Bitcoin’s surge past $50,000 catalyzed a broader marketplace upswing, propelling galore large-cap alternate integer assets specified arsenic Ethereum (ETH), Solana (SOL), and others to important gains.

According to information from CryptoSlate, Ethereum saw a 7% uptick, reaching $2,661, portion SOL surged 8% to deed $114. Among the apical 10 integer assets, Avalanche’s AVAX spiked 6% to $41, Cardano’s ADA roseate by 3.74% to $0.5574, portion BNB Coin (BNB) and Ripple’s XRP experienced much humble gains, each climbing by little than 3%.

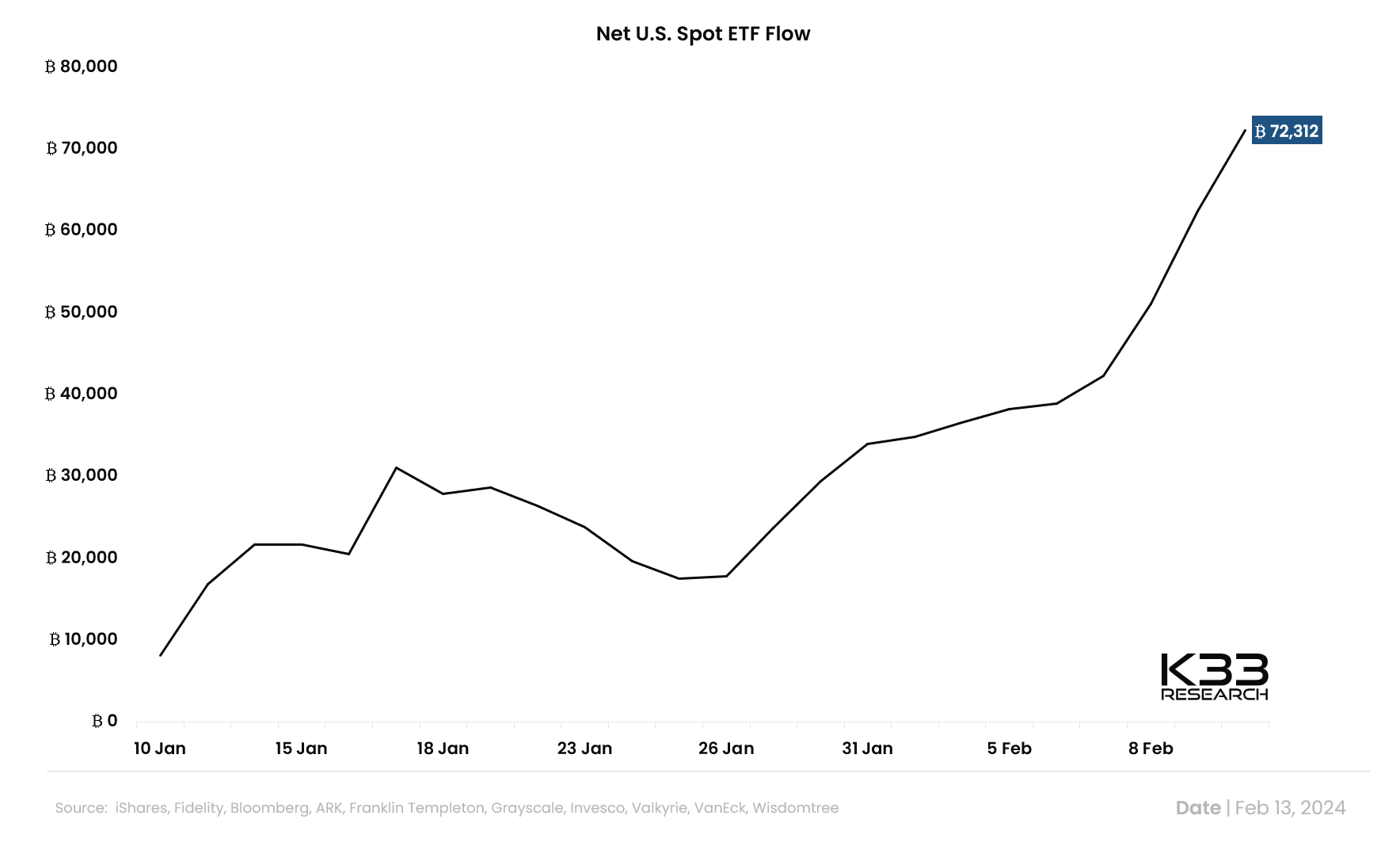

Market analysts property this bullish inclination to the buzz surrounding the aggregate spot Bitcoin exchange-traded funds (ETFs) successful the US. Vetle Lunde, a elder expert astatine K33 Research, noted that inflows into these ETFs person remained robust much than a period aft their launch.

Bitcoin ETF Flow. (Source: K33 Research)

Bitcoin ETF Flow. (Source: K33 Research)“Yesterday saw a nett inflow of 9,870 BTC, pushing the nett U.S. spot ETF travel since motorboat to 72,312 BTC. The caller 9 present clasp 228,000 BTC,” Lunde added.

During the past day, BTC’s terms crossed the $50,000 threshold for the archetypal clip since precocious 2021. The apical crypto’s worth has risen 4.2% to $50,146 arsenic of property time, extending a affirmative tally that had seen it summation 16% implicit the past week.

$184 cardinal successful liquidation

The broader crypto marketplace rally resulted successful a important liquidation totaling implicit $184 cardinal from much than 56,000 traders, according to Coinglass data.

Short traders, oregon speculators betting against terms increases, bore losses amounting to $134 million, portion agelong traders betting connected terms increases mislaid astir $50 million.

Across assets, Bitcoin led the liquidation charts with a full nonaccomplishment of $69.80 million. Short Bitcoin traders accounted for $55.04 cardinal successful losses, portion agelong traders mislaid $14.76 million. Ethereum followed closely, contributing $39.85 cardinal to the wide liquidation.

Other assets similar Solana, LINK, and ORDI besides experienced liquidations of $10.14 million, $5.93 million, and $4.81 million, respectively.

Across exchanges, Binance witnessed the highest proportionality of liquidations astatine 43.13%, totaling $79.42 million. Other platforms similar OKX and ByBit recorded liquidations of $58.29 cardinal and $18.73 million, respectively.

Notably, the astir important liquidation bid occurred connected Bitmex for LINKUSD, amounting to $3.14 million.

The station Ethereum, Solana spot gains arsenic Bitcoin’s rally supra $50,000 causes $184 cardinal liquidations appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)