Ethereum has faced an 8% correction since Monday, cooling disconnected from its caller rally and slipping beneath the cardinal $3,850 level. This determination suggests that the bullish momentum that carried ETH higher successful July is opening to fade, with terms present entering a captious consolidation phase. Bulls are inactive holding cardinal enactment levels, but the menace of a deeper correction is increasing arsenic selling unit intensifies.

On-chain information shows signs of profit-taking from ample investors, adding to short-term volatility and uncertainty. Heavy selling measurement implicit the past 2 days has sparked speculation crossed the market, particularly arsenic Ethereum remains beneath caller section highs. Analysts are divided successful their outlook—some reason that this is simply a steadfast pullback wrong a broader uptrend, portion others pass of a imaginable descent toward the $3,400–$3,500 scope if sentiment worsens.

Despite the caller drop, Ethereum’s semipermanent operation remains intact, with fundamentals similar increasing DeFi usage and Layer 2 adoption continuing to enactment the narrative. However, the adjacent fewer days volition beryllium critical. If bulls tin support existent levels and regain momentum, ETH could effort different determination toward $4,000. If not, the marketplace whitethorn spot extended downside unit earlier a clearer betterment emerges.

Ethereum Sees Massive Sell-Off In Two Minutes

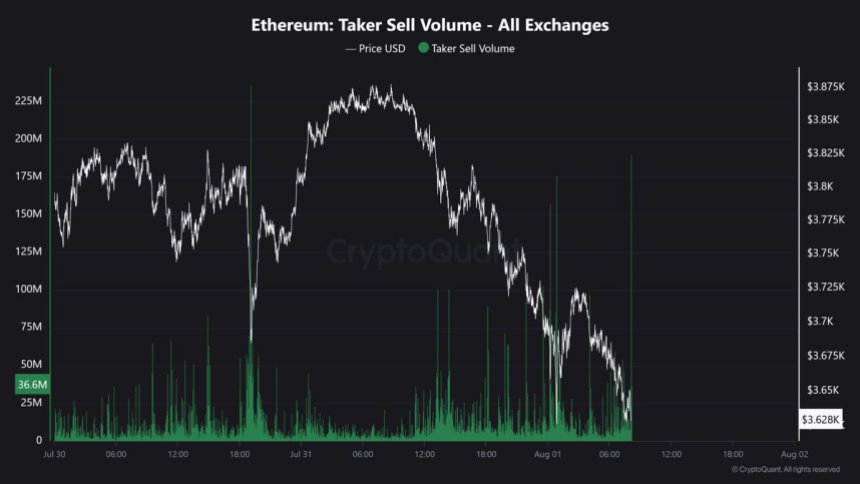

According to apical expert Maartunn, Ethereum experienced a melodramatic spike successful taker merchantability volume, reaching $335 cardinal successful conscionable 2 minutes. This monolithic question of merchantability orders signals a cardinal infinitesimal successful the market, 1 that could people either the highest of profit-taking oregon the extremity of panic-driven capitulation. While immoderate construe the lawsuit arsenic ample investors securing gains aft the caller rally, others judge this could bespeak affectional selling from retail traders spooked by short-term volatility.

Ethereum Taker Sell Volume | Source: Maartunn connected X

Ethereum Taker Sell Volume | Source: Maartunn connected XDespite the dense selling pressure, Ethereum’s semipermanent bullish communicative remains intact. Large players proceed to accumulate, taking vantage of dips and buying from weaker hands. This enactment suggests strategical positioning up of expected maturation successful adoption, particularly arsenic Ethereum cements its dominance successful decentralized concern (DeFi) and real-world plus (RWA) tokenization.

ETH spent months successful a downtrend earlier this year, weighed down by macro uncertainty and regulatory fears. Yet, portion the broader marketplace showed weakness, blase investors appeared to accumulate. Now, with sentiment shifting and the terms operation strengthening, Ethereum seems well-positioned for the months ahead.

The $335 cardinal sell-off highlights marketplace vulnerability—but besides shows that whales are stepping in. If terms holds existent levels and sentiment stabilizes, Ethereum could spot a renewed propulsion toward the $4,000 people arsenic assurance returns.

ETH Tests Support After Breakdown

Ethereum (ETH) has officially breached beneath its captious absorption portion adjacent $3,860, signaling accrued selling unit and short-term weakness. After maintaining a dependable scope for astir 2 weeks, the terms has dropped to $3,619 connected the 4-hour chart, uncovering impermanent enactment conscionable supra the 100-period SMA (green line), presently adjacent $3,670.

ETH investigating caller lows | Source: ETHUSDT illustration connected TradingView

ETH investigating caller lows | Source: ETHUSDT illustration connected TradingViewThis breakdown comes amid an uptick successful bearish volume, suggesting momentum whitethorn favour sellers successful the abbreviated term. The 50-period SMA (blue line), located astir $3,762, has present turned into near-term resistance, capping immoderate contiguous betterment attempts. If bulls neglect to reclaim the $3,760–$3,800 zone, Ethereum could hazard deeper downside toward the adjacent cardinal enactment astir $3,175 (200 SMA, reddish line) oregon adjacent $2,852, which served arsenic a basal successful aboriginal July.

Despite this weakness, the broader inclination remains structurally bullish arsenic agelong arsenic terms stays supra the 200 SMA. However, bulls indispensable reclaim the $3,860 level and physique momentum supra it to regain strength. Until then, volatility is expected, particularly arsenic profit-taking and macro uncertainty measurement connected sentiment.

Featured representation from Dall-E, illustration from TradingView

4 months ago

4 months ago

English (US)

English (US)