latest acquisition shows that deep-pocketed investors proceed to stake connected ETH’s rise, adjacent arsenic short-term volatility unsettles retail traders.

The wider marketplace remains delicate, with Bitcoin hovering astir $114,000 and large altcoins similar XRP, Solana, and Dogecoin besides declining. Analysts judge that the upcoming week, marked by Fed Chair Powell’s code and cardinal U.S. economical reports, could power Ethereum’s adjacent important move.

For now, ETH bulls look a pugnacious challenge: unless $4,500 is regained decisively, the astir apt absorption remains toward $4,000.

Cover representation from ChatGPT, ETHUSD illustration from Tradingview

4 months ago

4 months ago

English (US)

English (US)