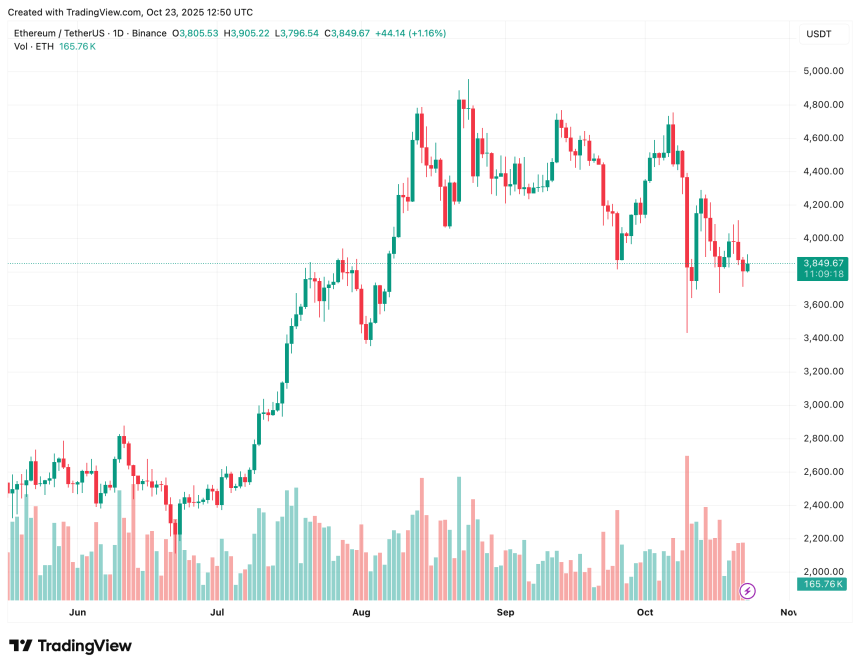

Ethereum (ETH), the second-largest cryptocurrency by marketplace cap, continues to commercialized somewhat below the psychologically important $4,000 terms level, pursuing the brutal drawdown connected October 9, which saw the integer currency trial the enactment astatine astir $3,435.

Ethereum Stays Above Realized Price – Bullish Momentum Soon?

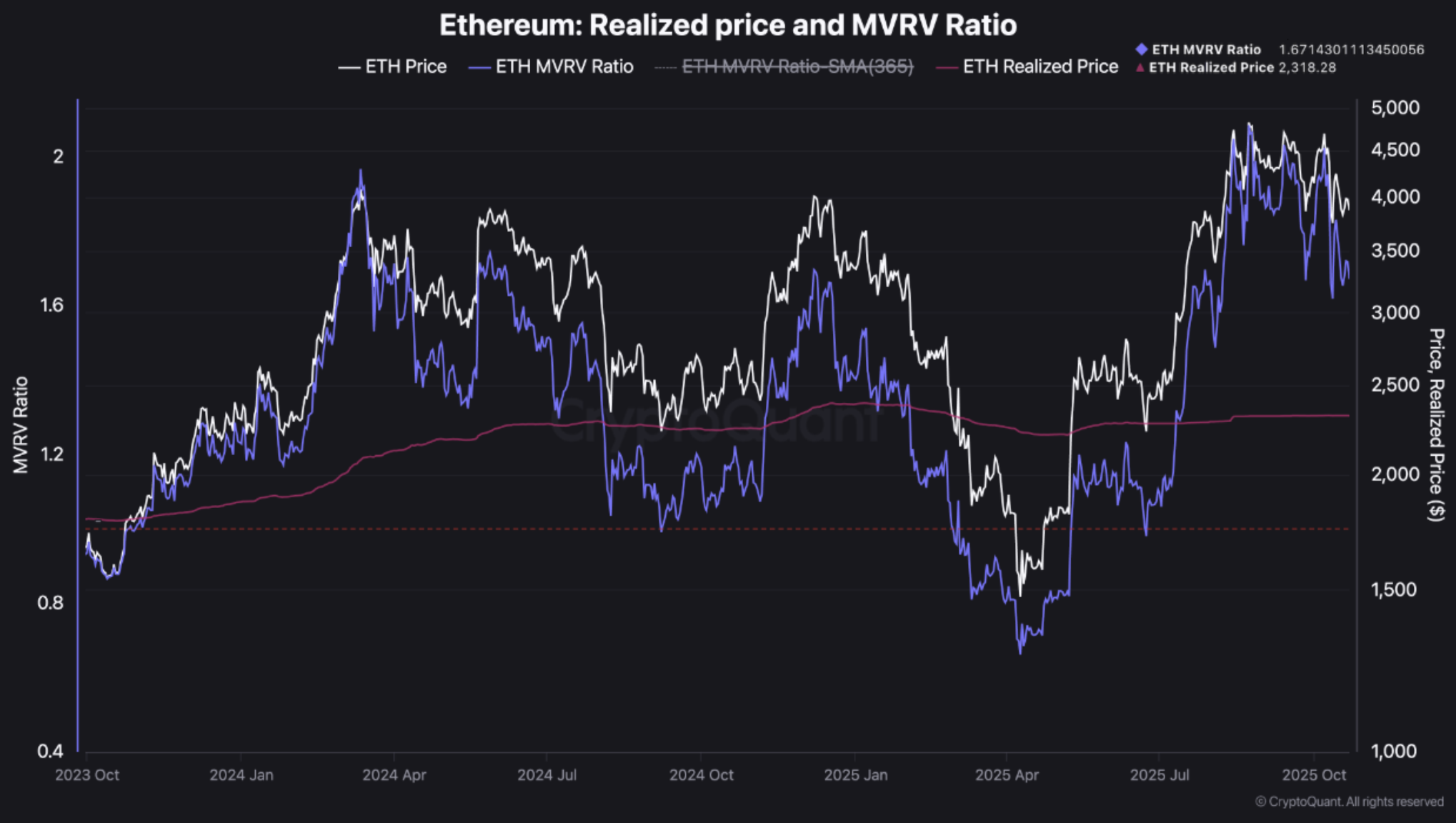

According to a CryptoQuant Quicktake station by contributor TeddyVision, Ethereum is trading supra its Realized Price astatine astir $2,300. Dubbing the terms level a “fundamental enactment zone,” the expert said that historically, immoderate dips beneath this level person marked a capitulation phase.

For the uninitiated, Realized Price represents the mean outgo ground of each ETH holders, calculated by dividing the full worth of each ETH astatine the clip they past moved on-chain by the existent circulating supply.

Realized Price efficaciously shows the “true” mean terms investors paid, serving arsenic a cardinal indicator of whether the marketplace is successful nett oregon loss. As agelong arsenic ETH trades supra Realized Price, the marketplace operation is apt to stay bullish.

The expert besides highlighted Ethereum’s Market Value to Realized Value (MVRV) ratio. Notably, ETH holders are currently, connected average, astatine 67% nett comparative to their outgo basis. This metric gives 2 large hints astir the existent market.

Source: CryptoQuant

Source: CryptoQuantFirst, it shows that though the marketplace is profitable, it is inactive acold from “overheated” levels. Second, it indicates that marketplace participants are assured astir the market’s upward momentum, but not rather euphoric.

To explain, the MVRV ratio compares the marketplace worth of an plus to its realized value. A higher MVRV indicates holders are sitting connected larger unrealized profits – often signaling imaginable overvaluation – portion a little MVRV suggests undervaluation oregon marketplace fear.

Further, TeddyVision noted Ethereum’s absorption from the Upper Realized Price Band, which is presently located astir $5,300. The expert remarked:

Price pulled backmost earlier reaching the “Overheating Zone. This isn’t a reversal – it’s a consolidation signifier aft distribution, a steadfast cooldown without structural damage.

Finally, spot inflows of ETH to crypto exchanges are besides slowing down, hinting that the adjacent limb up for the integer plus volition apt beryllium connected caller liquidity, and not leverage. To sum it up, Ethereum is dilatory moving from the organisation signifier to the consolidation phase.

Is It A Good Time To Buy ETH?

While providing reliable aboriginal predictions successful the crypto marketplace remains a challenging task, caller on-chain and speech information constituent toward ETH regaining its bullish momentum. For instance, Binance backing rates precocious hinted that ETH could surge to $6,800.

Similarly, ETH reserves connected exchanges proceed to autumn astatine a accelerated pace. Earlier this month, ETH proviso connected exchanges hit a multi-year low, expanding the probability of a imaginable “supply crunch” that tin dramatically summation ETH’s price.

That said, crypto expert Nik Patel precocious cautioned that ETH’s terms correction whitethorn not yet beryllium afloat over. At property time, ETH trades astatine $3,849, up 0.3% successful the past 24 hours.

Ethereum trades astatine $3,849 connected the regular illustration | Source: ETHUSDT connected TradingView.com

Ethereum trades astatine $3,849 connected the regular illustration | Source: ETHUSDT connected TradingView.comFeatured representation from Unsplash, charts from CryptoQuant and TradingView.com

4 months ago

4 months ago

English (US)

English (US)