Ethereum’s (ETH) determination to proof-of-stake — which would present staking rewards — is expected to thrust organization involvement successful the token post-Merge, Chainalysis said successful its latest report.

The blockchain information institution besides expects ETH to behave similar bonds and commodities, which would springiness organization investors further assurance successful the token.

Staking rewards could lure organization investors

Institutional investors whitethorn beryllium enticed by the precocious staking rewards, which could emergence to arsenic precocious arsenic 15% annually. For comparison, U.S. treasury bonds connection investors a 3.5% return.

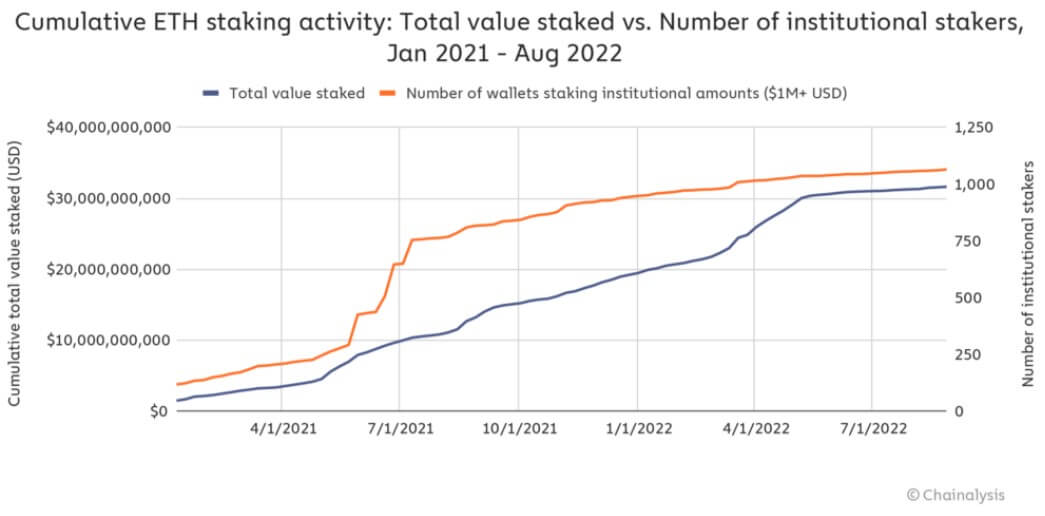

The study noted that organization investors — wallets staking implicit $1 cardinal ETH — person accrued implicit 5x successful the past year. According to the report, organization investors roseate to 1100 arsenic of August 2022, compared to little than 250 successful January 2021.

Source: Chainalysis

Source: ChainalysisWith the Merge designed to chopped Ethereum’s vigor usage by 99%, Chainalysis said organization investors with sustainability commitments would go much comfy with the asset.

Merge sets the signifier for aboriginal Ethereum improvements

Chainalysis wrote that the Merge would service arsenic a precursor to further improvements being planned for the Ethereum ecosystem

According to the blockchain analytical company, scalability improvements targeted astatine improving Ethereum’s velocity and lowering its precocious state fees are imminent post-merge. These changes would make:

“Ether a much charismatic plus to hold, and truthful to involvement arsenic well.”

Ethereum co-founder Vitalik Buterin antecedently said the Merge would lone marque Ethereum 55% complete. Buterin added that the different stages of the blockchain web improvement are “the surge, the verge, the purge, and the splurge.”

Bye-bye to miners

The Chainalysis study noted that Ethereum miners would person to find different web to usage their equipment, and Bitcoin (BTC) is not a viable option.

The study explained that Ethereum mining instrumentality could not efficaciously excavation Bitcoin due to the fact that Bitcoin miners usage ASIC machines, portion Ethereum is ASIC-resistant and uses GPUs.

The proof-of-stake power is expected to wounded some miners and GPU manufacturers. Ethereum mining is liable for 97% of each GPU mining activities, portion different networks suitable for GPU mining lone person a marketplace headdress of $4.1 billion.

However, Ethereum miners tin inactive instrumentality vantage of respective services and protocols built connected Ethereum, similar Render Network and Livepeer (LPT), which trust connected GPU powers for circumstantial tasks and reward the operators.

Meanwhile, miners tin besides statesman to excavation different assets similar Ergo (ERG), Ethereum Classic (ETC), etc.

The station Ethereum staking volition pull much organization investors post-merge – Chainalysis appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)