Data shows the Ethereum Open Interest has changeable up by much than 4% pursuing the crisp determination down successful the cryptocurrency’s price.

Ethereum Has Seen A Pullback Over The Past Day

The cryptocurrency assemblage arsenic a full has witnessed a plunge to footwear disconnected the caller month, with Bitcoin and Ethereum some being down by much than 5% implicit the past 24 hours. ETH is backmost successful the debased $2,800 levels, having fundamentally retraced the betterment that it had made during the past week of November.

The abrupt terms diminution has unleashed a question of liquidations connected the derivatives exchanges, starring to $158 cardinal successful Ethereum-related contracts being flushed. Of these, $140 cardinal of the liquidations progressive agelong positions alone.

Below is simply a heatmap from CoinGlass that breaks down the liquidation numbers related to the assorted integer plus symbols.

The heatmap related to the latest cryptocurrency marketplace liquidations | Source: CoinGlass

The heatmap related to the latest cryptocurrency marketplace liquidations | Source: CoinGlassInterestingly, portion notable liquidations person occurred, derivatives investors inactive haven’t go discouraged.

ETH Open Interest Has Gone Up Since The Dip

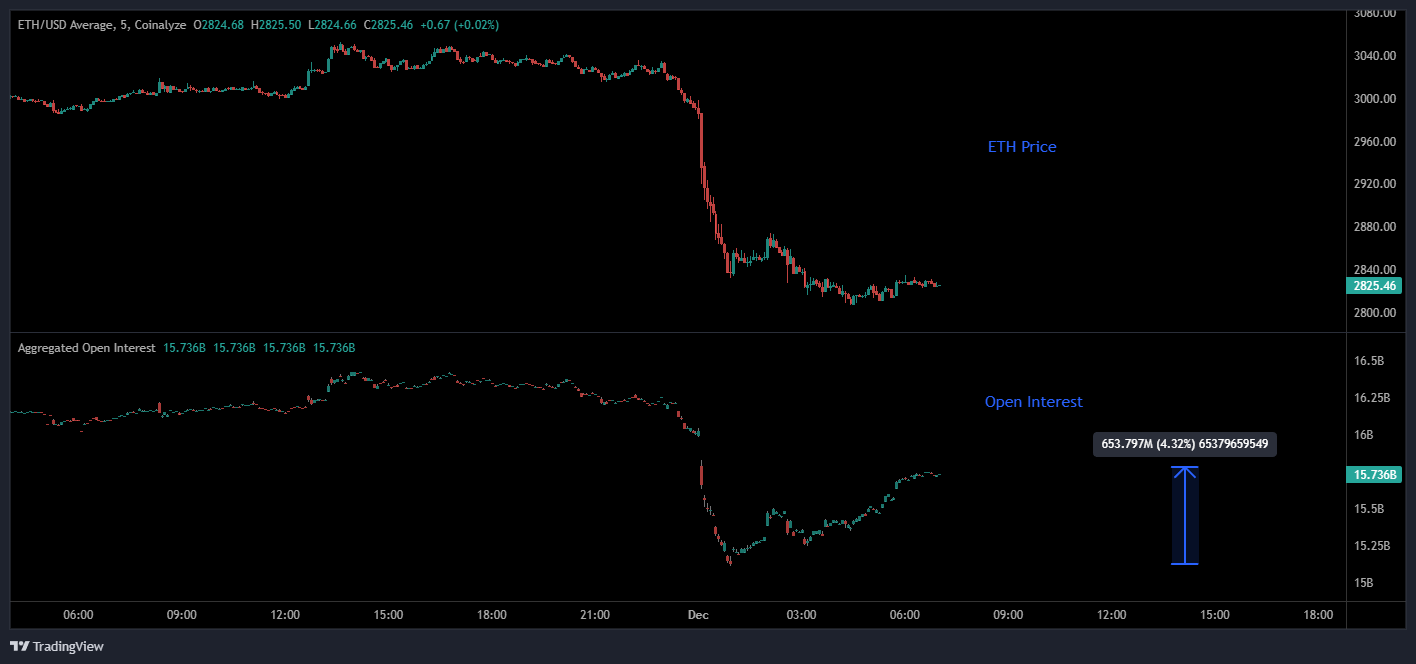

As pointed retired by CryptoQuant assemblage expert Maartunn successful an X post, the Ethereum Open Interest has witnessed a crisp leap pursuing the terms decline. The “Open Interest” present refers to an indicator that measures the full magnitude of positions related to ETH that are presently unfastened connected each centralized derivatives platforms.

Here is the illustration shared by Maartunn that shows the inclination successful this metric implicit the past mates of days:

The worth of the indicator appears to person risen successful caller hours | Source: @JA_Maartun connected X

The worth of the indicator appears to person risen successful caller hours | Source: @JA_Maartun connected XAs displayed successful the supra graph, the Ethereum Open Interest initially collapsed alongside the terms driblet arsenic agelong positions suffered forceful closures. As ETH’s bearish momentum tapered disconnected and the terms settled into a sideways rhythm, however, the metric saw a gradual reversal successful direction, indicating that speculators person started opening up caller positions.

Since the dip, the ETH Open Interest has gone up by astir $654 million, equivalent to an summation of 4.3%. “Looks similar the gamblers are backmost for different round,” noted the analyst.

Historically, a precocious worth connected the metric has mostly been thing that has led to volatility for the cryptocurrency. This is due to the fact that an utmost magnitude of positions implies the beingness of a precocious magnitude of leverage successful the sector. In these conditions, immoderate crisp plaything successful the plus tin induce a ample fig of liquidations successful the market. These liquidations lone provender backmost into the terms determination that caused them, making it much intense.

An illustration of this signifier was already seen during the past day. With the Ethereum Open Interest present rising again, it remains to beryllium seen whether much volatility volition follow.

Featured representation from Dall-E, CryptoQuant.com, CoinGlass.com, TradingView.com

2 months ago

2 months ago

English (US)

English (US)